Bitcoin Halving is expected to happen at 12 May 2020 07:07:39 UTC

What is the Bitcoin Halving Event?

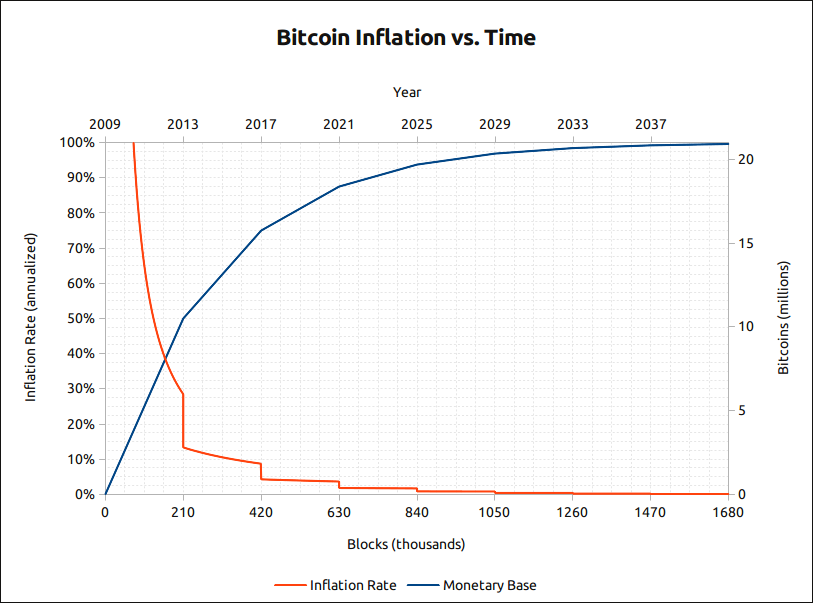

The Bitcoin Halving event which marks the point where Bitcoin mining rewards will be cut precisely in half. Many view this as a turning point for the price of Bitcoin because it will drastically reduce the new supply of Bitcoin, creating scarcity. Currently the Bitcoin Halving is expected to happen at 12 May 2020 11:04:30 UTC – the exact time and date may vary due to fluctuations in Bitcoin block creation time. Once the halving takes place, the amount of Bitcoin mined per day will decrease from 1,800 BTC to 900 BTC. It is important to remember this event is permanent and will affect all the Bitcoin mined in the future as well (until the next halving event). From an economics standpoint, the less Bitcoin there is being produced the more scare and less accessible Bitcoin will become.

Check out my video on what the Bitcoin halving is, and what opportunities it can mean for Bitcoin.

Reduced Sell Pressure on Bitcoin

There will be substantially less sell pressure from Bitcoin miners as they’re income of Bitcoin will half. Currently, miners will mint $13 million USD worth of Bitcoin per day. This is no small figure – and one of the reasons why mining is such a trillion dollar industry (Check out our Bitcoin mining guide for how to be part of it).

Will Miners shut down / got bankrupt?

After the Halving, miners will receive half of their regular income. This will drastically alter the dynamics and profitability of Bitcoin Mining. For miners who are using older machines (ASICs), the drop in income might spell certain doom. Some miners will yield negative profits and be forced to retire the older less efficient units. This is a common practice in mining – renewing hardware is part of the profitability cycle for miners. This is similar to other tech hardware businesses like server farms which require annual upgrades to hardware.

There is no risk that Bitcoin be without miners – till is still 900 BTC to be mined each day (~$7.5 Million USD). Miners will be looking to be more competitive and source cheaper and cheaper electricity. In addition, Bitcoin difficulty can drop if there is less hashrate on the network, meaning it will be easier to mine Bitcoin.

Hype and Expectations

The Bitcoin Halving comes with a lot of hype and optimism for the future of Bitcoin. Several memes have emerged with charts pointing to “pump” in the price of Bitcoin. The chart above shows the LOG price of Bitcoin over time, with a ascending trend indicating potential prices of $250,000 and even $2,000,000 for the price of Bitcoin. It is important to remember that with cryptocurrencies prices are high volatile and past trends don’t always indicate future trends.

Stats

| Total Bitcoins in circulation: | 18,367,900 |

| Total Bitcoins to ever be produced: | 21,000,000 |

| Percentage of total Bitcoins mined: | 87.47% |

| Total Bitcoins left to mine: | 2,632,100 |

| Total Bitcoins left to mine until next blockhalf: | 7,100 |

| Bitcoin price (USD): | $9,987.70 |

| Market capitalization (USD): | $183,453,074,830.00 |

| Bitcoins generated per day: | 1,800 |

| Bitcoin inflation rate per annum: | 3.64% |

| Bitcoin inflation rate per annum at next block halving event: | 1.80% |

| Bitcoin inflation per day (USD): | $17,977,860 |

| Bitcoin inflation until next blockhalf event based on current price (USD): | $70,912,670 |

| Bitcoin block reward (USD): | $124,846.25 |

| Total blocks: | 629,432 |

| Blocks until mining reward is halved: | 568 |

| Total number of block reward halvings: | 2 |

| Approximate block generation time: | 10.00 minutes |

| Approximate blocks generated per day: | 144 |

| Difficulty: | 16,104,807,485,529 |

| Hash rate: | 117.64 Exahashes/s |

| Current activated soft forks | bip34,bip66,bip65,csv,segwit |

| Current pending soft forks | |

| Next retarget period block height | 631008 |

| Blocks to mine until next difficulty retarget | 1576 |

| Next difficulty retarget ETA | 10 days, 22 hours, 40 minutes |

Michael Gu

Michael Gu, Creator of Boxmining, stared in the Blockchain space as a Bitcoin miner in 2012. Something he immediately noticed was that accurate information is hard to come by in this space. He started Boxmining in 2017 mainly as a passion project, to educate people on digital assets and share his experiences. Being based in Asia, Michael also found a huge discrepancy between digital asset trends and knowledge gap in the West and China.