Aave Protocol with their native token $LEND is a leading company within the decentralized finance (DeFi) sphere. The Company allows its users access to its open-source and non-custodial protocol to create money markets, joining a growing list of projects like Compound to bring decentralized options to the masses. We look at who is Aave ($LEND), its uses and how it differs from other projects such as Compound Finance.

What is Aave?

Named after the Finnish word for “ghost”, London-based company Aave was set up in September 2018 after a successful initial coin offering (ICO) the previous year for its ETHLend token which raised USD$16.2 million. The executive team under ETHLend migrated to Aave upon its establishment with ETHLend becoming a subsidiary of Aave. In January 2020, ETHLend announced it was no longer in operation and its website would only remain active for current users to close down their existing loans.

Aave’s aim is to fill in the gaps left by centralised fintech industry giants like PayPal, Skrill and Coinbase. Their main product is Aave Protocol, an open source and non-custodial protocol for creating money markets on the Ethereum blockchain.

Who is the team behind Aave?

Aave has a wealth of talent and experience within its team. Stani Kulechov (CEO) and Jordan Lazaro Gustave (COO) have retained and migrated their roles from ETHLend, bringing their wealth of knowledge to Aave. Their diverse 18 man team bring together a wealth of experience in the startup scene.

What is Aave Protocol?

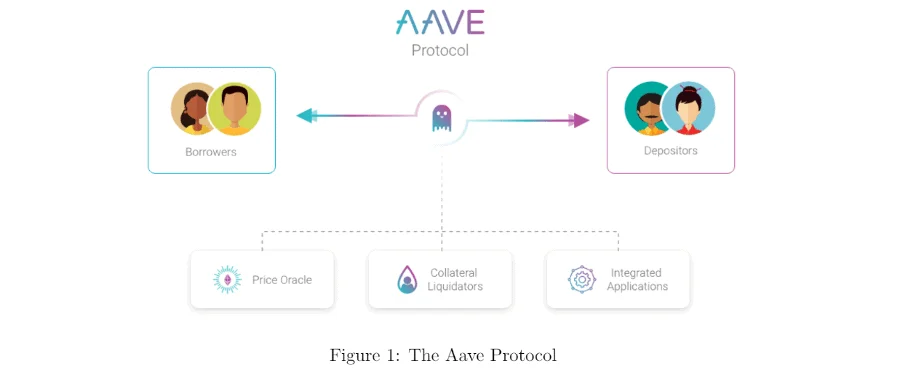

Aave’s biggest and most integral aspect is Aave Protocol which was launched in January 2020. Its shift from ETHLend marked a significant shift in strategy for the Company. Going from decentralized P2P lending to a pool-based strategy, Aave Protocol is an open source an non-custodial protocol that allows users to create their own decentralized money markets on the Ethereum blockchain.

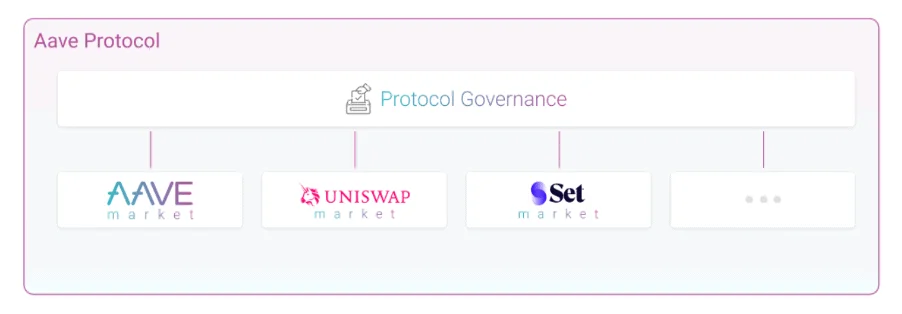

Depositors provide liquidity by depositing cryptocurrencies into lending pools which will then allow them to earn interest. Meanwhile, borrowers can obtain loans by tapping into these lending pools in either an overcollateralized or undercollateralized way. The loans do not need to be individually matched i.e. one lender to one borrower. Instead, deposits into the pool and the amounts borrowed/ collateral are used to make instant loans based on the pool’s state. There are currently 2 money markets that users can enter into, these are Aave and Uniswap.

Flash Loans

Aave has one feature that sets it apart from the rest. Flash loans allow customers or to take out loans without any collateral. These flash loans enable a customised smart contract to borrow assets from Aave’s reserve pools within one transaction. The loan is made on the condition that the liquidity is returned to the pool before the transaction ends. However, if it’s not repaid by that time, the transaction gets reversed- which will effectively undo any actions executed until that point and guarantee the safety of the funds in the reserve pool.

The Fast Loan feature is designed for developers to make tools that require capital for arbitrage, refinancing, or liquidating purposes. Aave explained Flash Loans saying it is “designed for developers/people with some technical knowledge”, with the benefit of risk-free loans. Aave charges a 0.09% fee on flash loans.

Rate Switching

Rate switching is another unique selling point for Aave, which arrived during the May upgrade of their borrowing/interest rates. Rate switching allows borrowers to switch between fixed and floating interest rates, something useful in a volatile decentralized market. For high-interest rates, users will usually opt for the fixed-rate but when it is more volatile and expected to be lower, one might go for the floating option to reduce borrowing costs. The fixed-rate can change but only when the deposit earning rate increases above the fixed borrow rate as the system could get unstable by paying out more than its being paid. If so, the fixed rate is rebalanced to the new stable rate. On the other hand, when the variable rate is lower than the fixed-rate by 20%, the loan will automatically decrease to account for the difference.

Which Cryptocurrency Tokens are linked?

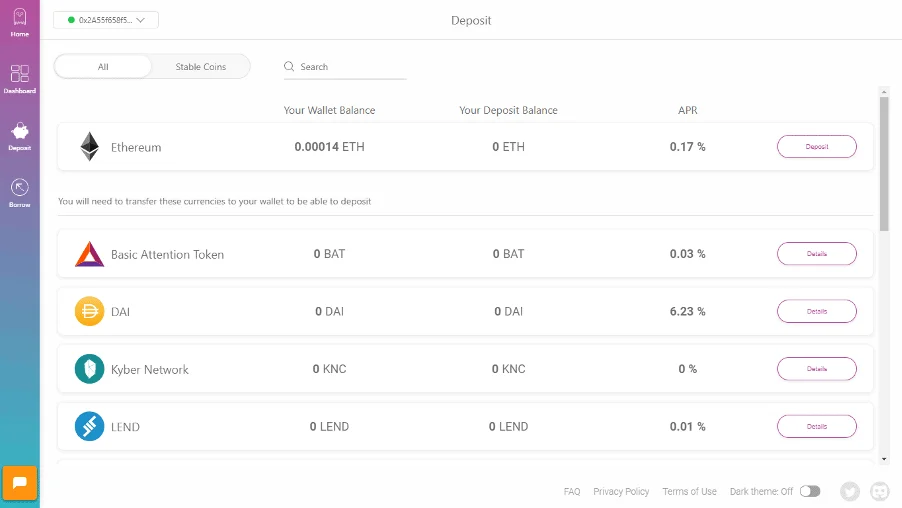

There are 19 tokens available on Aave. These include DAI, USD Coin (USDC), TrueUSD (TUSD), USDT Coin (USDT), sUSD, Binance USD (BUSD), Ethereum (ETH), Basic Attention Token (BAT), Kyber Network (KNC), ChainLink (LINK), Decentraland (MANA), Maker (MKR), Augur (REP), SNK, Enjin Coin (ENJ), REN, WBTC Coin (WBTC), Yearn.finance (YFI) and Ox Coin (ZRX).

Please note: Each asset has a different collateral requirement. This is because of the differences in price volatility. Stablecoins naturally give loan-to-value ratios, due to their price stability. A full breakdown of Aave’s grading process can be found in their Risk Framework.

Alongside these tokens, there is also a native token that Aave uses and which is called Lend. An explanation and analysis of the token can be found below.

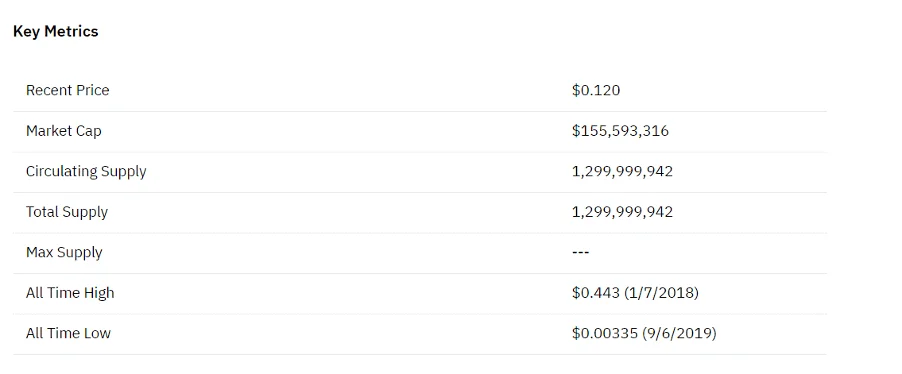

LEND ($LEND) Token

Often referred too as ETHLend, the LEND cryptocurrency token has rolled over to become the native token of Aave following the winding-up of operations by ETHLend in January this year. Although it has kept the name, the new Aave version of Lend is largely different from the previous one.

Built based on the ERC-20 standard, $LEND tokens can be used for fee reductions. The tokens are burnt from the fees collected from the Aave Protocol, with around 80% of platform fees used. This appears to suggest that Lend tokens will be worth more over time. LEND owners can also claim on protocol fees in exchange for acting as the first line of defense in the case of liquidity events by malicious borrowers.

In addition, $LEND tokens can be used for voting on Aave Improvement Proposals (AIPs). What’s more, LEND holders can vote with their LEND deposited on the Aave platform, even if it is currently being used as collateral. Currently, this feature is pre-launched on the Ropsten test network before it is launched on the Ethereum mainnet. This is so the Aave community can vote on proposals without incurring huge gas costs, try out the module and provide feedback to the Aave team before it is formally launched. It is also worth noting that the outcomes of all votes on the testnet are not considered as valid for the long term.

How to lend on Aave

Depositing and earning interest on Aave is a simple process. Before you start, you must visit https://app.aave.com/ and connect using a web 3.0 wallet such as Metamask, Coinbase Wallet or Fortmatic.

Depositing is easy, just simply pick your desired asset in which to invest and then allow Aave access to the asset. Once the transaction is processed, and the interest rate is confirmed you can check the rate changes on the Aave app. The interest-earning tokens are called aTokens which are similar to Compound’s C tokens.

There are some differences between Compound’s tokens and the aToken. The main one being that the aToken’s keep their underlying assets price and will increase the amount of owned tokens when the price goes up rather than increasing the tokens price.

Aave vs Compound ($COMP)

Both Compound Finance and Aave appear to be the two top DeFi lending platforms. However, both have unique features that set them apart. Compound does have USDT as a usable asset, but Aave has a wider range of tokens on offer. For Aave, their new interest rates and regulations, like rate switching gives them a slight edge. For first time users, Aave offers great incentive rates. However, lending rates and Borrow fees are higher on average with Aave. Either way though, Aave has proven a good addition to the Defi community and should prove popular. You can read more about Compound ($COMP) here.

Key features of Aave 2.0

Aave 2.0 was announced on 14th August 2020. Aave Market now offers 19 assets, plus the Uniswap Market offers different Uniswap pairs as collateral. The platform has also grown to over 15,000 users. Here are some of the key new features which can be expected in Phase 2 of Aave.

Pay with collateral

Currently, if users want to repay their loan with part of their collateral they need to do 4 separate transactions on several protocols: withdraw the collateral, buy the cryptocurrency which is borrowed, repay the debt and unlock all the deposited collateral. With this new function, Aave users can deleverage or close their positions by directly paying with collateral in 1 transaction.

Debt tokenization and native credit delegation

Users’ debt positions will be tokens i.e. users will receive tokens which represent their debt. This enables native credit delegation within the Aave Protocol, in addition to other features such as native position management from cold wallets and user-specific yield farming strategies.

Fixed rate deposit

Deposits on Aave can generate predictable interest rates which are not bound by market variations.

Improved Stable Borrow Rate

This will further ensure the predictability of interest rates by locking down their borrow interest rate to a specified time period.

Private markets

Aave will allow governance to open private markets to open private markets to support all types of tokenized assets. The Aave team are also working on a collaboration with RealT which will bring mortgages onto Ethereum.

Improved aTokens

aTokens are Aave’s interest bearing tokens which are minted when a deposit is made and subsequently burned when redeemed. The aToken is pegged 1:1 to the value of the underlying asset deposited with Aave. In Aave 2.0, there will now be a version 2 of the aToken which integrates the EIP 2612 which allows for gasless approvals.

Gas Optimizations

This feature is currently in the works and will lead to a significant drop in transaction costs for most of the interactions on Aave. For some interactions the gas cost may even be reduced by 50%. Aave version 2 will also implement native GasToken Support.

Security

In version 2, the internal design has been made simpler, the architecture is also improved so it is more formal verification friendly. Aave is also working with top auditors such as Consensys Diligence and Certora- a leading company in automatic verification technologies.

Native trading functionalities

Aave v2 will introduce the ability for users to natively trade their debt position from one asset to another, i.e. you can borrow DAI, and if USDC becomes cheaper to borrow, you could change your debt position to USDC in one transaction.

Users can also trade their deposited assets across the various cryptocurrencies supported by Aave, even when it is being used as collateral.

Margin trading is also introduced in version 2, so users can directly take long and short leveraged positions without using third party services. Conversely with margin lending, liquidity providers can increase the weight of their deposits to take opportunities.

Governance

Aave version 2 also introduces several new governance features. Now, AAVE token holders can delegate their voting weight to any other address. Aave believes this may lead to the emergence of Protocol Politicians, who will represent the interests of their peers to delegated their votes to them. But unlike most representative democracies we see around the world today, vote delegation is a liquid democracy so this means a user can instantly remove the delegation in a single transaction if they so wish.

The Aave team also recognises the pain points of the need to move tokens to another location to participate in governance. So Aave now allows users to be able to sign messages from their cold wallet to participate in Aave Governance. This will in turn reduce the security risk.

References:

AsiaCryptoToday: https://www.asiacryptotoday.com/aave/

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.