For a long time, decentralized platforms have been operating in silos, but now, developers are looking for ways to interface with different blockchain platforms. Apart from interoperability, new projects are looking for ways to power the seamless movement of tokens between chains.

One such project is Moonbeam ($GLMR, $RIVER), a platform that works under the belief that the future of distributed systems is multi-chain. The project brings smart contract technology to another level and takes developers, end-users, collators, and other network participants along with it. Moonbeam’s entry into the scene provides a crucial pillar to decentralized finance (DeFi) platforms.

For example, SushiSwap has already transferred its core exchange protocol on Moonbeam, specifically on the Moonbase Alpha TestNet. Below, we explore the platform, including how it offers Ethereum developers an easy way out.

Background

PureStake, a master in developing reliable, secure, and next-generation blockchain infrastructure, is behind the Moonbeam project. PureStake’s team experience spans from managing high-end data centers, as-a-service platforms, and networks for institutions strictly bent towards security and availability.

Top PureStake team members include Derek Yoo, Stefan Mehlhorn, and Tim Baldwin. Yoo, the CEO, has 20 years of experience in software development and cloud systems. Mehlhorn is the chief operating officer with 25 years in technical operations in various top companies such as Samsung.

Before joining PureStake, he was the CEO of Collego and Parmessa. On the other hand, Baldwin is PureStake’s vice president of engineering and has 20 years of experience leading DevOps and application development teams.

What is Moonbeam Network?

Moonbeam is a developer-focused decentralized network providing tools to enhance compatibility with the Ethereum blockchain. Notably, the network fully implements the Ethereum Virtual Machine (EVM), an application programming interface (API) with Web3 compatibility, and provides bridges to enhance connection with Ethereum-based protocols.

With these functionalities, developers can deploy solidity-based smart contracts and decentralized application (Dapp) frontends on Moonbeam with little to minimal modifications.

Additionally, Moonbeam is part of the Polkadot ecosystem, where it operates as a parachain.

Consequently, it taps into Polkadot’s security and connects to other networks on Polkadot.

Building on Moonbeam can either be done by employing a standalone node on the network or connecting to Moonbase, a testnet environment. The protocol supports major wallets such as MetaMask and MathWallet.

Note that Moonbeam’s Ethereum compatibility allows it to support other wallets that work with the Ethereum blockchain. In addition, it works with major Ethereum tools such as Remix, Truffle, HardHat, Web3.py, Ethers.js, and Web3.js. Additionally, for projects requiring interaction with external data, Moonbeam supports leading oracle platforms like Band Protocol, Chainlink, and Razor Network.

How Moonbeam Works

Moonbeam employs a proof-of-stake (PoS) mechanism for block production and transaction confirmations. However, it leverages Polkadot’s PoS model that features validators and collators. Collators collect transactions from Polkadot’s parachains, such as Moonbeam. They then create state transition proofs for use by validators on the relay chain.

Collators are selected depending on their stake in the protocol. However, the staked amount is slashed in case a collator acts dishonestly. Notably, network users can delegate their tokens to collators who share their block rewards with the delegators or nominators. The high the stake, the stronger the network security, the higher the chance of being selected as a collator.

Currently, the Moonbeam network caps the maximum number of nominators that can delegate their tokens to 10, and a nominator can stake their tokens with a maximum of 8 collators.

Each block production round takes roughly two hours and is made up of 600 blocks. The staking rewards are delayed for two rounds.

Observe that collators charge nominators for their service as soon as they are successfully nominated to be block producers. Therefore, during reward distribution, collators remove the commission after getting the block rewards and then distribute the rest to nominators depending on their delegated amount.

Glimmer ($GLMR) and River ($RIVER) token

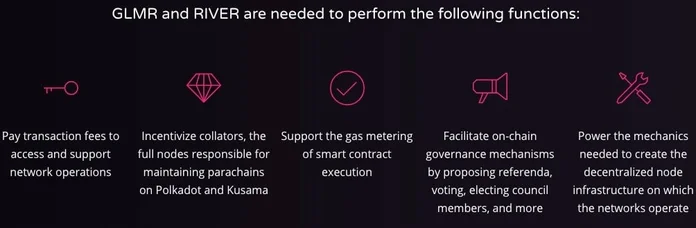

Moonbeam has 2 utility tokens: Glimmer ($GLRM) and River ($RIVER). The major difference between the 2 tokens is that they are respectively deployed on the Polkadot and Kusama relay chain.

Glimmer token (GLMR)

The Moonbeam platform has a base asset called Glimmer (GLMR), which has specific functionalities throughout its ecosystem. Glimmer works on the Moonbeam network and the Polkadot relay chain.

GLMR is used to:

- Pay transaction fees.

- Support network operations.

- Reward collators.

- Power on-chain governance.

- Support gas metering of smart contract execution.

GLMR has a genesis token supply of 10 million and an annual inflation rate of 5%. The token distribution goes to seed funding, strategic sale, public sale, parachain bond funding, treasury, development, partners/advisors, founders, among others. Moonbeam tackles the 5% inflation by burning 80% of the transaction fees.

River token (RIVER)

The RIVER token is deployed on Kusama and acts as a “CanaryNet” on the network. This means the token utility behaviours on Moonriver will mirror Moonbeam.

Governance on Moonbeam

Moonbeam employs community governance through the Glimmer token. Token holders range from developers, users, collators, and contributors. The governance aspect defines how token holders interact with proposals, referendum, voting, enactment, lock period, and delegation. Moonbeam takes a layered approach to governance.

Most importantly, governance is conducted on-chain. Some critical governance components include:

- Referendum – This is made up of the proposal with the highest number of votes. A proposal contains suggestions to change Moonbeam parameters, such as code upgrades and governance parameters. The platform supports a maximum of five proposals at each referendum.

- Voting – Voting is done by token holders. Notably, the weight of each vote depends on the amount of staked tokens.

- Council – This is a group of participants that propose referenda and vet community-suggested proposals. However, council members have special voting rights and are voted in by GLMR holders.

- Treasury – The treasury holds funds from users who wish to submit a proposal. The council can either approve or reject such proposals. Unfortunately, in case of a rejection, the proposer loses the amount held in the treasury.

Conclusion

Moonbeam is not a typical EVM implementation. Instead, it adds to the existing Ethereum features such as staking, on-chain governance, and inter-blockchain connections.

Notably, Moonbeam’s community governance framework employs a layered structure. As such, it ensures only the most viable proposals make it to the voting stage. Additionally, integrating EVM and Web3 makes it easier for developers to transfer existing projects to the network with minimal changes.

On the other hand, GLMR helps power the network by enabling staking, payment of transaction fees, and rewarding collators. Note that the network’s use of the Polkadot PoS consensus mechanism provides scalability and high transaction speeds.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.