KIRA Network ($KEX) is an interchain exchange protocol that allows users to earn block and fee rewards while staking any digital assets, such as cryptocurrency, stablecoins and non-fungible tokens (NFTs).

Background

KIRA is developed by a strong team consisting of full-stack developers, blockchain engineers, back-end developers, and technical architects. The team is led by Milana Valmont (CEO) and Mateusz Grzelak (CTO).

In the past, Valmont had held different roles which include being a blockchain consultant at Adcoin, as well as a strategy advisor at KNOKS. Grzelak had also held prominent positions in firms such as Settle Finance, Barclays, and Bity.

KIRA Network’s strategic partners include AlphaBit, TRG Capital, Swingby, and Math Wallet. In addition, the team also includes Roger Lim from NGC Ventures and Alssio Treglia from Tendermint.

What is KIRA Network?

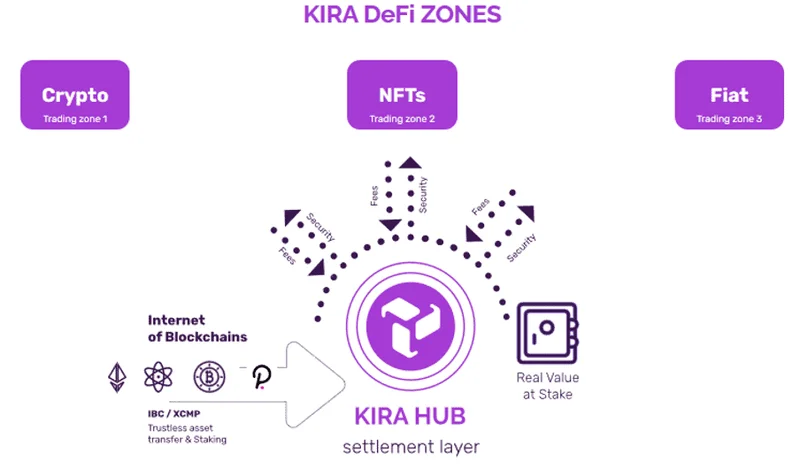

KIRA Network is a blockchain-based protocol that brings liquid staking into the DeFi market. It enables access to all virtual currencies, digital fiat, and non-fungible tokens (NFTs) within a cross-chain ecosystem.

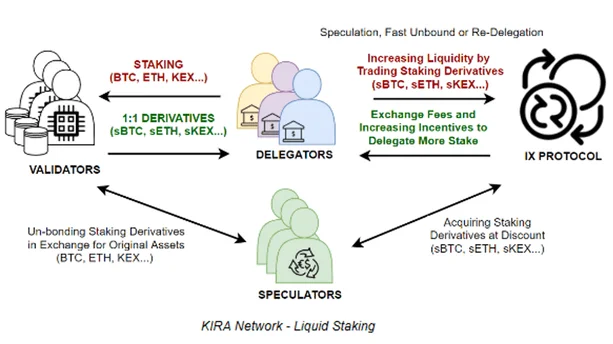

With liquid staking, liquidity providers can stake any digital asset. Consequently, they earn incentives emanating from new blocks and transaction fees.

The protocol’s idea of liquid staking stems from the current staking space. Here, centralized cryptocurrency exchanges provide crypto trading, acquisition, as well as act as a hub for a host of digital currencies.

Currently, a large number of those coins that are available for staking are found on centralized exchange platforms. For this reason, KIRA wants to change this by providing a decentralized platform that mirrors what traditional virtual currency exchanges offer.

As such, even small actors in the PoS ecosystem will have access to liquidity and evade security risks found on centralized platforms. Also, the protocol removes the cap on fee and block incentives for liquidity providers.

KIRA Network: 8 Key Pillars

To have a profound impact on the DeFi scene, KIRA Network is supported by eight pillars, which include:

Security

Using the Multi-Bonded PoS (MBPoS) consensus mechanism, the network can harness its security from staked assets. In addition, MBPoS helps remove the barrier as to which virtual assets can be staked and/or can attract rewards.

Utility

KIRA uses IXP (Interchain Exchange Protocol) to provide market access to the wide range of assets staked on the system.

Liquidity

KIRA supports liquidity provision through staking derivatives. The platform has a 1:1 ratio between staking derivatives and staked tokens.

Expansibility

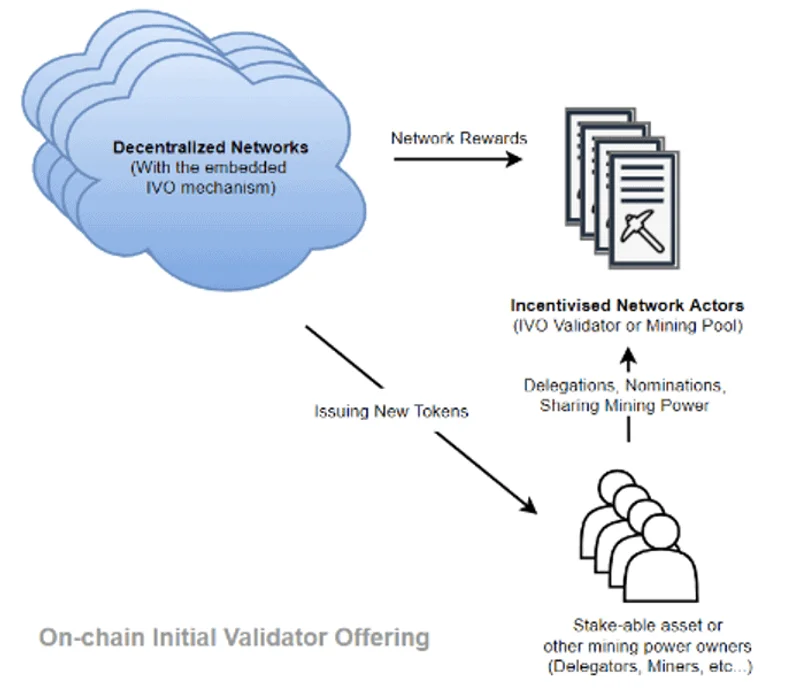

The protocol uses validators to ensure the credibility of transactions. Also, the validators operate Initial Validator Offerings (IVOs) that allow investors to raise funds for new projects without affecting their liquidity.

Investors delegate their tokens to the validators while the validators mine new tokens. Correspondingly, the former earn block rewards.

Upgradeability

Upgrading the system relies on developers. Therefore, to drive development, the protocol uses an on-chain contracting system as an incentive scheme.

Sustainability

To ensure the platform has long term viability, it uses an on-chain governance structure. To elaborate, the governing body touches on the network’s economic aspects that include inflation and interest rates.

Scalability

KIRA tackles scalability by removing restrictions on the number of validators and the stake value. In turn, this makes it possible to introduce shards or zones.

Interoperability

The Network makes use of Polkadot, Cosmos, and other cross-chain systems to power liquid staking. Notably, this staking mechanism does not discriminate against cryptocurrency assets.

KIRA Token ($KEX)

KEX is KIRA Network’s native token. Apart from being used as a staking token on the network, KEX is also used as a base asset upon which other currencies are valued.

Additionally, KIRA’s native currency is a requirement when participating in the system’s governance issues. Moreover, it’s used to reward holders, delegators, and validators. Note that KEX holders are rewarded by being offered low transaction and exchange costs.

In contrast, delegators earn almost 99 percent of all block rewards and close to 50 percent of all network fees. Validators, on the other hand, earn a commission depending on their configuration and sit on the system’s governance table. Their earnings could go up to 50 percent network fees.

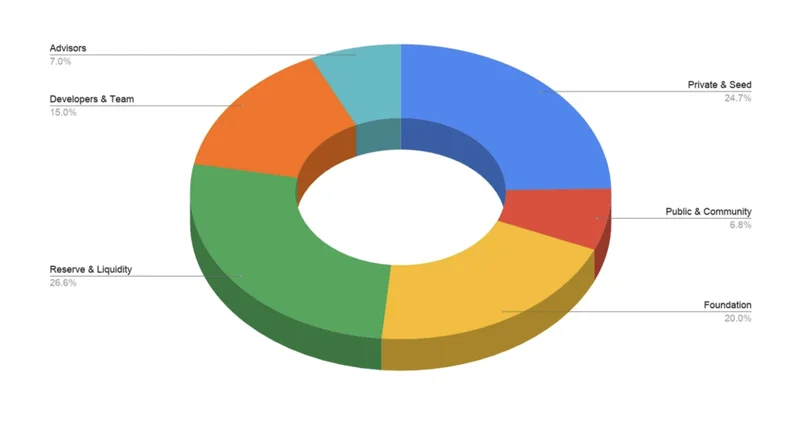

KEX is allocated to developers/team (15%), advisors (7%), the KIRA Foundation (20%), as well as reserve and liquidity (26.6%)

KIRA Network ($KEX) – Public Sale

KEX token is not available to trade yet and the public sale is soon to be announced. KEX will be launching ERC-20 KEX token on Ethereum network before KIRA Network is launched with the initial supply of 300,000,000 KEX token. Users will be able to swap for the native KEX token with the equal amount of value once the mainnet is launched.

KIRA Network has raised 3.6M during the seed (priced at $0.025) and private sale rounds (priced at $0.05), with a vesting period of 18 months starting at mainnet launch. All seed and private round participants will receive approximately 2.5% of their token after finalization of all stages of the public round distribution.

Public round has a $400k cap, token price at $0.075. Find out more here.

Governance on KIRA Network

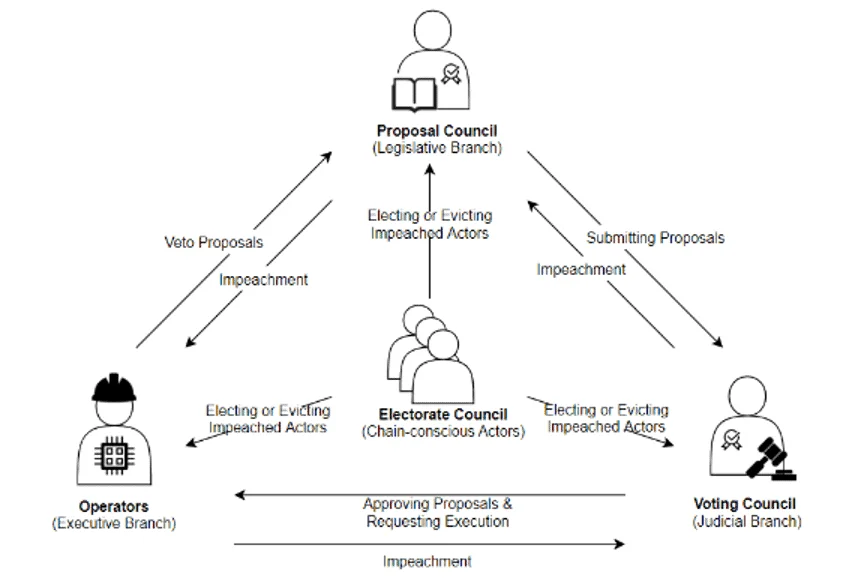

The protocol uses a governance structure that slowly hedges away from full dependency on stake and or wealth distribution. Governance is guided by rules that exclusively put whitelisted actors to execute on-chain actions that are cleared for execution.

On top of these rules are parameters and individually assigned permissions. The network puts checks and balances on its governance model through operators, a voting council, an electorate council, and a proposal council.

Notable KIRA Network Partnerships

To drive the adoption and usability of the KIRA protocol, the platform has partnered with notable players in the DeFi Space. Some of the most conspicuous are:

- KIRA and Finance.vote – The partnership enabled KIRA to provide liquidity to Finance.vote’s social trading layer. For this reason, it opened a new revenue stream for Finance.vote users by allowing them to conduct yield farming using digital assets in their portfolios.

- KIRA Network and Math Foundation – Here, the Math Foundation benefited from staking KEX (KIRA’s native token) tokens and the interaction with KIRA’s MBPoS.

- KIRA Network and Swingby – The partnership brought staking functionalities to Skybridge users. Skybridge is a decentralized inter-chain asset bridge.

- KIRA and Blockparty – This partnership made Blockparty one of KIRA’s validators.

Conclusion

From crucial partnerships to using a new consensus mechanism, KIRA Network is keen on expanding the possibilities in the DeFi space for liquidity miners and yield farmers. Furthermore, the protocol’s eight pillars help it to enhance security, sustainability, utility, scalability, among other functionalities that are key in driving DeFi adoption.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.