ArbiSpace ($ARS) is a crypto launchpad built on Arbitrum. They recently announced a live $ARS airdrop event which will end on 6th March 2023. In this article, we will explain what ArbiSpace is and how to position yourself for their airdrop.

ArbiSpace ($ARS) Airdrop Step-by-Step Guide

Here’s a step-by-step guide on how to get a potential ArbiSpace ($ARS) token airdrop:

- Go to gleam.io/iocyb/arbispace-special-airdrop-event.

- Submit your Arbitrum One wallet address.

- Follow them on Twitter and Telegram.

- Retweet ArbiSpace and quote their pinned Tweets.

- Refer a friend to boost your chances of getting more $ARS airdrop.

See below for more details.

What is ArbiSpace ($ARS)

ArbiSpace leverages the layer-2 rollup technology of Arbitrum to create a secure and smart launchpad for DeFi developers and investors. Essentially, it provides DeFi projects with all the features and tools they need. For example, for token issuance, liquidity management, community operations, and DAO governance. Meanwhile, everyday users can invest in crypto projects at an early stage, with the potential to get the most profit. It also offers revenue-sharing protocols for yield farmers, and has strict moderation mechanisms integrated for safety and security.

Does ArbiSpace have a Token?

ArbiSpace confirmed on their document that there will be a total supply of 170 million $ARS. There will be an initial supply of 300,000 $ARS. ArbiSpace will split this into two rounds: a private round of 130,000 $ARS and a listing round of 170,000 $ARS. The ArbiSpace team has 10.2 million $ARS locked for two years with a linear vesting of 5%. Also, 13.46 million $ARS locked for two years with a linear vesting of 5% for marketing campaigns.

Farming rewards will receive the largest share of 146 million $ARS. Additionally, the smart contract will release 100,000 $ARS per day for farming rewards in a 4-year period according to pre-set rules.

ArbiSpace Airdrop Rounds

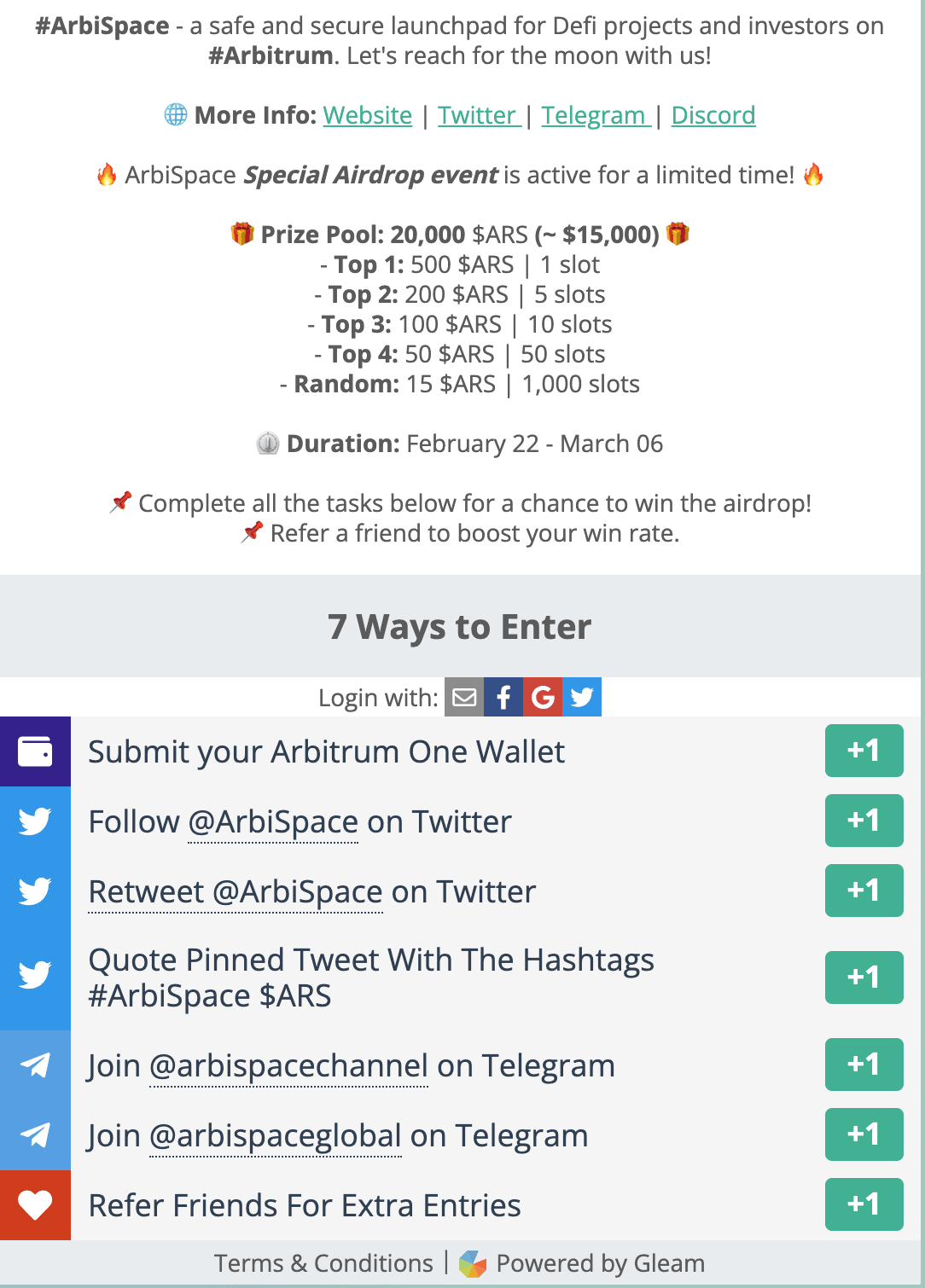

40,000 $ARS have been allocated to airdrops. Arbispace announced on Twitter that their airdrop event is now live for a limited time. The team will allocate 20,000 $ARS (worth around $15,000) for a second round of airdrop after 6th March.

How to Receive $ARS Token Airdrop?

All you have to do is go to gleam.io/iocyb/arbispace-special-airdrop-event and complete the tasks to be eligible for the $ARS airdrop. The tasks are very simple. You just have to submit your Arbitrum One wallet address, follow them on Twitter and Telegram. Retweet ArbiSpace and quote their pinned Tweets. You can also refer a friend to boost your chances of getting more $ARS airdrop.

Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: ArbiSpace confirmed on their document that there will be an $ARS airdrop.

Airdropped Token Allocation: 40,000 $ARS in total will be airdropped. The first round, consisting 20,000 $ARS, is live, and the cutoff date is 6th March 2023.

Airdrop Difficulty: The tasks for the airdrop are very simple to complete. All you have to do is (1) submit your Arbitrum One wallet, (2) follow them on Twitter and Telegram, (3) retweet them and quote their pinned Tweets, and (4) and refer a friend for extra entries.

Token Utility: $ARS will be used as a fee for token minting, launchpad, and smart contract locking. $ARS will also be rewarded for yield farming protocols.

Token Lockup: The ArbiSpace team has 10.2 million $ARS locked for two years with a linear vesting of 5%. Also, 13.46 million $ARS locked for two years with a linear vesting of 5% for marketing campaigns.