Bybit is a cryptocurrency exchange offering trading perpetual contracts in the cryptocurrency market. However, it’s essential to understand the rates and fees that come with using the platform. In this article, we’ll explain Bybit’s funding rates and fees and give you some tips on how to manage them.

Use our PROMO CODE below to get a sign-up bonus of up to $30,000!

Check out our Bybit guide and review here.

What is Bybit?

Bybit is a cryptocurrency exchange founded by Ben Zhou and launched in 2018. The exchange currently has over 10 million users worldwide and supports over 100 cryptocurrencies. Bybit offers the following products: spot trading, derivatives trading (including USDT/USDC perpetual contracts, USDC options, leveraged trading, inverse perps and futures), an NFT marketplace, and Bybit earn.

Bybit Funding Rate Explained

Bybit’s funding rate can be challenging to understand for new traders. However, it’s essential to know how it works to manage your trading costs effectively. In simple terms, it is a fee that traders pay or receive when holding a position overnight. If you’re holding a long position, you’ll pay a funding fee if the funding rate is positive. If you’re holding a short position, you’ll pay a funding fee if the funding rate is negative.

Funding Rate Calculation

Funding Fees on Perpetual Contracts

Bybit charges a funding fee for holding positions overnight, and the fee is calculated based on the funding rate. This is calculated using the following formula:

Funding Fee = Position Value * Funding Rate

In this formula, “Position Value” is the total value of the trader’s position, and “Funding Rate” is the current funding rate. The fee is charged every eight hours, and it’s debited or credited to the trader’s account.

The Funding Rate is already stated on the screenshot, i.e. 0.0001%. The Position Value is calculated using the following formula:

Position Value=Quantity of Contract x Mark Price

For example:

Trader Bob holds a long position of 10 BTC contracts and the Mark Price is 16,000 USDT at the end of the funding interval with a Funding Rate of 0.0001%.

To calculate the Position Value:

Position Value= 10 x 16,000 = 160,000 USDT

Now we can calculate the Funding Fee:

Funding Fee= 160,000 x 0.0001% = 0.16 USDT

Since the Funding Rate is positive (i.e. 0.0001%), long position holders have to pay short position holders. So, Trader Bob must pay 0.16 USDT to a short position trader. Meanwhile, a short position holder with the same quantity of contracts (i.e. 10 BTC) will receive 0.16 USDT.

Funding Fees on Inverse Contracts

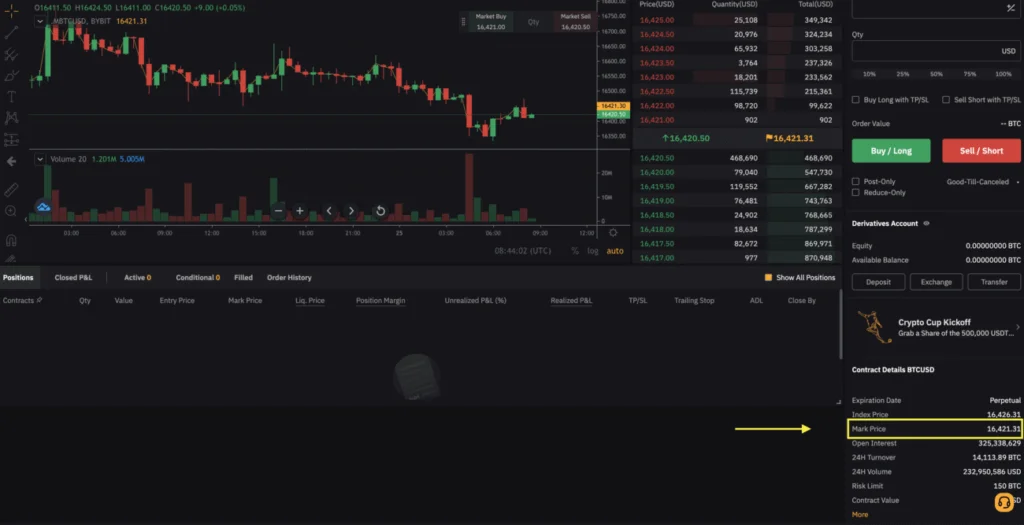

Here’s how to calculate the funding fees on Bybit inverse contracts using the below screenshot as an example. Since the funding rate is positive, long position holders need to pay a 0.01% funding rate to short position holders.

The funding fee is calculated using the following formulas:

Funding Fee= Position Value x Funding Rate

The Funding Rate is already stated on the screenshot, i.e. 0.01%. The Position Value is calculated using the following formula:

Position Value=Quantity of Contract / Mark Price

For example:

Trader Tom holds a long position of 10,000 BTCUSD contracts and the Mark Price is 16,000 USD at the end of the funding interval with a Funding Rate of 0.01%.

To calculate the Position Value:

Position Value= 10,000 / 16,000 = 0.625 BTC

Now we can move on to calculate the Funding Fee:

Funding Fee= 0.625 x 0.01% = 0.0000625 BTC

Since the Funding Rate is positive (i.e. 0.01%), long position holders have to pay short position holders. So, Trader Tom must pay 0.0000625 BTC to a short position trader. Meanwhile, a short trader holding the same quantity of contracts (i.e. 10,000 BTCUSD contracts) will receive 0.0000625 BTC.

When does Bybit calculate its Funding Rates?

Bybit generally calculates its funding rates every 8 hours i.e. at 00:00 UTC, 08:00 UTC and 16:00 UTC. These are known as “funding intervals”. However, Bybit may adjust the interval depending on the live market situation. Particularly if there is a significant gap between the Last Traded Price and the Mark Price.

What are the Last Traded Price and the Mark Price on Bybit?

Bybit uses two prices to protect traders from market manipulation, also known as a Dual-price Mechanism. These are the Last Traded Price and the Mark Price. The Mark Price is used to decide when to liquidate a trader’s position and to measure their profits and losses. It is based on a global Spot price index plus a decaying funding basis rate. A trader’s position will only be liquidated if the Mark Price reaches their liquidation price. The Mark Price can be found at the bottom right-hand corner of the page.

The Mark Price can be found at the bottom right-hand corner of the page.

On the other hand, the Last Traded Price reflects Bybit’s current price and is always anchored to the spot price.

When do Bybit traders pay/receive the funding fee?

Traders will only pay or receive funding fees if they hold an open position at the end of every funding interval. As mentioned, this is generally at 00:00 UTC, 08:00 UTC and 16:00 UTC. However, Bybit warns users that opening/closing a position within 5 seconds before/after the funding interval does not guarantee they would be included or excluded from receiving or having to pay.

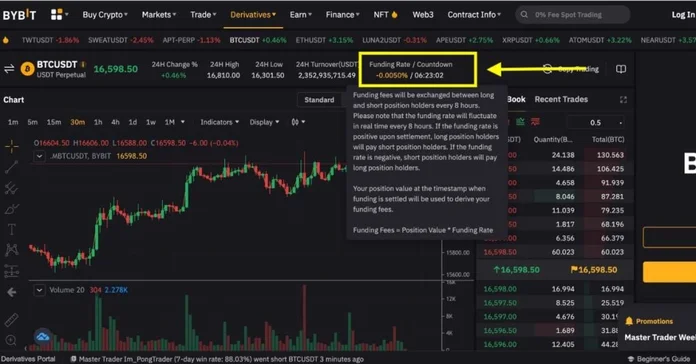

Users can see the current funding rate and when the next funding interval ends on Bybit. In the example above, the funding rate is negative. This means that short position holders will pay fees to long position holders at the end of the countdown.

The funding rate mechanism happens between traders, so Bybit doesn’t take any fees. If a user has to pay a funding fee, it is taken from their available balance. If they don’t have enough money in their balance, the fee is taken from their position margin. This can make the liquidation price of their position more likely to reach the mark price. This increases the risk of liquidation.

Bybit Funding Rate History

Bybit’s funding rate history is available here on the platform’s website. The history is crucial for traders who want to understand how the rates have changed over time and make informed trading decisions.

Mobile App

Bybit has a mobile app that you can download from Google Play or the Apple App Store. The app helps traders keep track of the latest rates and fees. It has a chart that shows the current funding rate for each contract on the platform.

Managing Bybit Funding Rates and Fees

Bybit funding rates and fees can affect how much money a trader makes. Traders need to manage these costs to make the most profit. Here are some tips on how to do that:

- Watch the funding rates for the cryptocurrencies you trade. Look at the chart and past data to find patterns and make better decisions.

- Be careful with your positions to lower your funding fees. Close positions before the funding interval if the rate is high or if you’re not sure about the position.

- Bybit lets you trade with up to 100x leverage. This can make your profits or losses bigger. Use leverage carefully and don’t take on too much risk.

- Make sure you have enough money in your account to pay the funding fees. Bybit will close your positions if you don’t have enough money to pay the fees.

How to profit with Bybit Funding Rates and Fees

Crypto funding rates are linked to the price trend of the asset. The spot market sets the rate. When the price of the cryptocurrency is going up, the rates will be higher. When crypto prices are rising, there are usually higher trading price premiums and rates. In these situations, traders who hold short positions on perpetual contracts and go long on the spot market can earn funding fees.

When crypto prices are falling, the trading price of perpetual contracts will be lower than the spot price. This will make funding rates go down. Traders who go long in the perpetual contracts market and hold short positions in the spot market during this time can receive funding fees.

On Bybit, you can check the historical and predicted rates here.

Conclusion

Bybit is a popular cryptocurrency trading platform that offers perpetual contracts on several cryptocurrencies. Traders need to understand the funding rates and fees associated with the platform to manage their costs effectively. By monitoring the rates, managing their positions, using leverage wisely, and keeping a sufficient balance, traders can maximize their profits on Bybit.

Sign up and get started today!

Frequently Asked Questions (FAQs)

Bybit funding rate is the interest rate that traders pay or receive for holding positions overnight. It is calculated based on the difference between the funding rate index and the last traded price of the contract. Bybit charges a funding fee every eight hours for holding positions overnight.

Bybit funding fees are the fees charged for holding positions overnight. The funding fees are calculated based on the position value and the funding rate. The funding fee is debited or credited to the trader’s account based on the position they hold.

Bybit funding rates and fees are calculated based on the position value and the funding rate. The funding rate is determined by the difference between the funding rate index and the last traded price of the contract. The funding fee is calculated using the following formula: Funding Fee = Position Value * Funding Rate.

It is a chart that shows the historical funding rates for each cryptocurrency offered on the platform. Traders can use the chart to analyze the funding rates and make better-informed trading decisions.

Traders can manage Bybit funding rates and fees by monitoring the rates, managing their positions carefully, avoiding overexposure to the market, using leverage wisely, and ensuring that they have a sufficient balance in their account to cover the funding fees.

Binance also charges a funding fee for holding positions overnight. The funding fee on Binance is calculated using the same formula as Bybit. However, the rates and fees on Binance may differ from those on Bybit.

Angela Wang

Angela loves cryptocurrency, technology that improves our lives...and food. Anything that merges these worlds together is even better.