Currencies have been around for thousands of years as a way to replace the bartering system and so that people can ascribe a unified value which they can exchange with others. With the popularity of “going digital”, digital currencies have started to emerge to the forefront as a potential new asset class. Starting with Bitcoin in 2008 as the world’s first digital currency, from there many other digital assets evolved such as Ethereum and other cryptocurrencies. Now, companies and even nations are hopping onto this trend to create digital currencies that would serve their own purposes, such as Libra and China’s national digital currency DCEP (Digital Currency Electronic Payment, a.k.a. DC/EP). In this article we take a look at the similarities and differences between cash, Bitcoin, Libra and DCEP.

History and development

Many cultures around the world developed the concept of commodity money i.e. objects that have value in themselves as well as their value in their use as money likely during the Bronze Age. Objects that were used as “money” included cowry shells in ancient China, Africa and India, whilst other countries used salt. Eventually metals were favoured and used as money because they were more durable. For example the Egyptians used gold bars of differing weights and the Mesopotamians used silver. During the seventh century in China, the concept of the banknote was developed, though paper money was only formally introduced around the 11th century. The reason for this was so that merchants and wholesalers did not want to carry heavy copper coins in larger commercial transactions.

Bitcoin was invented in 2008 by a “Satoshi Nakamoto”, whose true identity or identities still remains a mystery today. Bitcoin was revolutionary at the time because it was created as a decentralised digital currency without control by any bank or authority. It could be sent from person to person on the Bitcoin network without having to rely on any intermediaries.

Libra was created by the Libra Association, who was in turn co-founded by Facebook and formerly other companies such as PayPal, eBay, Visa and Mastercard. The purpose of Libra was to make it easier and more cost effective for people to transfer money on Facebook, thus attracting new users. In addition, potentially helping to empower billions of people who are unbanked. The plan was for this token to be backed by a portfolio of several types foreign currencies namely 50% USD, 18% EUR, 14% JPY, 11% GBP and 7% SGD to avoid volatility.

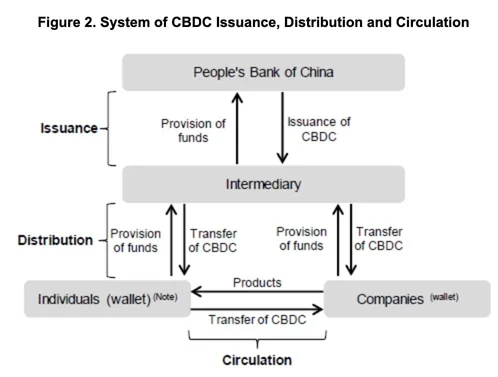

DCEP is poised to become the world’s first national digital currency and will be issued by China’s state bank, the People’s Bank of China (PBoC) as a digital version of cash. It is designed as a replacement of the Reserve Money (M0) system and will be pegged with China’s national currency the Renminbi (RMB) at a 1:1 ratio. This means that in future, instead of handing over physical money to buy items in China, you can simply access your electronic wallet on your phone and transfer DCEP to the shopkeeper.

Development of DCEP started in 2014 with the establishment of a research institute dedicated to digital currencies and looking at how to improve the Chinese Yuan system with blockchain technology. However during 2014 to 2018, the development process slowed down, this was probably because the decentralised nature of Bitcoin or blockchain is incompatible with the nature of the Renminbi as a legal national currency. Things rapidly picked up towards the end of 2019 however and this was directly attributable to Facebook preparing to launch Libra, particularly as partner members of the Libra Association and the currencies which Libra was to be backed by had consciously rejected China. Hence, feeling the heat of the competition, China’s central bank felt immense pressure to urgently speed up in the global competition towards a digital currency.

Currently, China had already completed the backend infrastructure of DCEP though there will still be ongoing pilot testing as part of the research and development process. Eventually, other Chinese cities, foreign firms and venues for the 2022 Winter Olympics hosted by China will participate in testing of DCEP.

Type of technology used

Cash is the only type of asset mentioned in this article which does not require any form of technology. Cash is physical paper or coins which can be transferred simply by handing it over to the recipient. Transactions are recorded on a ledger, and can be physical (e.g. a notebook) or digital (e.g. a spreadsheet).

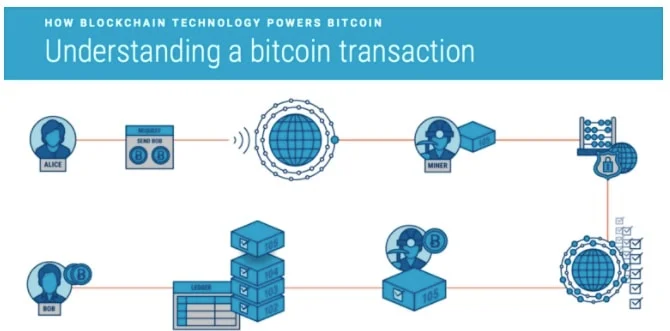

Bitcoin utilises blockchain technology, its founder Satoshi Nakamoto referred to Bitcoin as “a new electronic cash system that’s fully peer-to-peer, with no trusted third party.” Transactions are also publicly recorded on the blockchain, anyone can see what transactions have been made, although they cannot modify the transaction records.

Libra also utilises blockchain technology, but unlike Bitcoin which runs on a public blockchain, Libra would run on a consortium, or permissioned (private) blockchain. This blockchain can only be accessed and managed by the Libra Association, a group of companies which includes Facebook, Thrive Capital, Shopify, Tagomi and Temasek Holdings etc. This digital currency will be on an open-sourced platform built using its own programming language called Move.

DCEP is built with blockchain and other cryptographic technologies such as asymmetric cryptography, smart contracts, UTXO and digital wallet. This was confirmed by Mu Changchun, Head of the People’s Bank of China Digital Currency Institute. In particular, asymmetric cryptography (a.k.a public-key cryptography) technology is a process whereby a public key is used to encrypt a message so that only someone who uses the related private key can decipher it. It is the use of this technology that creates the linkage between DCEP and the blockchain and cryptocurrency industry. DCEP, due to the quasi-anoymous nature (as will be seen below) will also be making use of technology that can track its movements, and big data and data mining technology to monitor and prevent illegal activities.

Anonymity

Cash is truly anonymous as it has no features that can distinguish who its owner is. Simply put, if you picked up a $100 banknote lying on the street it would be very difficult, if not impossible for anyone to challenge your ownership of it. That is why cash is still the preferred instrument of choice for criminal activities such as money laundering, according to a study by Eruopol.

Libra’s aim is to be private. In its White Paper, Libra claims that they would support a privacy approach, though simultaneously taking into account the regulatory aspects of this. However unlike Bitcoin, Libra’s transactions won’t be fully public. Node administrators that run the network e.g. Facebook etc will have a copy of all the transactions made by users. How Libra will achieve this aspect of privacy in practice is unknown. Though there is speculation that short term anonymity can be created under Libra through how the Libra wallet is funded. For example, people can possibly purchase Libra from street sellers who would fund the wallet, or funding the wallet through ATM machines or using other cryptocurrencies. In short, Libra users cannot expect total privacy and anonymity.

Bitcoin allows users to make sever pseudonymous addresses. They are merely strings and numbers and letters, which are not attached to anyone’s identity. But unlike Libra, all transactions on the blockchain are public. So you may be able to find out who the owner of an address is through corroborating the transaction information with known information on who owns certain addresses. It is specifically through this method that funds belonging to victims of various scams are traced and identified, such as the PlusToken scam that resulted in losses of over $3 billion dollars worth of cryptocurrencies.

On the opposite end of the spectrum is DCEP, which contains features that allow China’s central bank to track the movement of the currency and supervise transactions. Filed patents concerning DCEP hint at this, since the patent concerned appears to be a tracking system that would make DCEP’s movements traceable between transactions and payment parties. Although Mu reassures people that DCEP would balance between allowing anonymous payments and “classified supervision” when illegal activities such as money-laundering are involved.

Market observers believe that the underlying motivation is because China desires to protect its capital boarders in case newer global payment systems and advanced technologies could facilitate illegal cash flows. In addition, Mu confirmed this fear and desire to preserve control when he expressed that if the Renminbi can be converted into Libra, there would be a massive currency exchange which would trigger its depreciation.

Efficiency of transactions

Cash transfers are inefficient, even more so if the transfers are across different jurisdictions. We all have been through the experience of having to wire money overseas which can take several days to process. These methods are also cumbersome, outdated, expensive and time consuming as it involves several entities such as banks.

One of Bitcoin’s major advantages is that you can transfer it conveniently across countries without going through banks. However compared to Libra and DCEP, the efficiency of Bitcoin transfers is still slow at around 7 transactions per second. Depending on the amount of transaction fees you were prepared to pay, some transactions could still take hours.

Libra’s design is to be more efficient than Bitcoin. This is mainly due to the fact that Libra is centralised, i.e. transactions are processed through the Libra Association, which means that Libra will draw less energy. Libra’s transaction speed also aims to be around 1,000 per second, which is much faster than Bitcoin. However this is not confirmed to be in the case in practice since Libra has not been launched yet.

According to Yang Wang, Senior Research Fellow with the Fintech Institute of Renmin University, DCEP has a peak transaction speed of 220,000 transactions per second. As with Libra, DCEP has also not been launched yet so it is unknown if this is the case in practice.

Decentralised?

Though anonymous, cash is in fact not decentralised. Banknotes are issued by banks which are regulated by governmental authorities. If you have a bank account, it is the bank that processes your transactions. So there is always some form of control by a central authority or an institution.

Bitcoin on the other hand is completely decentralised, no intermediary is required to process transactions. All transactions are visible on a public ledger known as the blockchain. Each of these Bitcoin transactions is validated and confirmed by the entire Bitcoin network and anyone with the correct hardware can join in and participate in this process.

Libra transactions, as mentioned previously is partially decentralised. Transactions won’t be fully public i.e. we cannot look up a transaction with a blockchain explorer like we can with Bitcoin. However, node administrators that run the network e.g. those in the Libra Association would have access to every user’s transactions.

DCEP is highly centralised. The digital currency would be issued by the PBoC to various intermediaries such as Alibaba and Tencent. These intermediaries would then distribute DCEP to companies and individuals in China and DCEP would circulate when transactions occur.

Current status

The status and usage of cash is well developed. It remains the most popular payment method for face-to-face transactions and for cheap everyday purchases. In 2019, the Diary of Consumer Payment Choice found that consumers still used cash in 26% of transactions and 49% of all small-value payments under USD$10 were made in cash. Overall, cash is the second most used payment method, with debit cards being the most popular.

Bitcoin is now gaining more usage and popularity since its invention in 2008. According to data from the US Bureau of Consumer Financial Protection, Bitcoin had US$4 billion in purchasing power in 2018. There are also many major retailers that accept Bitcoin payments e.g. Starbucks and Whole Foods. And almost every country would at least have 1 Bitcoin ATM machine where people can buy Bitcoin. Despite this, its usage is still minuscule compared to credit card purchases, which had a volume of USD$3.7 trillion in 2018. This may be because Bitcoin is still most well-known for being speculative, with many holding onto their Bitcoin in the hopes that they may sell it at a later date for profit.

Libra was announced in June 2019, and is going through some bumps in its development. The project faced suspicion and even criticism from regulators from the European Union, the United States, Switzerland and Japan. Banks also were notably absent during the initial Libra announcement, expressing reluctance to join because of uncertainties surrounding regulation and feasibility. In additional, shortly after Libra was announced several high profile members of the Libra Association such as PayPal and Vodafone departed.

However the Libra project is not “dead” as such, they released the second edition of its White Paper in April 2020. In May 2020, the Libra Association appointed its new CEO and announced several incoming members-bringing it to a total membership of 27. In June 2020, the Association also appointed its Chief Compliance Officer. Going forward, it seems that the Libra Association would continue to try and grow whilst engaging in dialogue with regulators. The Libra Association does not set a definitive timeframe for launch in the second edition of its White Paper, but it certainly is unlikely to be 2020 as per its initial projections.

As for DCEP, it has been confirmed that there will be closed pilot tests in Shenzhen, Chengdu, Suzhou, Xiong’an and some of the 2022 Winter Olympics locations. This will then be expanded to 28 cities and provinces including Beijing, Shanghai, Guangzhou and the Hong Kong Macau Greater Bay Area. However there is currently no timetable for when DCEP will be officially launched. Experts have revealed that it is unclear whether DCEP can debut in the second half of 2020, although plans for its development have certainly been ramped up by the PBoC.

Summary

Here’s a table showing the various features of DCEP, Libra, Bitcoin and Cash.

| DCEP | LIBRA | BITCOIN | CASH | |

| Anonymous? | Can be made anonymous | Yes | Yes | Yes |

| Type of technology used? | Smart contract, asymmetric cryptography etc. | Consortium blockchain | Public blockchain | Nil |

| Efficiency? | High | High | Low | Low |

| Decentralised? | No | Partially | Yes | No |

| Volatility? | Low | Low | High | Low |

| Portability? | High | High | Medium | Low |

| Security? | High | High | High | Low |

| Offline payment support? | Yes | No | No | Yes |

| Transaction speed (TPS/sec)? | 220,000 | 1,000 | 7 | N/A |

| Current Status | Undergoing testing | In development | In circulation | In circulation |

Angela Wang

Angela loves cryptocurrency, technology that improves our lives...and food. Anything that merges these worlds together is even better.