Solana ($SOL) meme coins have gained significant popularity amongst cryptocurrency traders due to their playful and often humorous nature. Most importantly, there have been some cases where if you are early into buying a Solana memecoin, you could stand to make huge gains. This is because you have entered the market and bought up some of the coins before others enter, saturate the market and increase the price of the memecoin. Therefore, one of the main objectives in playing with Solana memecoins is that you need to be early. Here’s our guide on how to snipe Solana ($SOL) memecoins early.

Check out our video guide!

What is a Solana ($SOL) memecoin?

Solana meme coins are fun and humourous cryptocurrencies on the Solana blockchain. They often lack serious utility but thrive on community engagement and social media buzz. These meme coins are also usually inspired by internet memes, jokes or cultural references.

Solana meme coins are popular because they attract passionate communities. Their appeal lies in the fun and lighthearted nature of memes, which encourages active participation. The coins also gain traction through platforms like Twitter, Discord, and Reddit. Memes, jokes, and creative content drive interest and engagement. The fact that the Solana blockchain has high-speed and low-cost transactions, also makes Solana an attractive platform for meme coins. This is because users can trade and participate without hefty costs.

Learn more about Solana ($SOL) HERE

Which are the most popular Solana meme coins?

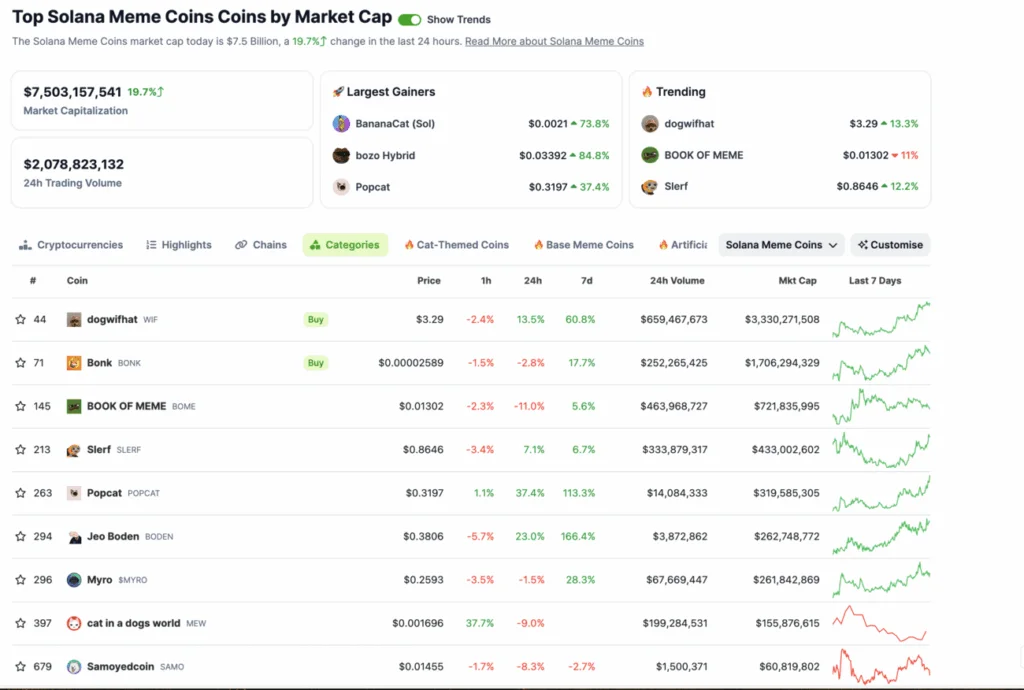

Here are some of the most popular Solana meme coins on the market right now:

- Dogwifhat ($WIF)

- Bonk ($BONK)

- Book of meme ($BOME)

- BananaCat ($BCAT)

- Myro ($MYRO)

You can see a full list of Solana meme coins and their details on Coingecko HERE

How to snipe Solana ($SOL) memecoins early

Here’s a guide on how to snipe Solana ($SOL) memecoins early

- Understand your risk tolerance.

Meme coins are based on short-term jokes or cultural references. As mentioned previously, they generally do not have an actual utility and are mostly just for fun. However, you will be using real funds when trading these memecoins, so it is very risky. Therefore, you should understand your risk tolerace. For example, if you have very little funds, you may want to reconsidering putting all your funds into one memecoin.

- Set up alerts

Set up alerts on platforms like CoinMarketCap, CoinGecko, or any other tracker that offers new token listings. By doing this, you will be among the first to know when a new meme coin is listed, giving you a head start.

- Get Solana ($SOL) tokens

You will need Solana ($SOL) to swap for Solana memecoins. You can obtain Solana ($SOL) tokens on most major exchanges such as Bybit, BingX or Binance.

Sign up for Bybit here! - Research the memecoin community

Before buying a memecoin, you should research the project and its community. Look for projects backed or created by credible names or those with active and positive community feedback. See if the memecoin is constantly posting and marketing themselves. You can research the memecoin by typing the coin ticker symbol or token address on Twitter. Look for strong, active engagement on social media platforms such as Twitter, Discord, and Telegram. Teams that are communicative and communities that are passionate often indicate a promising project.

- Look at token metrics

When deciding whether or not to trade a memecoin, we look at various token metrics. One metric is holder distribution, for example, on pump.fun, you can see the holder distribution statistics on the bottom right hand side of the page. If only the developer is holding the token, there is a strong risk that they may rug pull once you buy. You can also look at the replies underneath the token chart to get a general idea of what the community feels about the memecoin. Another metric to consider is whether the memecoin unique. This is because if the memecoin is a secondary version of a meme, or it is not humourous, then people may not be that interested in buying it.

- How to buy the dip

Buying on dips can be used for speculation or simply to secure better entry points for a long-term position. Keep a watch list of strong tokens ready so you can quickly secure a profit during any market drop.

- Find tokens tied to trending narratives

Tokens tied to trending narratives like AI, AI agents, DPin, or AI agents are often the first to recover after a dip. Investors return to projects that align with current market trends. Examine how the price has reacted to past dips and assess the current level of interest.

- Find memecoins with high liquidity

Memecoins with higher liquidity ensures that a token can be bought or sold easily without significant price slippage, which is crucial for profit-taking. Check trading volumes on major exchanges. Low liquidity makes it harder to exit positions, especially in volatile markets. You can consider exploring memecooins with a market cap between 10 million and 500 million to balance risk and reward.

- Look for whales or funds accumulating a token

If whales or funds are accumulating a token, it increases trust within the project because smart money typically avoids weak projects. You can track whale wallets using tools like GMGN.AI for significant transactions.

- Trade meme coin

According to the website, Pump.fun is a meme coin trading platform that aims to prevent rug pulls by attempting to make sure that created tokens are safe. Each meme coin on their platform is a fair-launch without presale or team allocation. That means that no team members of the coin can hold the coin before its public launch. This also means there are no team members who can quickly trade the coin immediately after the public launch, thereby giving them an advantage over the public.

How pump.fun works is that once you find a meme coin that you would like to buy, you buy the coin on the bonding curve. You can also sell the meme coin at any time if you wish to lock in your profits or losses. When enough people buy the meme coin such that it reaches a market capitalization of US$69k, US$12k of liquidity will be deposited into Raydium and burned. The effect of this is that the token supply would be reduced, making the token scarcer and potentially pushing the coin price upwards. - Monitor price action after any dips

Price dips when trading memecoins are inevitable. However, strong tokens recover quickly after dips, signaling market confidence and sustained interest. Monitor the price action after a dip. Rapid recovery often indicates strength and resilience in the token.

Angela Wang

Angela loves cryptocurrency, technology that improves our lives...and food. Anything that merges these worlds together is even better.