Non-fungible tokens (NFTs) are taking the art and gaming worlds by storm. Digital artists and gamers are seeing their lives change thanks to new communities and methods of earning and selling. Celebrities are joining in as well as they recognize a new opportunity to connect with fans.

From fine art and music to cats and rocks, these digital assets have exploded within blockchain news, some selling for millions of dollars. Some experts claim that NFTs are changing the landscape of investing forever, while others are convinced they’re a bubble poised to pop any day now.

NFTs have certainly been causing a splash and controversial debates – but what are they exactly?

What is a Non-Fungible Token (NFT)?

NFTs are tokens that we can use to represent ownership of unique items. They let us tokenize things like art, collectibles, even real estate.

In economics, a fungible asset is something that can be readily interchanged – like money. They can be exchanged because their value defines them rather than their unique properties. For example, you can swap a $100 note for five $20 notes and it will have the same value.

If something is non-fungible, it means it has unique properties so it can’t be interchanged with something else or divided into smaller units. It could be a house, or a painting such as the Mona Lisa, which is one of a kind. You can take a photo of the painting or buy a print, but there will only ever be one original painting.

In the same way, NFTs are scarce digital assets with distinctive characteristics, making them difficult to swap for another similar asset because it will likely not have the same value. Therefore, digital tokens can be thought of as certificates of ownership for virtual or physical assets.

How do NFTs Work?

NFTs exist on a blockchain, which is a distributed public ledger that records transactions and is maintained by thousands of interconnected computers around the world. The blockchain’s advanced encryption and peer-to-peer network secures the proof of ownership of NFTs, ensuring that no one can modify the record of ownership or copy and paste a new NFT into existence.

To create an NFT, it has to be “minted” from digital objects that can represent both tangible and intangible items, including:

- Art

- GIFs

- Videos

- Collectibles

- Music

- Virtual avatars and video game skins

- Designer sneakers

- Tickets to a real world event

- Deeds to a car

- Legal documents

Even tweets can be an NFT. Twitter co-founder Jack Dorsey sold his first ever tweet as an NFT for more than $2.9 million.

Ownership is managed through the uniqueID and metadata that no other token can replicate. NFTs are minted through smart contracts that assign ownership and manage the transferability of the NFTs. When someone creates or mints an NFT, they execute code stored in smart contracts that conform to different standards from regular tokens.

The owner or creator can also store specific information inside them. For instance, artists can sign their artwork by including their signature in an NFT’s metadata. NFTs can also contain smart contracts that may give the artist, for example, a cut of any future sale of the token.

Examples of NFTs

The NFT world is relatively new. In theory, the scope for NFTs could be anything that is unique or requires proof of ownership. Here are some examples of NFTs that exist today:

How and Where to Buy NFTs?

If you are keen to start your own NFT collection, you will need to acquire some key items. First, you will need to get a digital wallet that allows you to store NFTs and cryptocurrencies.

You will likely need to purchase some cryptocurrency such as Bitcoin (BTC), Ethereum (ETH), or Binance Coin (BNB), depending on what currencies your NFT provider accepts. You can buy crypto using exchange platforms and then you will be able to move the funds to your wallet of choice.

You will want to keep fees in mind as you research options. Most exchanges charge at least a percentage of your transaction when you buy crypto. Different NFT providers also have different gas fees which are fees you need to pay when you make an NFT purchase.

Once you’ve got your wallet set up and funded, there’s no shortage of NFT sites to shop. Currently, the largest NFT marketplaces are:

- OpenSea – the original peer-to-peer NFT marketplace, and the largest. Offers NFTs of everything from in-game items and collectibles, to artwork, music, GIFs, and more. To get started, all you need to do is create an account to browse NFT collections. You can also sort pieces by sales volume to discover new artists.

- Rarible – one of the leading NFT marketplaces on Ethereum, Rarible is a community-owned platform that showcases a wide range of digital art and collectibles. Similar to OpenSea, you can buy and sell all sorts of media. Sellers also have the option to create more than one NFT for a single image, selling it more than once.

- Axie Marketplace – NFT-powered video game Axie Infinity plays host to the second-largest NFT marketplace. It trades exclusively in Axies, which are cute, Pokémon-like digital pets which players can buy and trade on the Axie Marketplace. Unlike art NFTs, which are collected for collecting’s sake, Axie Infinity’s NFTs have a purpose: you can use them in-game to battle against monsters and other players, earning tokens that can be put towards breeding new creatures.

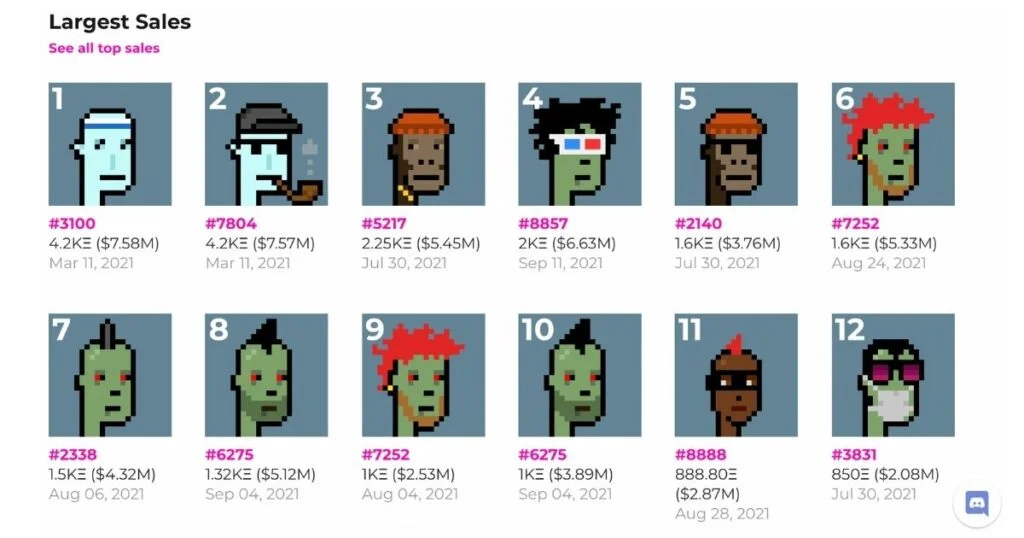

- CryptoPunks/Larva Labs – One of the most popular NFT collectibles on the Ethereum network, CryptoPunks is a series of 10,000 randomly generated characters with a pixel art aesthetic and unique attributes. CryptoPunks can be purchased at creator Larva Labs’ marketplace, where the majority of sales take place.

- BakerySwap – BakerySwap is one of the first to be launched on Binance Smart Chain (BSC). The NFT marketplace makes up one section of the platform, which also allows users to trade and swap liquidity assets directly with each other.

- Enjin Marketplace is the ideal choice for Enjin-based NFTs. The Enjin Wallet can help in listing and purchasing gaming collectibles and items easily. The marketplace offers game item collections, community-backed collectibles, and gamified reward programs.

- Foundation – Foundation bills itself as a “creative playground” for artists. It’s played host to a number of notable sales, including the NFT of iconic Internet meme Nyan Cat, Edward Snowden’s first NFT and an audiovisual digital collectible created by producer Richard D. James, better known as Aphex Twin. Foundation’s marketplace is simple to operate, letting you place bids on timed auctions just like you would with a regular auction site.

- KnownOrigin – KnownOrigin has a much smaller all-time trading volume because it aims to provide a more curated, gallery-like experience for the discerning NFT connoisseur. All of its artwork files are held on IPFS, which provides a measure of protection for the underlying assets. With a strong focus on digital art, this is a marketplace that shuns the crazier aspects of the NFT world, so you’ll find no wacky avatars or cute monsters here.

Gaming Potential of NFTs

NFTs have seen a lot of interest from game developers. NFTs can provide records of ownership for in-game items, fuel in-game economies, and bring a host of benefits to the players.

In a lot of regular games you can buy items for you to use in your game. But if that item was an NFT you could recoup your money by selling it on when you’re done with the game. You might even make a profit if that item becomes more desirable.

For game developers – as issuers of the NFT – they could earn a royalty every time an item is resold in the open marketplace. This creates a more mutually-beneficial business model where both players and developers earn from the secondary NFT market.

NFTs also make it possible so that if a game is no longer maintained by the developers, the items you’ve collected remain yours. In-game items can outlive the games themselves so even if a game is no longer maintained, your items will always be under your control. This means in-game items become digital memorabilia and have a value outside of the game.

Decentraland, a virtual reality game, even lets you buy NFTs representing virtual parcels of land that you can use as you see fit.

Is it Profitable to Invest in NFTs?

NFTs are speculative assets. Because they are new and have limited historical performance that you can use to judge them, they are a risky investment. However, you can’t dismiss them either because you can purchase them in small amounts.

Investing in NFT assets is purely a personal decision. One person might choose to buy NFTs because they have money to spare. Another one may buy a piece because it holds meaning for them. The value for NFT assets is not fixed or driven by technical, fundamental or economic indicators that usually influence the stock prices; instead, it is determined by what buyers are willing to pay for it. As a result, an NFT holder might be forced to resell it at a lower price than what they paid for it.

However, NFT assets also have the potential for mind-boggling gains depending on the traction and value the asset is able to obtain over time. When the collectible series CryptoPunks were initially released, you could obtain one for free. Today, one CryptoPunk can sell for millions of dollars.

NFTs also seem to be here to stay, as traditional industries are starting to appreciate the value of NFTs. For example, renowned auction house Sotheby’s has created their Sotheby’s Metaverse where NFT artwork is being auctioned- with bidding on some items exceeding 1 million USD for some works.

CryptoPunks, created by Larvalabs is also seen by many in the NFT space as a “sure win”. Top CryptoPunks NFTs have been sold for nearly US$8mil, and 1000s of CryptoPunks are still being offered for sale.

Controversies Surrounding NFTs: Are NFTs Bad For The Environment?

While a lot of money is circulating in the NFT market, there is some controversy linked to these trendy digital collectibles especially pertaining to the environment – particularly in terms of contributing to climate change.

Making NFTs requires a significant amount of energy, and protesters are extremely worried about the huge effects of this craze on the environment. The creation of some of these NFTs is consuming as high as 192 kWh.

While artists have promised to make carbon-neutral artwork, the cryptocurrency systems will not allow the verification of such promises. For instance, Bitcoin, Ethereum and others are founded on a proof-of-work system that makes the users’ financial records secure, which still consumes a lot of energy as well.

The impact on the climate is actually what is holding back many brands from joining the NFT bandwagon. However, companies and individuals are expanding their revenue streams, so these NFT controversies will not last forever. Also, the art and design community is hungry for NFTs that are changing hands at astronomical amounts of money. The initial intent for creating NFTs was to give artists the opportunity to assert digital ownership of their art; however, the fact they are becoming more elitist is creating tension.

The buy-in fees for NFTs are prohibitive for many people, and the price of a single art piece is extremely high, causing the public to rate the marketplace as a playground for the superrich investors. It also makes the majority of the artists feel disadvantaged, yet this sphere was created for them to have more control of their work.

Conclusion

It’s difficult for some to wrap their minds around the concept of NFTs, but that’s understandable. Why would someone spend millions of dollars on something they can’t even touch? Well, think of it this way: The same way art collectors wouldn’t mind giving up an arm and a leg for a one-of-a-kind Picasso painting, there are virtual art lovers who see the true value in owning the original source of a scarce, culturally-relevant digital asset.

Whether or not NFTs are here to stay, they have certainly become a new plaything for art and crypto enthusiasts alike, and there is real money to be made if you can make it happen. NFTs gives new meaning to digital art and blockchain adoption, and the prices seen at sale indicate it is a real part of the future of art, and collectibles in general.

That said, approach NFTs just like you would any investment: Do your research, understand the risks—including that you might lose all of your investing dollars—and if you decide to take the plunge, proceed with a healthy dose of caution.

Sources: