Decentralized finance (DeFi) has come a long way since it was first conceptualized. Now, the market has nearly $4 billion worth of assets locked up. And DeFi Money Market (DMM) is one of the most promising protocols that is gaining a lot of traction.

The DMM platform allows users to earn annual yields of 6.25 percent for holding Ethereum-based tokens like USDC and DAI. What makes it even more interesting is that it is backed by real-world assets that create passive income that is greater than the interest owed.

These real-world assets will be tokenized and launched on the Ethereum blockchain tracked by Chainlink’s decentralized oracle network.

Background: Who is the team behind DMM?

DeFi Money Market is a product of the DMM Foundation, which was established in the UAE. The members are a team of veteran experts hailing from academia, the legal and regulatory sector, and fintech.

It is one of the few projects backed by top Silicon Valley venture capitalist Tim Draper.

What is the DeFi Money Market (DMM) Ecosystem?

The DeFi Money Market Ecosystem (DMME) is a decentralized protocol that allows users to earn interest on any Ethereum-based tokens by lending them for real-world assets like real estate, jewelry, automobiles, etc. as collateral. The goal of this ecosystem is to enable anyone in the world to earn consistent and stable interest on their money. Furthermore, their rates are higher than traditional competitors. They currently have an APY (Annual Percentage Yield) of 6.25% for DAI and USDC accounts, which is above most traditional alternatives.

DMME aims to seize the trillion-dollar opportunity that is currently resting on centralized finance (CeFi) companies. And it does this by blending real-world assets with digital assets, which enables them to create a more robust and transparent system.

DMM Protocol: What is it and how does it work?

The DMM Protocol can be split into three parts: an array of Ethereum smart contracts, a treasury management system, and a data feed that allows off-chain data to stream into the smart contract.

These three components blend to form the DMM Ecosystem and allow the creation of DMM tokens backed by off-chain real-world assets.

The DMM protocol currently supports DAI and USDC. For this walkthrough, let’s use USDC. First, a user deposits USDC to the protocol. Then mUSDC is minted. The dollar amount will be used to provide loans collateralized with real-world assets.

And once the loan gets paid, the interest will be deposited back to the system. Then, users can convert their mUSDC to USDC plus interest.

DMG Governance ($DMG) token

$DMG is the governance token of the platform. It allows the community to regulate and grow the DMM ecosystem, as well as its protocol. As the DMM community grows globally, DMG is paramount to encouraging active participation and mitigating centralization risk.

DMG holders have the capability to govern the parameters of the protocol as well as decisions on asset allocation.

The token is a fork of Compound Finance’s governance asset $COMP but with extra functionality such as “native burn.”

DMG token distribution

The DMM ecosystem has a total of 250,000,000 DMG tokens. The supply distribution is as follows:

- 40% will be allocated to the DMM Foundation for future development, support, and other general functions

- 30% will be sold in several public token offerings

- 30% will be allocated as a reserve for paying developers, partners, as well as other protocols for integration and growth of DMM’s decentralized network

At present, 60% of the total supply of DMG has been time-locked in smart contracts with different locking periods.

DeFi Money Market Account

A DeFi Money Market Account (DMMA) is a new DeFi native asset class that enables any holder of Ethereum-based tokens to earn interest from real-world assets represented on the blockchain.

In other words, DMMAs are technically ERC-20 tokens that get created when we swap an Ethereum token into DMM tokens called mAssets.

DMM DAO

A DAO (decentralized autonomous organization) is an organization where the decisions regarding the rules of the system are written in code and voted on by its members.

One of the core ideas of the DMME is that every stakeholder in the network should be able to take part in the decision-making process regularly without the need for permission. Initially, the DMM DAO members will consist of the core team and community members. To be part of the DAO, you have to be a holder of $DMG tokens, which gives you voting rights to the system.

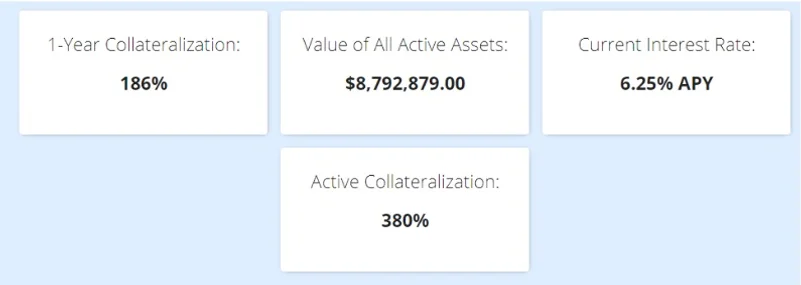

The DMM DAO is one of the few DAOs that is already generating revenue through its yield taken from real-world asset loans. The value of all assets amounts to roughly $8.7 million with active collateralization of 380%. Furthermore, the team anticipates that DMG tokens, not to mention the entire DMM protocol itself, to be totally distributed and decentralized a year from now.

Conclusion

In order to succeed, DMM ultimately needs to fully decentralize the traditional financial system. Bridging real-world assets to the Ethereum blockchain is no easy task, but DMM is on its way to successfully execute its goal by using the right tools and partnering with the right organizations. The tokenization of physical assets will bolster DeFi and entire crypto space and possibly take a huge bite from the trillions of dollars worth of capital from legacy financial systems.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.