Benchmark Protocol ($MARK) is a supply elastic, stablecoin-alternative that connects traditional finance with the cryptocurrency market by revolving around the volatility index. It provides liquidity to the DeFi space during periods of high volatility to optimize value and stability.

Background

Founded by David Mass, the Benchmark protocol aims to bridge the digital currency market to traditional financing. The project was set in motion by a team composed of investors, blockchain engineers, and financial experts to strengthen security and the efficacity of loan collateral within the blockchain.

The sudden selling pressure experienced by the crypto market in march of 2020 prompted the team to act as they understood the risks within DeFi. The Birth of Benchmark exhibits the unique drive of the ambitious team behind the platform.

Ultimately, Benchmark’s team looks to be a household name within the market by staying relevant within the mainstream DeFi space and optimizing their product to the needs of the blockchain.

What is Benchmark Protocol?

Benchmark Protocol is a supply-elastic collateral and hedging system driven by a volatility index. Simply put, the Benchmark Protocol lessens liquidation events and hedges risk with its very own cryptocurrency, the $MARK token.

Furthermore, Benchmark’s algorithm functions as a rule-based utility that adjusts supply, and is supported by the CBOE volatility index (VIX) and deviations from the target metric, which is equal to 1 Special Drawing Rights (SDR) unit. The Benchmark team believes that implementing the SDR creates a larger and far more efficient use case rather than exposure to just one currency.

The Benchmark Protocol provides a dynamic and supply-elastic token in the MARK token, as it manages to connect traditional capital markets to DeFi. The platform’s protocol is unique and efficient; completely separate from the crypto market prices and trends.

The protocol prides itself as an ideal hedge exhibiting total transparency with all users and transactions making a secure and reliable solution for the DeFi sector. Its immutability is robust enough to prevent systematic risk arising from cease and desist orders.

Benchmark’s innovative approach has isolated the recurring issue of overshooting the target peg within the varying market conditions. Through the MARK token, the platform can effectively rebalance supply within a 5-hour window after the New York Stock Exchange (NYSE) ensuring the reduction of arbitrage activity for token users.

The distinct algorithm effectively adjusts to trends within DeFi while implementing traditional finance market strategies. The protocol actively monitors and regulates the total supply of tokens to compensate for anticipated price movements. This method helps in reducing excessive amplitudes of price percentage changes.

SDR

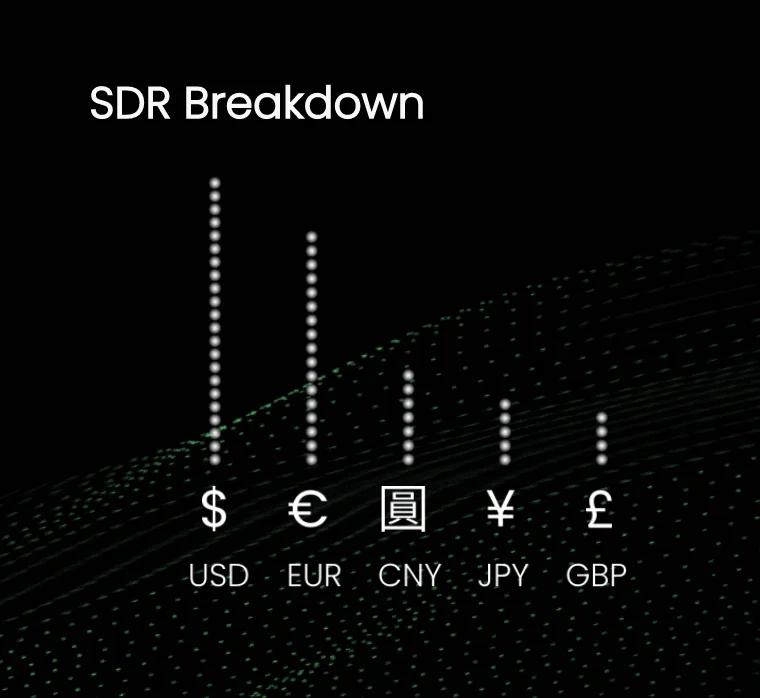

Since its implementation by the International Monetary Fund (IMF), the international reserve asset SDR has been an important factor concerning the health of the international financial system. SDR value is supported by five currencies: the Euro, Chinese renminbi, Japanese yen, U.S. dollar, and British pound sterling.

The Benchmark Protocol has been targeting the SDR’s historic price of $1.4075, with a long-term view utilizing macro-exposure to the world’s most established currency basket. The SDR is a superior and secured peg that will not face a tough path should the US Dollar experience strong inflation.

The Benchmark Protocol primarily benefits from SDR diversified and global currency risk instead of single currency risk, which will attract more users globally, thereby, contributing to the growth of the project long term.

Volatility Index (VIX)

Described as the market’s “fear indicator”, VIX is a real-time market index used to estimate the market’s expectations for the relative strength of near-term price changes and volatility typically within the S&P 500 index (SPX).

The blockchain-based platform relies on the VIX as an accurate and suitable predictive element for price development. The VIX enables the platform to be ahead of its competitors by allowing it to be more dynamic and proactive in the DeFi market.

The Press

The platform values Liquidity providers a great deal, as they are essential for the proper operation of the MARK token as a stable collateral utility. Furthermore, liquidity mining is an essential component of the Benchmark Protocol during the bootstrap phase.

The Press is the second phase of Benchmark’s liquidity providers rewards distribution program. It is the largest token allocation with 27% of the total supply provided to liquidity mining initiatives that compensate the liquidity providers’ active participation in the Benchmark network. The Press will feature core MARK Pairs, such as MARK-ETH and MARK-USDC on Uniswap.

The team plans to implement The Press for a period of 3 to 7 years, all depending on distribution velocity.

MARK Token

Built on the Ethereum blockchain, Mark Token is Benchmark’s native asset. MARK is an ERC-20 utility token and was released to the market while taking into consideration SDR and the VIX. So, MARK is secured to the world’s most stable currency (the SDR). Additionally, the token’s rebalances are smart and fast, derived from VIX.

Overall, Benchmark’s native token can be described as a supply-elastic collateral utility designated to increase liquidity during periods of high volatility and in direct correspondence with global equities markets.

MARK is a dynamic digital asset separate from other crypto implementations as it does not rival traditional fiat or paper currencies, which enables token holders to rely on a global currency risk profile versus a single currency risk profile. Additionally, through the platform’s utility token, users are shielded from inflation and further benefit from collateralization of risks.

XMARK Token

xMARK is another ERC-20 utility token within the platform, which represents MARK but is not affected by rebases. xMark is designed to help move the platform towards on-chain governance. The token is minted by holders staking MARK tokens within the single-asset staking platform and is currently available on Binance Smart Chain and Quickswap.

Conclusion

Overall the Benchmark protocol manages to deal with the issues of volatility and inconsistency within the blockchain elegantly. Through MARK and xMARK utility tokens, users are ensured that rules-based, non-dilutive, and supply-elastic collateral will facilitate their crypto journey.

The DeFi sector is set to benefit tremendously from such technology, which provides a unique product that is currently lacking in the blockchain.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.