Base Protocol ($BASE) created a token with a value pegged to the total market capitalization of every cryptocurrency available in the market. The purpose is to diversify a person’s investments and expand their exposure to a lot of cryptocurrencies that they would not have otherwise availed from existing traditional investment vehicles.

This has helped investors because trading on the cryptocurrency market has always been challenging. Especially when the performance of some coins varies a lot from each other. There are big gainers and big losers. In addition, choosing which digital currency to invest in can be truly difficult at times considering their inherent risks. Fortunately, Base Protocol’s token aims to solve this problem.

Learn more about Base Protocol and how rebasing works in our debate with Nick Ravanbakhsh, co-founder of Base Protocol.

Background

Nick Ravanbakhsh and Dylan Senter, founders of the Base Protocol, started the project to address the lack of a crypto index fund product for the cryptocurrency market. They came up with the idea to establish a basket of digital assets that track the market.

Both of them are also co-founders of Spectiv, a digital token designed as a rewards system for content creators, aiming to do away with the advertising intermediaries like YouTube or Facebook.

Base Protocol’s key team members also include Chris Peña (Head of Development), who has over 10 years of experience being a developer for systems that span multiple industries,and Based McGee (Head of Development — Solidity), who has 10 years of experience being a software engineer.

What is Base Protocol?

Base Protocol is an Ethereum-based synthetic token that has its price derived from the value of all digital assets in the cryptocurrency market. You can think of it like a stock index. It functions as a trading vehicle where the price is dependent on the movement of all other stocks held in its particular market.

Through Base, investors can participate in the cryptocurrency market with the Base Protocol index mitigating risk.

Rather than simply speculating on the numerous cryptocurrencies that pop up almost daily, investors can spread their risk by simply investing in Base Protocol. This means that they can have a stake in every successful coin, at the same time, have a more balanced risk exposure.

And for as long as the cryptocurrency market continues to grow, you cannot lose. Basically, this project is geared to those who believe in the nascent industry’s long-term potential.

Features of Base Protocol

Base Protocol as a Synthetic Asset

A synthetic asset in finance is a tool designed to produce the same effects as investing in another asset (called the underlying asset). However, it also alters the key characteristics of the underlying asset.

This is effectively the engineering mechanism behind the Base protocol, which is a synthetic asset that simulates the performance of the cryptocurrency market. To do this effectively, it is built with some important features in place.

Elastic supply

BASE’s value is designed to be the combined value of all cryptocurrencies in the market at a ratio of 1:1 trillion. Hence Base Protocol is built to always achieve equilibrium with the market cap of all cryptocurrencies (target price). This means that its supply could also change depending on the current state of the market. Through its rebasing method, BASE could ensure that it can reconcile the difference between the value of its coin and the total market cap for cryptocurrencies.

Rebasing- how does it work?

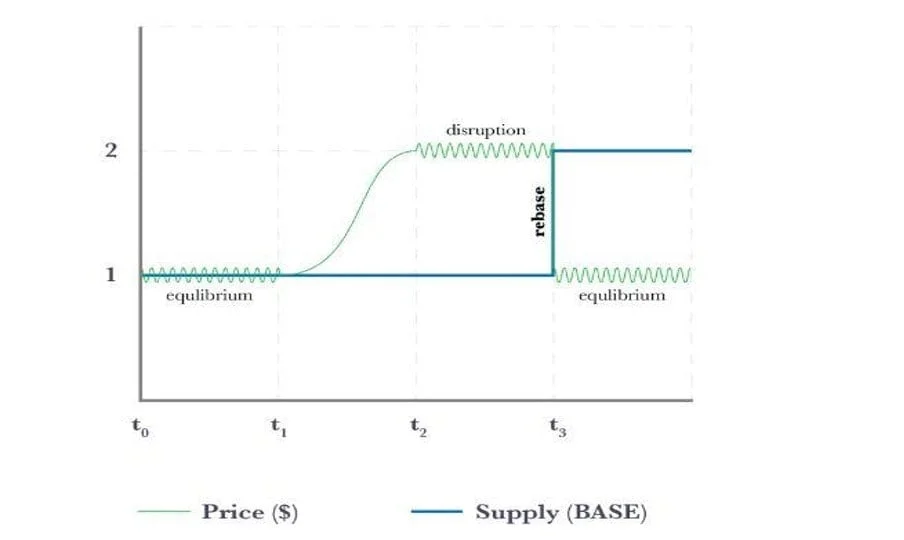

Rebasing is the term used for the process by which a synthetic asset’s price is restored in equilibrium to the underlying asset. BASE’s rebasing mechanism adjusts its total supply until the market price reaches the target price.

While this protocol functions to ensure that the market price of BASE always correlates with the target price – it often only manages to influence the corrections. It is left to market actors to respond to rebases to correct prices.

Example

- t0 — An investor buys 1 BASE with a market price $1

- t1— The market price of BASE goes up to $2 – out of sync with the target price of $1

- t2 — To restore the market price’s equilibrium to target price, BASE’s total supply is adjusted in proportion to the difference. This is a “rebase”, and the process is called a “rebase event”.

- t3 — Regardless of the rebase event, the investor’s net $ balance and his percent ownership of the total supply are always constant.

BASE Token ($BASE)

Base’s token ($BASE) is the token associated with the Base Protocol index and is both itself a cryptocurrency and a measure of the cryptocurrency market as a whole. It serves as a trading instrument that enables individuals to make investments based on the whole cryptocurrency market, instead of just a single or few digital asset selections.

BASE’s value follows the ratio of 1:1 trillion, based on the whole market cap for cryptocurrencies. For example, if the market cap is at $800 billion, the value of one BASE is $0.80.

The protocol is based on the Ethereum blockchain and can be bought on Uniswap. The price feed uses Chainlink’s decentralized oracle network.

While BASE is becoming more popular as an investment instrument, it can serve other specific purposes too. Here are some of the other features that the $BASE token can be used for.

Uses for $BASE token

Price Reference

Traders trying to analyze the potential movement of a particular coin could track its price with the value of BASE to determine how they fare against the whole crypto market. This can even be better than just comparing altcoins with BTC because it shows an overview of the whole crypto economy.

Hence $BASE is intended to be a single token that allows an investor to speculate on all crypto assets simultaneously. This way, they don’t have to buy any specific coin or invest in a select few and can spread their stake across the entire industry.

As long as the investor is optimistic about the industry’s future, they can invest in the market as a whole.

Safe Haven

According to the Team, purchasing BASE allows holders to make safe investments, instead of just selecting a single digital asset.

This is because cherry-picking cryptocurrencies into a portfolio opens the investor to the risk of loss — seeing how volatile the market can be. People might also miss out on the emergence of the rapid rise of any new currency.

By investing in $BASE, however, the idea is that one can mitigate the risk of exposure of individual coins while enjoying the rest’s potential gains.

Price Reference

As a market tracker, BASE’s price is indicative of the total market cap of the crypto market. Crypto investors already track the performance of altcoins in relation to bitcoin instead of USD.

The performance of any altcoin in relation to bitcoin is more a more important measure for the decentralized economy. But even better would be to use $BASE as the price reference. Instead of just BTC, the trader can see how well any altcoin performs against the entire crypto market.

Lending Instrument

BASE can be utilized as a hedge for leveraged crypto trading. It can be considered an alternative to borrowing in BTC since it is less volatile. For example, if the value of BASE drops and they have to repay the loan they made, they can suffer less in terms of losses since it depends on the overall drop in the market.

Base Cascade

BASE Cascade is a program on the platform designed to reward BASE holders. This is because it also serves as their contribution to the liquidity of Uniswap’s pool. In order to take part in the Cascade program, users have to lock their BASE and ETH on the Uniswap liquidity pool. They get a percentage of the transaction fees based on the volume of trading in the pool as a reward.

After they have deposited their BASE and ETH on Uniswap, they are given LP tokens, which is the token that they can stake to claim their rewards on Cascade.

At first, the rewards multiplier for Cascade participants is at 1x. 30 days after they are staked, it increase to 2x. 60 days after, the multiplier becomes 3x. The increase in the multiplier happens everyday until it reaches the ceiling point, which is at 3x.

Participation in Cascade is merely optional. Only the user can decided how much liquidity they want to contribute. Furthermore, they can withdraw at any point in time.

Conclusion

Devising new ways to expand the investment opportunities for the cryptocurrency market serves the purposes of adoption and new use cases. Base Protocol’s initiative to create a product that expands the exposure of its users to the whole crypto market can be a convenient entry point for fresh investments.

Some of the factors affecting the arrival of new entrants to the crypto space include the volatility of some coins and the difficulty in selecting the best-performing coin. With Base as one of their options, not only are investors given a much safer alternative to investing in single digital assets, they are also given the opportunity to speculate on the crypto market as a whole. Given that this project could potentially bring new interest to the space, we can expect a more vibrant community if the project becomes successful.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.