As the world races to combat climate change, blockchain technology is emerging as a powerful tool to enhance the efficiency, transparency, and accessibility of carbon markets. For crypto folks, it’s worth understanding the basics: carbon credits are tradable units where one carbon credit represents a reduction, avoidance, or removal of one metric tonne of CO2e (carbon dioxide equivalent) from the atmosphere. Tokenizing these credits onchain unlocks global participation and streamlines trading and retirement, making climate action more scalable. At the forefront of this revolution is Klima Protocol, a decentralized platform dedicated to bringing carbon markets onchain.

With its innovative approach to tokenizing, trading, and retiring carbon credits as part of the Real-World Assets (RWAs) movement, Klima Protocol is redefining how we interact with environmental assets. In this article, we’ll dive into Klima Protocol’s mission, explore the latest updates with KLIMA 2.0, and highlight what’s on the horizon for this groundbreaking project.

Klima Protocol: A Vision for a Sustainable Future

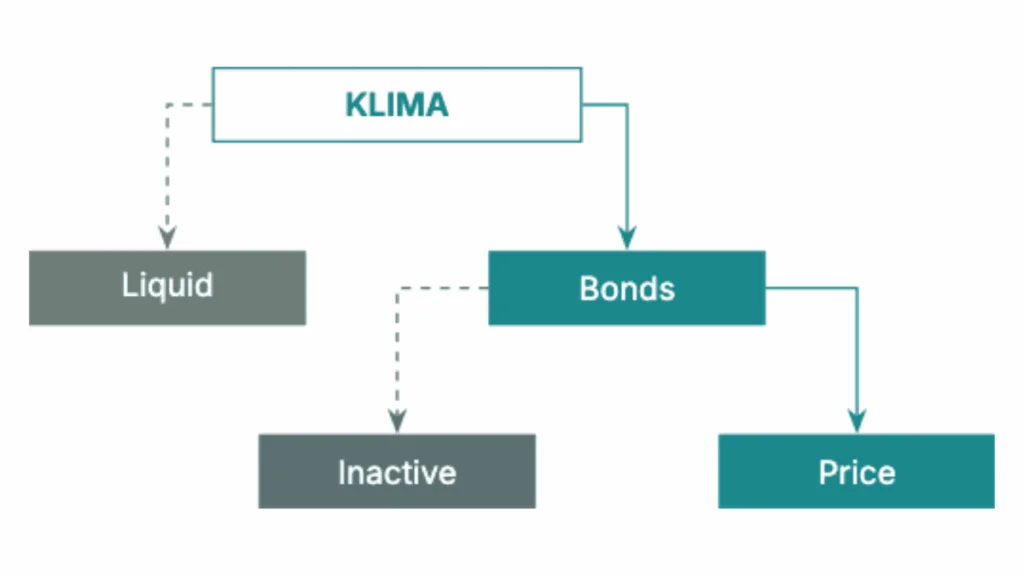

Klima Protocol aims to create a decentralized liquidity hub for carbon credits. According to its whitepaper, Klima Protocol leverages blockchain technology to facilitate efficient carbon credits’ trading, generate fees, and incentivize stakeholder participation through its dual-token system: $KLIMA and $KlimaX. $KLIMA represents carbon-backed assets, while $KlimaX serves as the governance token, empowering holders to influence the protocol’s direction, such as deciding which types of carbon credits to purchase.

The protocol’s treasury is backed by a diverse range of carbon credits, ensuring that $KLIMA maintains intrinsic value tied to real-world environmental assets. By capturing the inefficiencies of traditional carbon markets—such as broker fees (aka middlemen) — and redistributing that value to ecosystem users, Klima Protocol is building an open, interoperable carbon economy that aligns financial incentives with climate impact.

KLIMA 2.0: A New Era for Carbon Markets

On April 1, 2025, Klima Protocol announced its highly anticipated KLIMA 2.0 update via a detailed post on X by @OptimaResearch. This update marks a significant evolution in the protocol’s token ecosystem, introducing several key changes that promise to enhance its impact on the carbon market and the broader DeFi space. Let’s break down the major updates:

1. Migration to a New $KLIMA Token on Base

Klima Protocol is migrating the existing $KLIMA token to a new version on Base, a layer-2 scaling solution for Ethereum. This transition aims to improve scalability and reduce transaction costs, making it easier for users to interact with the protocol. The new $KLIMA will continue to be backed by the carbon credits in Klima’s treasury but will reflect a broader and higher-quality range of assets compared to the previous standard of 1 Base Carbon Tonne (BCT). Additionally, $KLIMA holders can now stake their tokens to earn ecosystem fees and provide liquidity in core pools, capturing value from trading fees and arbitrage opportunities. This model of yield generation is derived from what Klima calls “structural delta”—the efficiencies gained by bringing carbon markets onchain.

2. Introduction of $KlimaX: Fixed-Supply Governance Token

Alongside the new $KLIMA, Klima Protocol is launching $KlimaX, a fixed-supply governance token designed to give holders a say in the protocol’s carbon credit purchasing decisions. By staking $KlimaX, users can vote on which types of carbon credits the protocol should acquire, directly influencing the treasury’s composition. Staked $KlimaX also earns yield, and holders can provide $KLIMA/$KlimaX liquidity to earn additional rewards. The value of $KlimaX is intrinsically tied to the success of $KLIMA, creating a symbiotic relationship between the two tokens.

There is an entire exposition detailing the mechanics of Klima 2.0. Refer to the “Three Economic Pillars” section in the whitepaper.

3. $kUSD: A Game-Changing Syncratic Balancer Token

Perhaps the most exciting addition to what’s coming is $kUSD, a new type of asset dubbed a Syncratic Balancer Token (SBT). Unlike traditional stablecoins, $kUSD combines yield, decentralization, and long-term stability by being fully backed by a mix of US Treasuries and climate risk-focused assets. Drawing inspiration from Tether’s $USDT model—which generated $7 billion in revenue in 2024— the majority of $kUSD’s profits will be distributed to holders while using a portion to supercharge its carbon economy. This innovative approach positions $kUSD as a potential game-changer for both the wider DeFi space, offering a stablecoin-like experience with real yield opportunities.

4. Fair Launch for $KLIMA and $KlimaX

Klima Protocol is kicking off KLIMA 2.0 with a Fair Launch, allowing existing $KLIMA holders to stake their tokens and earn points toward the new $KLIMA and $KlimaX tokens. The Fair Launch details are available on Klima’s GitHub or KlimaDAO’s resource hub, and the staking process is now live at app.klimaprotocol.com. This inclusive approach ensures that long-term supporters of the protocol are rewarded as it transitions to its next phase.

Upcoming Updates: What’s Next for Klima Protocol?

Klima Protocol isn’t stopping with KLIMA 2.0 rollout. The project has outlined several upcoming initiatives to further solidify its position as a leader in carbon credit tokenization:

Staking Mechanics and Yield Optimization

Following the Fair Launch, Klima Protocol will publish detailed information on staking mechanics for $KLIMA and $KlimaX. This will provide users with clear guidance on how to maximize their yield through staking and liquidity provision. The protocol’s focus on yield generation—through trading fees, arbitrage—will create new opportunities for passive income while supporting the growth of the carbon economy.

Partnerships for $kUSD Development

Financial service providers, asset managers, and leading protocols are collaborating to support the development of $kUSD. These partnerships aim to deliver real yield onchain, enhance the token’s stability, and establish $kUSD as a powerful tool for decentralized finance.

Security and Transparency

On April 8, 2025, Klima Protocol partnered with Hashlock to conduct a security audit of its smart contracts, ensuring the integrity of its decentralized infrastructure. This commitment to security, combined with the protocol’s emphasis on transparency (as highlighted in its interactive whitepaper by Léo de Souza, Director of Applied Research at Klima Foundation), will build trust among users and stakeholders.

How to Get Involved: A Step-by-Step Guide

For existing $KLIMA holders and newcomers alike, now is the perfect time to join Klima Protocol ecosystem. Klima Fair Launch guide provides a clear roadmap for participating in the Fair Launch:

- Visit the Official DApp: Head to www.klimaprotocol.com to access the Fair Launch dApp.

- Stake Your $KLIMA: If you’re an existing $KLIMA holder, stake your tokens to earn points toward the new $KLIMA and $KlimaX tokens.

- Stay Informed: Follow Klima Protocol on X (@KlimaDAO) for updates on staking mechanics and other developments.

- Explore $kUSD Opportunities: Keep an eye out for more details on $kUSD, as this token promises to offer unique yield opportunities.

Conclusion

Klima Protocol is more than just a blockchain project—it’s a movement to align financial incentives with environmental impact. With KLIMA 2.0, the protocol is taking bold steps to enhance the efficiency of carbon markets, empower its community through decentralized governance, and introduce innovative financial instruments. Whether you’re a long-time $KLIMA holder or a newcomer looking to make a difference, now is the time to get involved.

Head over to www.klimaprotocol.com to stake your $KLIMA and participate in the Fair Launch. Follow Klima Protocol on X for the latest updates, and join the community in building a sustainable future—one carbon credit at a time.

ronalthapa

Ron achieved $60,000+ (peak PnL) in airdrop rewards in 2024. He is an expert in testnet airdrop farming. If there is a points system, he knows exactly how to min-max it. Ron is also a data-driven trader, proficient in LTF price action. He hopes one day to be in the top 10 of the Bybit WSOT leaderboard.