Radix DLT ($XRD): Taking DeFi to the next level?

Radix DLT is a layer 1 distributed system to power the needs of the decentralised finance (DeFi) ecosystem. As DeFi continued to gain traction, the top blockchain networks supporting the market were already overstretched. As it turns out, scalability appears to be a hard nut to crack and hence projects like Radix DLT are formed.

The motivation behind the Radix protocol’s creation is to save the $71 billion lost every year caused by unnecessary friction in the conventional financial system and allow those at the lower and higher levels of finance to make ground by powering a strong DeFi ecosystem.

Check out our video which explains the scaling problems currently faced by Ethereum, and how Radix attempts to solve it.

Background

The Radix team believes that using distributed ledger technology (DLT) to build a permissionless network will ease the development and accessibility of innovative financial applications. With these applications, we could finally bring down the guarded walls of traditional financial markets.

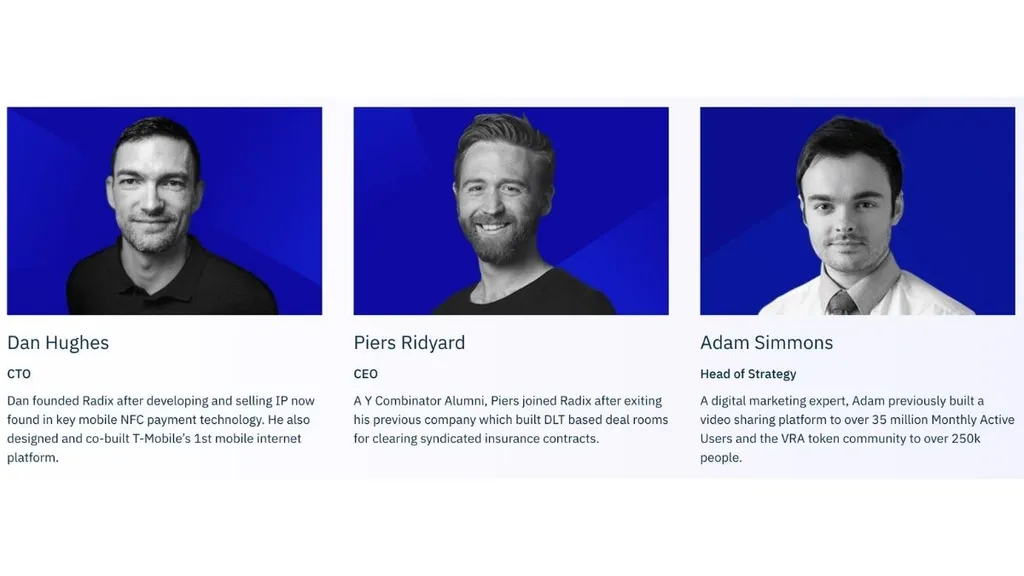

The project was founded by Dan Hughes, who also happens to be its CTO. Hughes’s former work includes the design of T-Mobile’s first mobile internet platform.

Other team members include the organization’s CEO, Piers Ridyard, as well as CPO, Albert Castellana. The project is being supported by the Radix Foundation.

What is Radix DLT?

The team behind Radix DLT defines the project as the “first layer 1 protocol specifically built to serve DeFi.” The protocol seeks to remove the inefficiencies found in open finance (OpFi) both in the current and future settings. Hughes and his team want to achieve this through:

- Re-engineering the consensus mechanism used in popular blockchain systems.

- Employing decentralized virtual machines.

- Activating on-ledger code.

- Building DeFi-bound components and applications.

- Incentivizing developers who drive the growth of the new-found financial breakthrough.

Having its developers at the core of driving growth for innovative financial products, Radix provides its support by building highly-secure smart contracts, fast and interoperable OpFi decentralized applications (dApps), engaging and rewarding a distributed developer community, and guarding DeFi composability when scaling dApps on public blockchains.

Radix network

The network is made up of Cerberus (a consensus mechanism), Radix Engine (a development environment), Radix Component Catalog, and developer royalties.

Cerberus

At the heart of the protocol is Cerberus, a re-engineered consensus mechanism which uses a sharded Byzantine fault-tolerant (BFT) solution. This approach enables the system to be parallelized across multiple nodes without losing message complexity and responsiveness.

The sharding concepts allows unlimited network splits or shards. Each shard can represent anything on the platform. By allowing unlimited shards, Cerberus shifts focus from global ordering to partial ordering.

With global ordering, transactions are stored in a predefined chronological order. Partial ordering, at a very basic level, is the opposite of agreed chronological ordering. However, partial ordering has to differentiate between related and unrelated events or transactions when recording them on the blockchain.

Using a “braiding” mechanism, Cerberus uses a new BFT-style system to sign interactions between nodes handling different shards before committing transactions.

Radix Engine

This is Radix’s specialized application layer that powers the interaction between a smart contract’s code with the actual blockchain. The layer powers the project’s virtual machine (VM), which in turn, powers the partial ordering system.

Furthermore, the Radix VM handles concurrency to drive DeFi applications further.

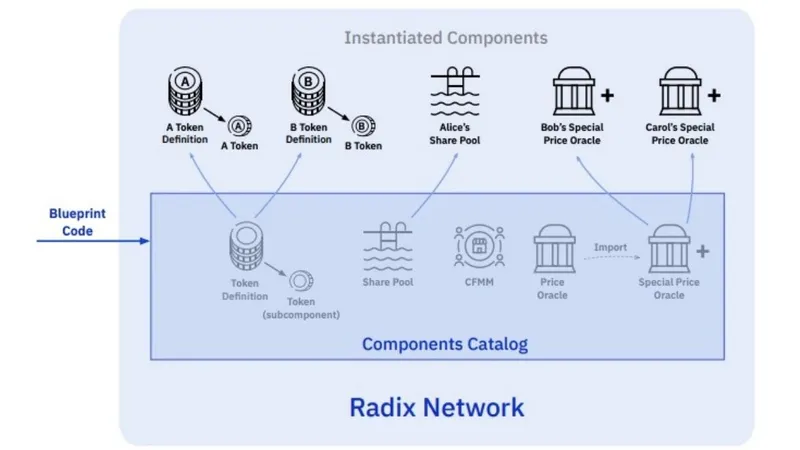

Radix Component Catalog

In other blockchain systems, a developer’s work becomes an active smart contract after being pushed to the system’s users. For Radix, the component catalog handles apps before being registered as “active” on the platform.

In other words, the catalog contains templates ready for use to create additional active components. The new template-based products are called instantiated components.

Developer Royalties

The Radix system uses developer royalties to encourage developers to contribute. However, the project takes a different approach by employing distributed self-incentives such as those found in proof-of-work systems called mining rewards.

Radix Token ($XRD)

The platform has a native token, XRD, which is used to pay for transaction fees. Note that these fees are paid to node runners.

A transaction fee is charged for token creation, messaging, and anything else that requires a change of the ledger state. The fee is burnt upon validation of the operation.

Furthermore, the platform’s tokens have a controlled unlocking mechanism that spans 365 days. With each unlocking, the Radix Foundation’s amount of XRD reduces while those in the public domain increases.

E-Radix (eXRD) Token Sale and tokenomics

Radix Token Sale began on 8th October 2020 and a total of 642mil E-RADIX tokens were available to purchase at $0.039 per token.

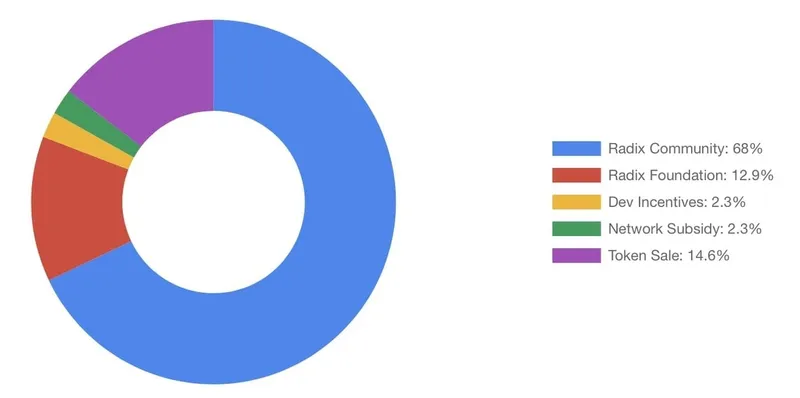

There will be an Initial Supply of 4.41 billion E-RADIX as both locked and unlocked tokens. The following chart shows the proposed distribution of the Initial Supply tokens.

The unlocking mechanism for E-RADIX tokens will start on 17th November 2020. Of the Initial Supply of 4.41 billion E-RADIX tokens, 4.2 Billion tokens will be distributed and of which 99% will be locked and 1% unlocked.

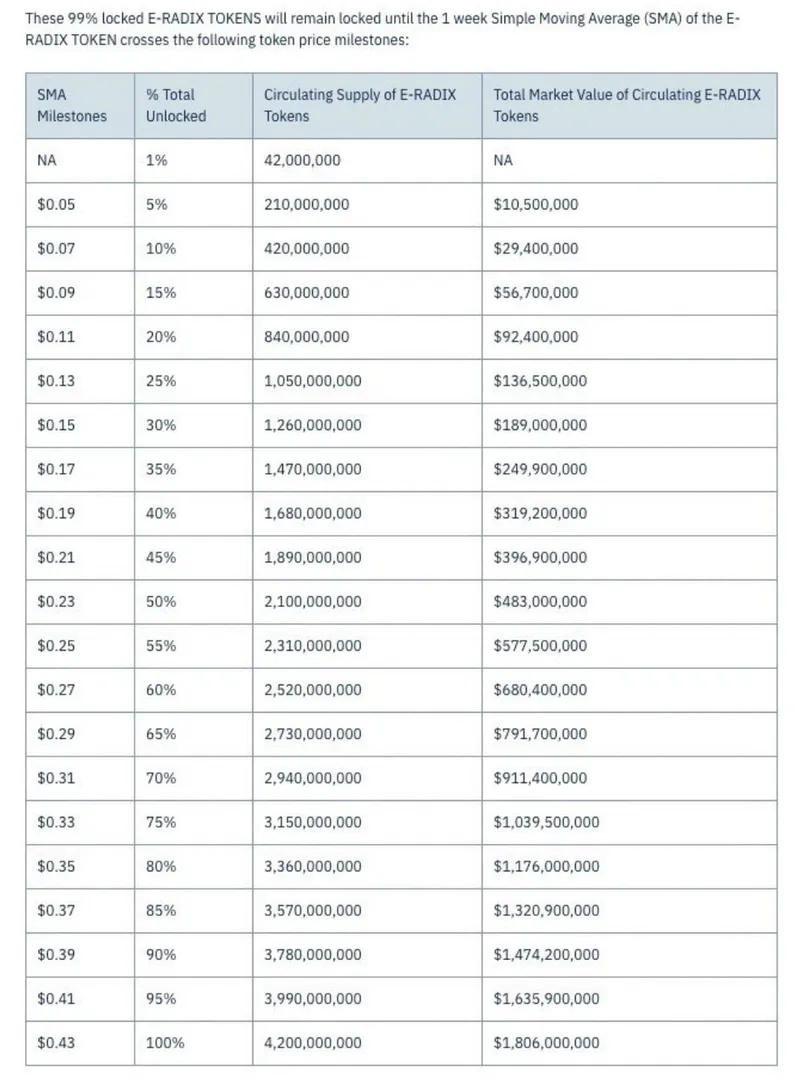

These locked tokens are subject to a price-based unlocking schedule which will allow holders to withdraw the tokens at certain price milestones as follows:

E-RADIX will be available for trading on Uniswap.

This E-RADIX token is an ERC-20 token. When the RADIX ledger is instantiated, this E-RADIX token will be exchangeable 1:1 for RADIX (XRD) tokens. As mentioned in their key milestones article, the Team are on track for the Radix main net to go live in Q2 2021.

On the mainnet, Radix will create a further 5.19 billion RADIX tokens which will also follow the same unlocking schedule as the E-RADIX tokens mentioned above.

How to withdraw your unlocked E-RADIX (eXRD) and RADIX (XRD) tokens

As mentioned in the previous section, E-RADIX and RADIX tokens are subject to a price-based unlocking schedule. However, to claim these tokens you will need to withdraw them from the unlocking smart contract.

This involves visiting their Radix tokens unlocking website and connecting the wallet that you used to purchase the E-RADIX tokens. If that wallet address has an allocation of EXRD in the unlocking smart contract, you will see details of your total allocation together with the amount which is unlocked and can be withdrawn. Then all that is required is to click the “withdraw” button and follow the steps to withdraw the eXRD.

Make sure to check back when an unlocking event occurs because it will mean you can withdraw more tokens!

For a detailed walkthrough on how to claim your unlocked tokens, click here.

Staking Radix Token

With OpFi, staking, yield farming, and liquidity mining are common occurrences. Radix powers this DeFi subset by allowing users to lock their XRD to earn network emissions and be involved in decision making.

Network emissions are periodically generated tokens that are spread across active staking nodes while considering the amount of staked tokens. Emissions make up for 2.5% of the yearly inflation rate.

There are two approaches to locking tokens:

- A user can lock XRD and become a node runner on the network; or

- a user can lock Radix tokens and delegate his stake to another node runner, also called a staking node. A staking node has the power to validate transactions.

Radix’s consensus mechanism limits the stake weight per node to 33% to prevent node runners from having absolute power over the transaction validation process.

Network Subsidy

The network subsidy is an additional amount of tokens distributed to transaction validators. The tokens are unlocked by the Radix Foundation every 24 hours and are expected to run for 10 years. However, to earn the subsidy tokens, a staking node has to consistently meet specific factors on responsiveness, bandwidth, and computing power.

Other Radix token categories are the public token grant to support community contributors, the Radix team token grant to support the team, and the stable token reserve that supports stable coins on the network.

Conclusion

The projected growth of the DeFi market requires creating new distributed systems that, if possible, have unlimited scalability. Radix is one such project. With a key focus in leading the migration from centralized finance (CeFi), the project provides hope to the future of OpFi.

From a re-designed consensus mechanism to decentralized self-incentives for developers, the project is keen on ensuring that DeFi overshadows CeFi.

The Radix token supply approach is another key component of the network that shifts from the traditional approach of major blockchain-based systems that power OpFi protocols.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.