Introduction

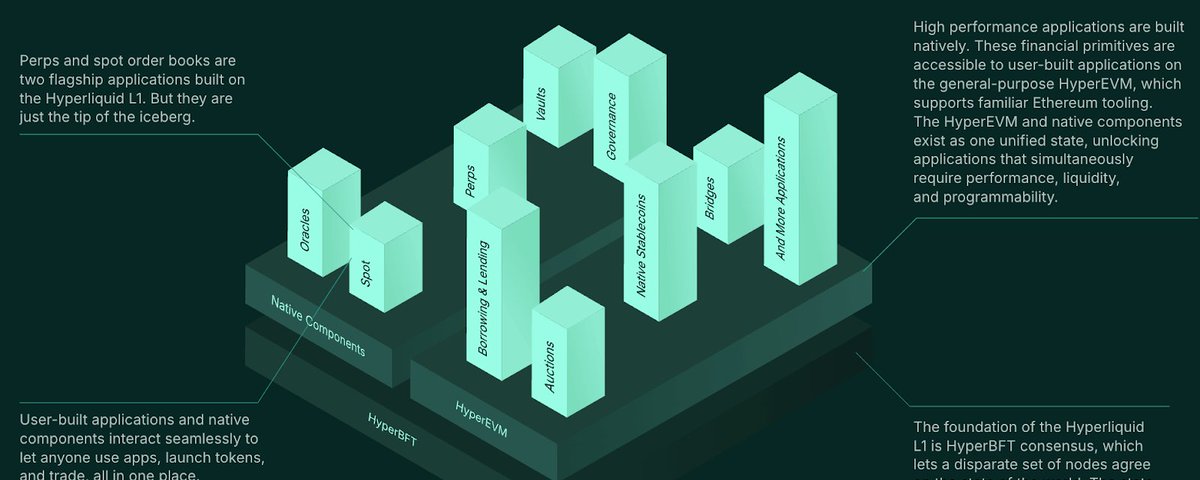

HyperEVM, the smart contract layer of the Hyperliquid ecosystem, is designed to provide a high-performance environment for decentralized finance (DeFi) applications. Unlike a separate blockchain, HyperEVM is secured by the same HyperBFT consensus as HyperCore, allowing for seamless and direct interaction with Hyperliquid’s core functionalities, such as spot and perpetual order books. This integration offers low fees, fast transaction finality, and full composability with leading protocols, making it a fertile ground for innovation in the DeFi space.

This guide aims to provide a more comprehensive understanding of the HyperEVM ecosystem, detailing its architecture, advantages, and the various applications built upon it. We will also explore strategies to maximize potential airdrop opportunities within this rapidly evolving ecosystem.

Understanding HyperEVM: Architecture and Advantages

HyperEVM is not a standalone blockchain but an integral part of the Hyperliquid Layer 1 blockchain. It leverages Hyperliquid’s existing infrastructure and consensus mechanism (HyperBFT) to offer a high-performance and secure environment for smart contracts. This unique architecture provides several key advantages:

- Seamless Integration with HyperCore: HyperEVM can directly interact with Hyperliquid’s core components, including its spot and perpetual order books. This allows DeFi applications built on HyperEVM to access deep liquidity and real-time market data without bridging risks or latency issues.

- Permissionless Development: Developers can deploy ERC20 contracts and other EVM-compatible applications on HyperEVM using standard tooling. This permissionless approach fosters innovation and allows projects to integrate with Hyperliquid’s trading infrastructure easily.

- Enhanced Functionality for DeFi Protocols: HyperEVM enables advanced DeFi functionalities. For instance, lending protocols can read real-time asset prices from HyperCore order books and execute liquidations directly through smart contracts, streamlining operations and reducing risks.

- Unified State: The unified state between HyperCore and HyperEVM eliminates bridging risks often associated with separate chains, providing a more secure and efficient environment for users and developers.

- Scalability and Performance: By leveraging Hyperliquid’s high-throughput Layer 1, HyperEVM benefits from fast transaction processing and low fees, crucial for demanding DeFi applications.

Current State and Future Development

HyperEVM is currently in its alpha stage, with a focus on gradual rollout and iterative development. This phased approach ensures stability and allows for continuous improvement based on user feedback. While some advanced features, such as higher throughput and write system contracts, are not yet live on the mainnet, they are planned for future implementation. This commitment to a fair, credibly neutral platform and a user-centric development process positions HyperEVM for long-term growth and adoption.

The HyperEVM Ecosystem: A Deep Dive into Live Applications

The HyperEVM ecosystem is rapidly expanding, with numerous protocols offering innovative solutions across various DeFi sectors. The original article listed 25 applications, and we will now present them in a more organized and detailed manner, highlighting their core functionalities and potential airdrop interaction methods. We will also incorporate additional information where available.

Bridges

| Project Name Twitter Handle | Description | Core Interaction Methods | |

|---|---|---|---|

| The Hyperliquid Bridge (by LayerZero) | @LayerZero_Core | Official LayerZero-powered bridge connecting HyperEVM to 120+ chains. | Bridge assets like USDT0, USDe, APE, PLUME, RLP, USR, COOK, and cmETH to HyperEVM; Transfer tokens from any LayerZero-supported chain to HyperEVM; Use the bridge interface at thehyperliquidbridge.xyz/transfer; Track cross-chain transactions for potential points. |

| Garden Finance | @garden_finance | Cross-chain Bitcoin bridge with zero slippage and fast transfers to HyperEVM. | Bridge BTC to HyperEVM in one click; Swap assets on Bitcoin, Ethereum, Arbitrum, Base, and Berachain to HyperEVM; Use their one-click swap feature for seamless transfers; Track transaction history for potential points. |

Decentralized Exchanges (DEXs)

| Project Name Twitter Handle | Description | Core Interaction Methods | |

|---|---|---|---|

| HyperSwap | @HyperSwapX | Low-slippage DEX with deep ecosystem integration, positioned as a lightweight alternative to KittenSwap with optimized trading and low TVL mining. | Provide liquidity and quality LP tokens; Participate in regular trading, especially with partner tokens; Hold ecosystem assets like Hypio NFTs, Buddy tokens, CatCabal, or PiP for additional rewards. |

| HyperSwap (formerly KittenSwap) | @KittenSwapDEX | Leading AMM DEX on HyperEVM, offering low-slippage swaps and high liquidity. | Swap tokens with low fees; Provide liquidity to earn trading fees; Participate in liquidity mining programs; Stake LP tokens for additional rewards. |

| HyperUnit (formerly HyperDEX) | @HyperDEX | Decentralized exchange with advanced trading features and deep liquidity. | Trade various assets with advanced order types; Provide liquidity to earn trading fees; Participate in trading competitions; Stake platform tokens for governance rights. |

Lending & Borrowing Protocols

| Project Name Twitter Handle | Description | Core Interaction Methods | |

|---|---|---|---|

| HyperLend | @hyperlendx | Primary lending protocol on HyperEVM supporting core assets like HYPE, stHYPE, LHYPE, and USDXL. Provides liquidity foundation for other protocols including Harmonix, Mizu Labs, and Felix. | Deposit assets early in new cycles (HYPE, LHYPE, or USDXL); Borrow assets to increase point weight; Activate daily XP cycles (hold ≥100 points and deposit ≥$50); Leverage available boosts (Testnet participants get permanent point multipliers, Hold @HypioHL NFTs for additional points); Stack rewards by using borrowed assets in other protocols. |

| HypurrFi | @HypurrFi | Leverage lending platform and issuer of the native overcollateralized stablecoin USDXL. Users can collateralize $HYPE or stHYPE to borrow USDXL while still earning interest on their collateral. | Deposit $HYPE and borrow USDXL; Add borrowed USDXL to liquidity pools on KittenSwap or HyperSwap; Hold or lend USDXL for potential future rewards; Participate in early user activities (platform tracks borrowing, adding liquidity, or transferring USDXL). |

| Felix Protocol | @felixprotocol | First native stablecoin protocol on HyperEVM where users can mint feUSD by collateralizing HYPE. Offers dual earning paths through liquidation rewards and liquidity provision. | Collateralize HYPE to mint feUSD; Stake feUSD in stability pools for liquidation rewards; Add feUSD to liquidity pools on KittenSwap or HyperSwap; Use feUSD across multiple protocols for potential additional rewards. |

| Keiko Finance | @KeikoFinance | Permissionless borrowing protocol with dynamic interest rates and liquidation ratios. | Deposit assets like HYPE or wstHYPE as collateral; Borrow against your collateral with dynamic interest rates; Participate in the protocol’s points program; Monitor liquidation ratios to maintain healthy positions. |

| Timeswap | @TimeswapLabs | Fixed-rate lending protocol on HyperEVM offering unique lending and borrowing opportunities. | Provide liquidity to earn fixed-rate yields; Borrow assets at fixed rates; Participate in their points program; Integrate with other HyperEVM p### Staking & Yield Farming |

| Project Name Twitter Handle | Description | Core Interaction Methods | |

|---|---|---|---|

| Staked HYPE | @stakedhype | Liquid staking protocol for HYPE tokens on HyperEVM. | Stake HYPE to receive stHYPE (liquid staking token); Use stHYPE across DeFi protocols while earning staking rewards; Integrate with money markets like Felix Protocol and HypurrFi; Participate in the decentralized validator network. |

| Looped HYPE | @Looped_HYPE | Rebasing token representing LHYPE, allowing users to earn increased yield without gas fees or tracking. | Stake LHYPE on the official website; Use LHYPE in DeFi positions; Participate in early user programs. |

| HyperUnit (formerly HyperStake) | @HyperStake | Staking platform for various HyperEVM assets, offering competitive yields. | Stake HYPE, stHYPE, and other ecosystem tokens; Earn staking rewards; Participate in governance through staked tokens; Monitor staking APYs and optimize returns. |

| HyperUnit (formerly HyperFarm) | @HyperFarm | Yield farming protocol on HyperEVM, providing opportunities to earn high returns on crypto assets. | Deposit assets into farming pools; Earn yield in various tokens; Participate in new farming opportunities; Monitor APYs and adjust strategie### Other DeFi Protocols & Tools |

| Project Name Twitter Handle | Description | Core Interaction Methods | |

|---|---|---|---|

| HL Names | @hlnames | Domain name service for HyperEVM, similar to ENS for Ethereum. | Register .hl domain names; Set up wallet resolution for easier transactions; Trade domain names on secondary markets; Connect domains to other ecosystem protocols. |

| Hyperbeat | @0xHyperBeat | Verification and ecosystem fund focused on quality, revenue, and long-term engagement with Hyperliquid. | Stake HYPE with Hyperbeat to accumulate Hearts points; Access Hyperbeat through Royco Markets; Participate in ecosystem activities to earn Hearts points. |

| Genesy | @GenesyHL | Gamified DeFi experience on HyperEVM where strategy plays a key role. | Participate in gamified DeFi strategies; Transfer tokens between HyperCore and HyperEVM for Genesy; Climb leaderboards through strategic gameplay; Earn rewards based on performance and strategy. |

| Hyperfly | @hyperflyai | DEX aggregator and AI-powered trading assistant for HyperEVM. | Use the DEX aggregator for optimal swap routes; Deploy AI agents for automated trading strategies; Track protocol points and rewards; Monitor new protocols joining HyperEVM through their platform. |

| HyperUnit | @hyperunit | Decentralized asset tokenization protocol built on Hyperliquid. | Deposit native BTC, ETH, or SOL to receive tokenized versions; Stake tokenized assets for yield; Participate in governance; Use tokenized assets across HyperEVM DeFi. |

| HyperUnit (formerly HyperLaunch) | @HyperLaunch | Launchpad for new projects on HyperEVM, offering early access to promising tokens. | Participate in IDOs and token sales; Stake platform tokens for allocation priority; Research upcoming projects; Earn rewards from successful launches. |

| HyperUnit (formerly HyperNFT) | @HyperNFT | NFT marketplace and platform for creating and trading digital collectibles on HyperEVM. | Buy, sell, and trade NFTs; Mint new NFTs; Participate in NFT auctions; Discover new collections. |

| HyperUnit (formerly HyperGame) | @HyperGame | Gaming platform on HyperEVM, featuring various play-to-earn games and NFT integrations. | Play games to earn crypto and NFTs; Participate in gaming tournaments; Trade in-game assets; Discover new blockchain games. |

| HyperUnit (formerly HyperSocial) | @HyperSocial | Decentralized social media platform on HyperEVM, enabling users to connect and share content. | Create and share content; Connect with other users; Earn rewards for engagement; Participate in community governance. |

| HyperUnit (formerly HyperDAO) | @HyperDAO | Decentralized autonomous organization platform on HyperEVM, empowering communities to govern projects. | Participate in governance proposals; Vote on key decisions; Stake tokens for voting power; Earn rewards for active participation. |

Conclusion

The HyperEVM ecosystem, with its innovative architecture and growing suite of applications, presents a dynamic and promising landscape for DeFi enthusiasts and airdrop farmers. By actively engaging with these diverse protocols, users can not only maximize their potential rewards but also contribute to the growth and decentralization of this cutting-edge ecosystem. As HyperEVM continues to evolve, staying informed and actively participating will be key to unlocking its full potential.

Latest News on Hyperliquid

Michael Gu

Michael Gu, Creator of Boxmining, stared in the Blockchain space as a Bitcoin miner in 2012. Something he immediately noticed was that accurate information is hard to come by in this space. He started Boxmining in 2017 mainly as a passion project, to educate people on digital assets and share his experiences. Being based in Asia, Michael also found a huge discrepancy between digital asset trends and knowledge gap in the West and China.