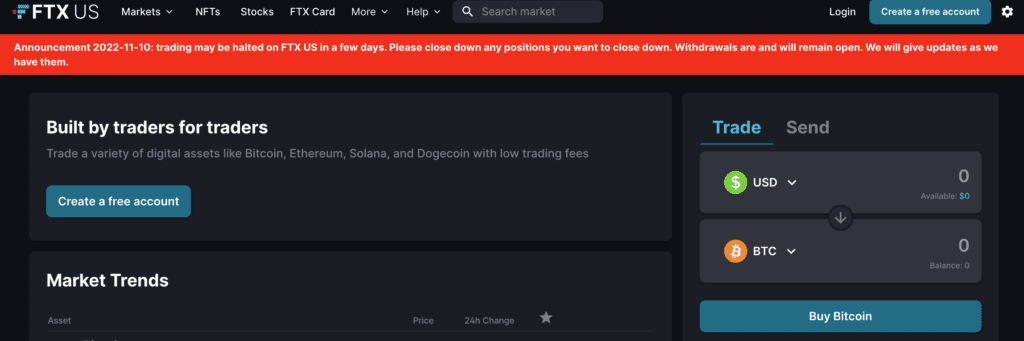

FTX EXCHANGE (INCLUDING FTX INTERNATIONAL AND FTX.US) ARE NO LONGER IN OPERATION

Both exchanges have filed for bankruptcy. Subsequently, the exchange was “hacked” and more than US$600 million worth of cryptocurrencies drained. The hacker is strongly rumoured to be a former FTX employee. For more about how this story unfolded and the latest news, check out these articles:

- SBF vs CZ War: What’s happening with FTX and Binance?

- Binance to Acquire FTX: What This Means for All Investors

- Binance Will NOT Acquire FTX: What is Next?

- BlockFi suspends withdrawals over unclear status of FTX

- FTX, FTX US and Alameda File for Bankruptcy

- FTX Hacked: Hacker Identity Revealed by Kraken

- What will happen to BlockFi?

- Were BlockFi’s assets held on FTX?

What is futures trading?

Newcomers to cryptocurrency and digital asset trading must navigate a complex sector filled with acronyms and technical jargon, as well as dozens of ways to trade across multiple exchanges.

One option newcomers may have heard of, and which they may want to learn more about is futures trading.

At first glance, this seems like a complicated way to invest, but the team at exchanges like FTX do their best to make the process as straightforward as possible.

What are futures?

Futures are a type of derivative financial contract that creates an obligation for the parties to exchange the asset at a price and date that is predetermined.

The buyer is obliged to buy that asset, and the seller has to sell the asset, even if the price of the asset has gone up or down.

Think of future trading as a fixed price sale in the future. You agree with someone on a price that is higher or lower than the current price, and then in the future, the sale gets executed at the same agreed price.

The underlying assets in the contract can be anything from a set of cryptocurrencies to real estate or any other commodity. The contracts are designed to have a detail of the quantity of the underlying asset, and also help in the execution of the trade on a trading platform.

Why is it called futures trading?

Futures are generally named by the month they expire. For example, a January gold futures contract will expire in January and is based on gold as an underlying asset. Similarly, you can also find contracts for other commodities as well.

Traders usually use the term futures broadly for a whole asset class. However, there are multiple futures contracts available based on different assets. These future contracts include:

- Commodities such as crude oil, corn, wheat, and so on

- US bonds, or any other government-backed financial bond

- Precious commodities like platinum and gold

- Index futures such as the Dow Jones Industrial Index

Examples

A very good example of a contract available on FTX is the Donald Trump 2024 futures contract.

This is a contract that allows traders to ‘bet’ whether Donald Trump will return to the White House following the next presidential election in 2024.

The contract expires on $1 if former president Donald Trump wins the 2024 election and it expires at $0 if he loses the election. The contract specifically also specifies other scenarios in which the contract expires early, for example, if he decides not to run in the future presidential election.

So if anyone invests $100 right now into the contract they will get 1063 positions of the contract which may become worth $1063 if Trump wins, and if he loses the amount would become zero.

The leverage used by the futures market is usually high. Leverage is a process in which a buyer can purchase the contract even if they enter it with a fraction of the contract’s value. The buyer only needs to come up with a fraction of the money, while the remainder is put up by the broker.

One of the most important things in futures trading is the exchange, where the whole trade gets executed and settled. As futures trading also involves physical exchange, it is important to have a good exchange with a stellar reputation backing up your trade. However, it should be noted most futures contracts are for people who speculate on the trade.

Difference between options and futures contracts

For people who are new to futures, it is important to understand there’s a difference between futures and options. An options contract does not put an obligation on the buyer or the seller. In the American way of doing business, it gives them the right to execute the trade before the expiration time, while in Europe the right is given after the expiration time.

In a futures contract, the buyer has to take possession of the underlying asset, and subsequently, the seller has to sell him that asset, they can settle for the cash equivalent. However, the trade has to take place.

The buyer also has the option of loading off their position any time before the trade expires to get rid of their obligation. This is one thing that is common in options as well as futures trading giving an advantage to the buyer to benefit from the leverage holder’s position before expiration.

FTX Exchange

Hundreds of platforms deal with crypto futures trading, however, traders need to be careful about which one they choose. They need to select a platform based on their preferences.

FTX has been one of the most promising entrants in the futures trading domain and has been taking up market share. The platform is slowly gaining a lot of traction and is widely considered to be one of the best platforms for futures trading. So, if you are interested in futures trading, FTX should be considered.

FTX was founded by Sam Bankman-Fried in 2019. He is also the founder of Alameda Research, a cryptocurrency, and blockchain research company that creates specialized algorithms for trading cryptocurrency. He is also a high-profile trader and created FTX as a trading platform that specializes in margin trading, futures trading, and leveraged trading. The exchange is backed by Binance, the biggest crypto exchange in the world, in what has been termed as a ‘strategic partnership’.

The FTX exchange was founded due to the SBF’s quest for a crypto trading platform that had it all from a trader’s perspective. He wanted a trading platform that put traders at the heart of the experience and designed FTX to cater to trader’s every need.

Simplicity, security, and abundance of features were made important parts of the FTX core philosophy. Even though the exchange was designed for traders, the UI/UX was kept simple and intuitive, so novices don’t feel overburdened.

To get started with FTX exchange, check out our FTX Exchange Guide.

What makes FTX futures different from regular futures?

The futures trading on FTX is a little different from other exchanges that offer futures contracts.

FTX futures are settled using stable coins. The settlements are made using stable coins as collateral and regular crypto cannot be used. This means that the volatility of crypto has no real effect on the users. This also gives the users a USD-based settlement exposure which means that you can use USD as the base currency for all your collateral and contracts, without the need for a bank account. Being in the crypto space also makes it easier for the position to be shifted around.

To avoid clawbacks, FTX futures has a unique program for providing backstop liquidity. The backstop liquidity is provided to accounts that are about to go bankrupt. This prevents the exchange from clawbacks.

Backstop liquidity is the assistance from the exchange that helps in creating a secondary source of funds for liquidity when the primary can’t cover it, in case of a bankruptcy event. It also stops the buyer from making additional payments to the seller in the case, which are called clawbacks.

The margin calls on the platform are measured and careful which avoids exposure to major price dislocations and huge losses.

How to post collateral?

In FTX futures the collateral is based upon stable coins and you do not have the option to post collateral in other cryptocurrencies. The current stable coins that are accepted include TUSD, USDC, and PAX.

For you to deposit or withdraw collateral you can go to your wallet on the FTX exchange and deposit USDC, PAX, or TUSD in your wallet. You can deposit them through a credit card or wallet transfer as well.

All margins posted on the wallet are in USD in your wallet by default, even if you fund it with stable coins the balance is shown in USD.

The collateral has a weight difference for each stable coin, in the case of USD fiat, the weight is kept at 1 meaning you can keep the collateral at the same amount. However for USDT, it is 0.975, for BTC it is 0.95 and for ETH it is 0.9 which means for the collateral to be high you have to have more collateral. This means that for $100 invested in USDT the collateral is at $97.5 while for the equivalent amount in BTC it is $95.

You can use the same collateral pool for all of your positions, by default all currencies that include USD, non-USD fiat, stable coins, and some cryptos can be counted as collateral. Cross margin is used for the account as every sub-account has its collateral wallet which is central to that account. Sub-accounts are considered as accounts and each sub-account has its own collateral. If you want isolated margins you would need to create a sub-account for each margin pool.

How do Futures expire?

The futures contract expires based on the set date of expiration. For example, a quarter future contract will expire every quarter between 2 am and 3 am UTC. Once the futures contract has expired the collateral amount gets credited into the seller’s account.

What are perpetual futures?

Perpetual futures are based on contracts that have no expiration date. The perpetual contracts work hour-wise, with each hour the contract has a funding payment.

This has a function of keeping the price of perpetual futures according to the index which is underlining it. The price can be kept stable without the position closing down or expiring.

How can I trade futures?

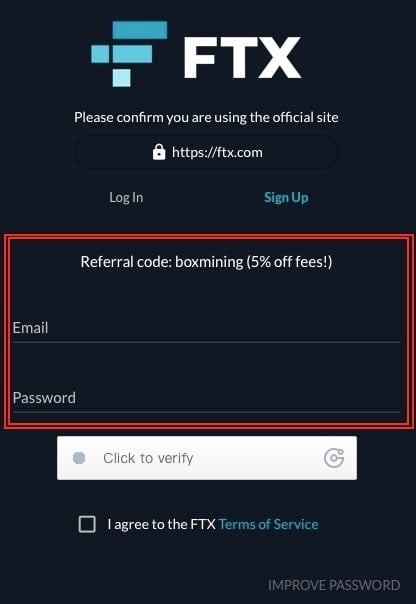

FTX is simple, go to the FTX website and you’ll see the registration page. Simply sign up with the email address you want to create your account with.

Once you have opened an account the next thing to do is to add funds to the exchange wallet. Depositing your funds into the FTX exchange can be done either through connecting it with an existing crypto wallet or you can deposit funds directly through using a credit card or a debit card.

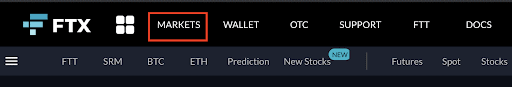

Once your funds have been deposited you can go to the ‘Markets’ tab on the front page:

In the ‘markets’ tab, you would get the following view, where you can see different futures contracts listed. The FTX exchange offers the largest collection of altcoins futures in the business.

You can also see the timed futures, for example, December expiration futures, as well as perpetual futures in the list as well.

The exchange also offers futures on US-based stocks and commodities as well.

Once you have decided you want to trade a future, you select the future you want to trade and you get taken to the console. The console looks something like this:

At the middle of the console you can look at the trading window which has the graphs displayed.

The top right corner shows you the index details as well as the price of the futures contract, along with its expiration. The bottom right shows you details of the collateral you have available, and the leverage can also be set from there as well.

Coming down from the console you can come to the order book as well as the order execution tab and the market trades tab:

The console of the futures tab is designed with professional traders in mind; the console has each functionality that a trader would require.

The traders can monitor the price through the grid as well as make reference lines on the console as well. You can also add a variety of indicators to the console. The index price shows you the average of all the exchanges in the area, it also shows you different details as well.

Below the console window, you can take a look at the current positions you have in the market as well as the previous positions you have had.

The futures trades can be made through the console easily by keeping the collateral in your wallets. Once you have the collateral you can start trading futures through the exchange easily.

Conclusion

Hopefully, this guide has given you an insight into the world of futures trading and gives you an oversight of how traders can and do use this method to make money on digital asset markets.

FTX is a great place to trade futures and to learn more about this exciting sector of digital asset trading, offering users a simple and easy-to-understand interface.

As with all investments, people should take care and ensure they have an appropriate trading risk mitigation strategy in place to manage their portfolios. Always make sure you never invest more than you can afford to lose. The cryptocurrency markets are by their very nature extremely volatile, with prices moving much more sharply than traditional markets, both up and down.

Check out our other FTX guides

- FTX exchange guide– Step by step guide on how to get started with FTX.

- FTX exchange review– Our review of FTX exchange.

- FTX funding rates– Learn how to earn passive income on FTX with funding rates.

- Crypto futures trading with FTX– Guide to crypto futures trading on FTX.

- Derivatives trading with FTX– Guide to derivatives trading on FTX.

Frequently asked questions

FTX uses a tiered fee structure for futures trading which starts at 0.020% for maker fees and 0.070% for taker fees. Frequent traders can get discounted trading fees up to 0.00% and 0.04% for maker and taker fees respectively.

This depends on the policies of each cryptocurrency exchange, but generally, residents of the United States are not permitted to trade crypto futures. A few exceptions are the Chicago Mercantile Exchange (CME) and the Cboe Options Exchange.

Trading in crypto or Bitcoin futures, or even cryptocurrency trading generally involves risks. One notable risk is the inherent volatility of cryptocurrency prices which can fluctuate greatly on a daily basis. Combined with leverage trading, this can hugely amplify any losses you may suffer if the market does not go in the way you anticipated.

Some traders use stop-loss or take-profit levels. These will close trades that are losses or before the market trend changes. These can help traders because it works automatically, so the trader does not need to be at their computer.

Another way to mitigate risks in crypto futures trading is avoiding emotional trading. For example, some traders feel FOMO (Fear of Missing Out) or revenge trade by “doubling down” when making a loss in an effort to minimise the loss. Emotional trading can in fact lead to further losses because it is not well thought out and researched.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.