Spool is a Decentralized Finance (DeFi) protocol geared towards ordinary users who want to earn yield on their own terms in a simple and straightforward way.

Background

DeFi has been an exciting avenue in the field of cryptocurrencies. Based on the Ethereum blockchain, it uses smart contracts, which are automated agreements used to automatically enforce transactions without the need for a government or a bank.

A vast new set of Ethereum-based protocols have emerged, giving rise to decentralized financial products that automate loans, savings and even insurance. According to Nottingham Trent University associate professor of Cyptofinance and Digital Investment Jeremy Eng-Tuck Cheah, the total value locked up in DeFi contracts grew rapidly from US$2.1 million to US$6.9 billion from September 2017 to August 2020, and continues to rise.

What is Spool?

Luke Lombe, a founding partner of Australian digital asset management firm Faculty Group and Spool contributor, describes Spool as DeFi infrastructure that allows users to create a fully diversified, yield optimised, auto-compounding and risk mitigated DeFi portfolio – in a simple and straightforward manner.

According to Lombe, these portfolios, called Spools, cover complex tasks such as risk evaluation, risk/reward based portfolio construction and rebalancing to deliver an investment’s most optimal yield from the custom strategies deployed based on the user’s indicated risk tolerance.

Arguably, Spool has three synergistic features. The first is accessibility. Its straightforward set-up won’t repel users who might not have otherwise delved into DeFi. The second is diversification. Spools allow diverse portfolio management automatically, easing workloads and reducing barriers for entry. Thirdly is economies of scale. With the automation, having more users simply makes Spool more cost effective to run.

How to set up a Spool?

With just one stablecoin deposit and five more steps done via a simple interface, a user can set a Spool up, which contributor Phil Zimmerer describes as a “vault”. And then the user kicks back as the Spool does the work. The steps are as follows.

Step One: Choose a preferred deposit currency

“We’re starting with stablecoins, essentially USDC, USDT or DAI. That will expand to capture more volatile assets like Bitcoin or Ethereum, which are all subject to DAO (Decentralized Autonomous Organization) vote,” says Lombe.

Lombe goes on to explain that Spool is by its very nature a DAO first and foremost, which will vote on various proposals, including choices of new currencies before they are enacted. Stablecoins are likely chosen because they are, well, relatively stable cryptocurrencies, as they derive their value from an underlying external asset, like a national currency or gold. USDC and USDT (also known as Tether) are pegged to the US Dollar, for instance.

Step Two: Choose a risk model

Lombe describes a risk model as essentially a set of criteria that a user would use to assess risk in DeFi. For example, a risk model could factor in Time on Market, as the longer a protocol has been around, the safer it’s likely to be.

From this, Spool creates a risk score for each protocol. For instance, Aave might get a 7.5 out of 10 or Curve a 6.8. This helps the user in figuring out how to diversify their portfolio. He goes on to explain how the nature of DeFi investment makes risk-assessed diversification crucial:

“I imagine people would understand DeFi risk as pretty binary. It’s either your money’s safe or your money’s gone (laughs). Generally it’s a matter of a smart contract failure as opposed to an exploit or a hack or potentially a rug pull.”

Step Three: Choose some protocols

Choosing a risk model allows a user to then select various protocols, such as the ones mentioned in the beginning of this article, that they can place their funds in.

“So Curve, Compound, Aave. All the ones we know generally are included in this list. More will be added subject to DAO vote. So you basically create your ideal portfolio based on the protocols that you like and know,” adds Lombe.

Protocols such as Compound and Aave allow users to trade loans and earn interest via smart contracts, while Curve allows for stablecoin transactions at optimised rates.

Step Four: Select Risk Tolerance

Next, a user chooses their Spool’s risk tolerance from a sliding scale. According to Lombe, Spool’s own protocol will factor in the selected risk tolerance level as well as the yield and risk for each of the chosen protocols and then dynamically shape a user’s portfolio and re-weight it according to the parameters set by the user.

“But it’s not static. As the yield changes (which it does on a daily basis), the algorithm will essentially rebalance your portfolio to ensure that you’re constantly getting the most risk-optimised or yield-optimised and risk-mitigated return.”

Spool’s adjustments do this under efficiencies. Ethereum’s gas fees, or the compensated cost of energy used to compute a transaction, can be quite high, as is the cost of rebalancing a portfolio to account for them. So Spool uses economies of scale to mitigate such costs. As Lombe states:

“For example, if your Spool algorithm says ‘move your funds from Curve to Compound’, and mine says ‘move from Compound to Curve’, a tracer smart contract simply reassigns the assignment, so the funds stay where they are. Just like if you’re transferring money to someone at the same bank, the bank doesn’t move anything, it just moves the number from one to the other.

Lombe adds that more likely, funds moving in the same direction will be batched together, sharing the cost of transaction fees. With numerous other efficiencies in mind, more users actually makes Spool more energy efficient.

Final Step: Name Your Spool

Finally, a user simply has to name their Spool and assign a performance fee, if desired. This fee sets how much the user is paid by anyone who uses their Spool to invest. Lombe states that:

“You can say, ‘I’ve created a fully diversified portfolio, it’s going to be automatically managed and optimised for you. All you have to do is click on this link’, and they deposit their funds and then you get a small fee, essentially. And that’s only a performance fee, so the user’s actual initial contribution won’t be diluted at all.”

By creating a Spool and sharing it with others, it allows people intimidated by DeFi choices to join in. This then increases economies of scale. Essentially, an end user becomes a kind of “sub-broker” within the Spool network. Major contributor to Spool Phil Zimmerer explains:

“There are going to be users who don’t want to do due diligence, are not able to or it’s simply not worth their time. They’re more likely to trust a person or a group or a friend. And I’m uncomfortable giving financial advice. I think this resonates with a lot of people. So you can create your own “vault” and front load all your decision making with your knowledge and then you can share that schooling with people.”

SDK

However, what’s really interesting about Spool is that on top of what it can already do is its potential to be used as an SDK, or a software developer kit. As Lombe explains:

“Essentially, it’s a DeFi middleware. Not only can you create these DeFi portfolios, you can fire an SDK useful as a backend for white label services. Essentially, use whatever user interface you have on the front end and create your own DeFi products.”

These third party DeFi products could be websites or wallet apps running Spool in the background unnoticed. This could mean a lot of development work saved on such products.

When combined with the ability to share Spools, the automation of diversification and yield optimization as well as the efficiencies that work on economies of scale, Spool looks to be a particularly powerful piece of middleware within the Ethereum ecosystem.

Perhaps more importantly for ordinary people, it allows for better governance of finance – a thing that traditional finance seems to be failing at. As Zimmerer states:

“Traditional finance is stacked against those who are uninterested in it. It’s sort of kept boring so that people don’t really care about it and don’t really know what’s happening. A very concrete example of this we can see is Covid hits the economy really hard, and then you would also assume that the financial markets should also tank. And what happens is central banks are printing a lot of money and obviously now as a lagging effect we are starting to feel it in terms of inflation.”

Zimmerer sees inflation as a kind of tax on laypeople, where traditional finance’s lack of accessibility means fewer to offset the same inflation that will not affect traditional finance’s participants.

“For me, it’s because we kind of live in a world that forces you to think about the economy. We see a lot more, at least in my social circle, people getting interested in investing and managing their finances. And on a systemic level, even if you’re just a regular person with a regular job, it’s not just enough to dump it into a high-yield savings account, because those yield very little compared to the yields you can get in the rest of the financial market.”

Cheah notes that the pandemic has driven global interest rates even lower, stating that some jurisdictions, such as the Eurozone, are now in negative territory and others such as the US and UK could follow. Meanwhile Lombe also notes that central banks have had to print more money in the advent of economic collapse, and this drives inflation even higher, eating away at savings yields.

The people at Spool seem to have an understanding about how serious world affairs influence the lives of ordinary people, and seek to use DeFi to provide solutions to these specific problems.

In this climate, DeFi simply looks more profitable. Protocols such as Compound have delivered yields as high as 6.75% for those who save with Tether. But Lombe says that Spool’s role is different. Rather than try and be a new competitor seeking to dominate market share within the Ethereum space, he says Spool is more concerned with what can be seen as the greater good.

“What Spool is trying to do is essentially not try to compete with the other farms out there because we’re not a farm, we’re an aggregator of sorts. We’re not trying to take the piece of the existing pie. We’re trying to grow the pie.”

Spool Token Staking Guide

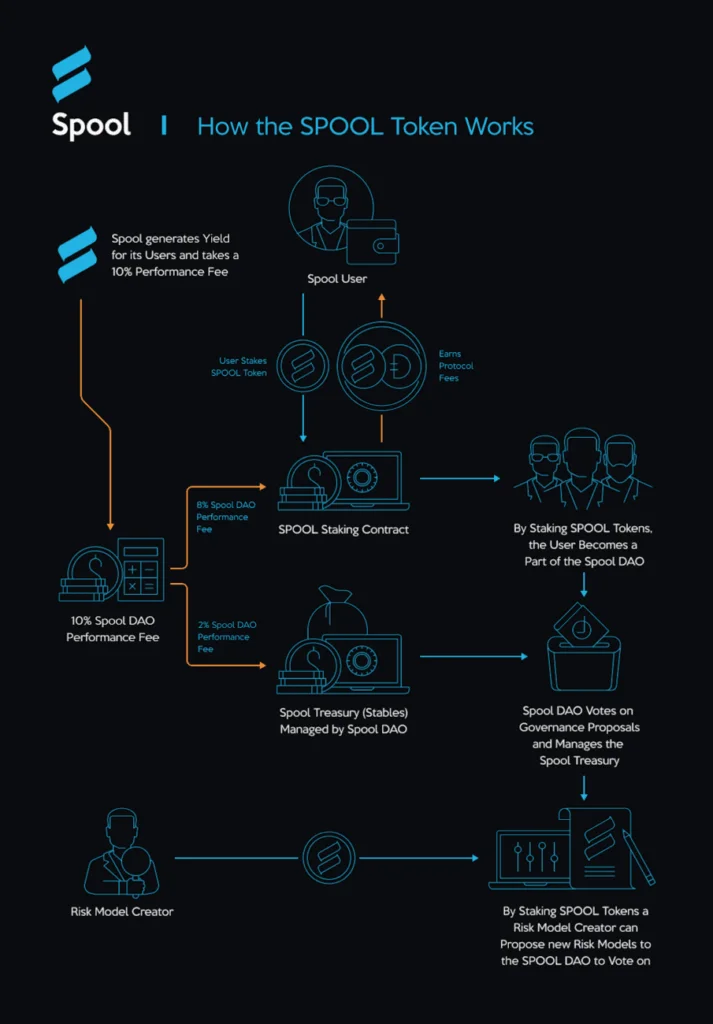

The purpose and benefit of staking SPOOL token is to obtain more SPOOL and the voSPOOL governance token. The voSPOOL tokens are distributed to stakers based on the amount of time continuously staked, capped at a maximum of the total number of SPOOL tokens staked. The distribution is calculated based on a weekly epoch up to a maximum of 156 weeks. However, if the staker stops staking their SPOOL tokens at any time, the calculation of the time spent continuously staking resets to 0- this means that their voSPOOL distribution will correspondingly be reset to 0. Here’s a step by step guide on how to stake your SPOOL tokens.

Step 1: Obtain the SPOOL token. $SPOOL can be purchased on exchanges like Uniswap. To get started with Uniswap, check out our Uniswap review and tutorial.

Step 2: Go to spool.fi and launch the Spool App on your web browser by clicking on the “Open App” button on the top right hand corner of the page.

Step 3: Click on “Connect Wallet” to connect your web3 wallet to the app. You can choose which wallet to connect such as Metamask, Ledger, Trezor, Coinbase Wallet etc.

Step 4: On the app, click the “Spool Staking” tab.

Step 5: On this page, you can see the amount of SPOOL tokens in your wallet and total SPOOL staked. You can also see the amount of claimable voSPOOL rewards earned and choose to either claim the rewards or stake these rewards. Furthermore, you can use your voSPOOL for voting on governance proposals on this page.

Step 6: To stake your SPOOL tokens, click “Stake” which will bring up a separate staking window.

Step 7: Input the amount of SPOOL tokens that you wish to stake, alternatively you can also click “max” which will stake the entirety of the SPOOL tokens in your wallet.

Step 8: Click “Approve” on both the app page and on your web3 wallet. This will allow the contract to interact and manage your SPOOL tokens.

Step 9: Click “Stake” to stake your SPOOL tokens and wait for the transaction to be completed. Note that this transaction will cost gas fees. Once your SPOOL tokens are staked, you can unstake them at any time.

Step 10: Once the transaction is completed, your $SPOOL tokens will be staked. We suggest you then refresh the page to see the updated amounts staked or remaining in your wallet.

Step 11: On the app, you can click on the “Platform Summary” tab to check the amount of $SPOOL tokens staked, the amount of voSPOOL accumulated, and the claimable staking emissions.

Step 12: On the app, you can also click on the “SPOOL Staking” tab to see the updated $SPOOL staking rewards.

Step 13: To claim all your rewards, click on “Claim All Rewards”. A pop-up window will then appear which shows both the SPOOL emission rewards as well as the voSPOOL emission rewards. Click “Claim” to claim these rewards.

Step 14: Wait for the transaction to be confirmed. Once completed, the SPOOL tokens will be sent to your web3 wallet. Note this will also cost gas fees.

Step 15: Clicking on “Stake Emissions Rewards” allows you to stake the rewards you have earned. A pop up window will appear and shows all the rewards that can be claimed and staked for both SPOOL and voSPOOL emissions. Click on “Claim and stake” to both claim your rewards and stake them in 1 transaction.

Step 16: Wait for the transaction to be confirmed. Once completed, the SPOOL tokens will be sent directly to staking and your balance will be updated. Note that this transaction will cost more gas than simply claiming the staking rewards.

Step 17: Once the transaction has been confirmed, it is suggested to refresh the page to see the updated amounts of staked or claimed SPOOL tokens.

REFERENCES:

Spool Official Website (https://www.spool.fi/)

Ethereum Official Website (https://ethereum.org/en/defi/)

Jeremy Eng-Tuck Cheah. 26 August, 2020. The Conversation. What is DeFi and why is it the hottest ticket in cryptocurrencies? (https://theconversation.com/what-is-defi-and-why-is-it-the-hottest-ticket-in-cryptocurrencies-144883)

Coach K. 14 Dec 2021. YouTube. The easiest DeFi tool ever created: SPOOL the e-toro of crypto. (https://www.youtube.com/watch?v=tNzqNoTCXPI&t=42s)

Boxmining. 2 Dec 2021. YouTube. Game Changing DeFi: Earn Yield On Your Own Terms (Spool). (https://www.youtube.com/watch?v=L0b4nvxPnbI&t=603s)

Lombe, Luke. 10 June, 2021. Medium. Spool: Infrastructure for Composable Capital Deployment. (https://medium.com/spoolfi/spool-infrastructure-for-composable-capital-deployment-3a86b2fac798)

Diversification. Investopedia. (https://www.investopedia.com/terms/d/diversification.asp)

Economies of Scale. Investopedia. (https://www.investopedia.com/terms/e/economiesofscale.asp)

Decentralized Autonomous Organization (DAO). Investopedia. (https://www.investopedia.com/tech/what-dao/)

Julian Dossett. Stablecoins: What they are, how they work and how to buy them. 6 Dec 2021. CNET. (https://www.cnet.com/personal-finance/crypto/stablecoins-what-they-are-how-they-work-and-how-to-buy-them/)

USDC Official Website. (https://www.circle.com/en/usdc)

Tether Official Website. (https://tether.to/)

Aave Officail Website. (https://aave.com/)

Curve Offical GitBook resources. (https://resources.curve.fi/base-features/understanding-curve)

Software development kit. Wikipedia. (https://en.wikipedia.org/wiki/Software_development_kit)

FAQs

Spool is a Decentralised Finance (DeFi) application that allows users to create a fully diversified, yield optimised, auto-compounding and risk mitigated investment portfolio – in a simple and straightforward manner. It is also middleware, and can be used to power other applications.

With just one stablecoin deposit and five steps done via a simple interface, a user can set up this automated DeFi portfolio, or Spool up. Choose a preferred currency, a risk model, some protocols to invest in, your risk tolerance, name the Spool and then set a performance fee to charge others than invest in your Spool (in that order). And then, just leave it alone to do its job.

DeFi yields currently seem to be doing better than traditional finance. Amid the global pandemic, inflation threatens to devalue returns from traditional savings. And while getting into Defi could be complicated, Spool is relatively simple and straightforward to use for beginners, and very easy to deal with for experts who are tired of manually managing their portfolios. As more users use it, the more stable it gets, and others can invest in your Spool without having to create their own for the said small performance fee.