The vast amount of innovations and creativity happening within the crypto space is overwhelming. Countless projects, protocols, apps, tokens, and communities are launching, layering, merging, forking and growing every day. It can be a lot to keep up with.

Fortunately, blockchains are public data sources, and the historical ledger of addresses and transactions is a treasure trove of data, just waiting to be unpacked and explored. Anyone can view the transactions that are occurring in real time and interpret what is happening on the blockchain. However, in its raw form, blockchain data is kind of like binary code: great for machines but tough for humans. What is needed is not only a data platform that can convert it to a more useful form, but also a community of analysts that can give it meaning.

Enter blockchain analytics. Blockchain analytics is the act of inspecting, identifying, understanding, and visualizing data on a blockchain. Doing so allows users to gain valuable insights that would otherwise be hidden in traditional systems. Just as Google organized the internet of information for consumers and commerce by indexing the World Wide Web, making it accessible without requiring any knowledge about the underlying TCP/IP protocol, blockchain analytics technology is building the pathway for an easy-to-navigate internet of value as well as the emerging data economy.

What Is Blockchain Analytics?

Blockchain analytics is the process of analyzing, identifying and clustering data on the blockchain. Blockchain analytics also models and visually represents data in order to identify key information about users and transactions.

More and more companies operating with cryptocurrencies are using blockchain analytics tools to analyze transactions and assess the level of risks to meet regulatory requirements worldwide. This is done to help stop illicit transactions such as money laundering and fraud from being carried out.

Crypto asset transactions carried out are inherently anonymous so blockchain analytics providers help to provide the data needed to match a transaction with a person or company. This helps to keep cryptocurrency markets and transactions safer for everyone. Blockchain analytics can achieve this by scraping blockchain data, which is all public.

How Does It Work?

Blockchain analytics providers scrape publicly-available transactional data to tie crypto wallets back to illicit or criminal behavior. Data scraping is the act of collecting and structurally storing and updating data in real-time. This data includes information on which cryptocurrency wallets the cryptocurrency were sent to and from, the type of cryptocurrency, the amount, and the time of the transaction. As for cryptocurrency wallets, they are digital wallets that can send and receive payments. And specifically for those wallets maintained by cryptocurrency exchanges, users must first go through a Know Your Customer (KYC) onboarding processes whereby the personal details of the crypto wallet’s owner are recorded and stored.

When a crypto wallet transaction is made, that data is forever on the blockchain. It cannot be altered or erased. Through the scraping of these blockchains, blockchain analytics ties crypto transactions to illicit activity through certain signifiers such as a crypto wallet previously linked to illicit transactions like drug smuggling or terrorist financing. Through that, a wallet or transaction is flagged and given a risk score. When a crypto business or a financial institution works with a blockchain analytics provider, any transaction they undertake can be screened to provide a risk score for the crypto wallet in question.

If further investigation is needed, a blockchain analytics provider can forward this type of information and analysis to the relevant law enforcement authorities, who can match an identity with an anonymous wallet, via a Suspicious Activity Report (SAR). Because the transactional data in the wallet represents all transactions that the specific cryptocurrency has been used in, an end-to-end trail is thus created.

The wallet is tagged with a typology by the analytics provider, which ties it to a certain illicit activity that will be flagged in future transactions. The provider will also create a heuristic which clusters transactional wallet data with similar typologies. (Ultram) When multiple wallets are owned by the same person, blockchain analytics can help to determine if transactions carried out by different wallets are actually coming from the same place.

Collecting data on the identifiers of illicit transactions is a continuous process. Blockchain analytics is a key line of defense for creating fair and legal crypto environments, helping to discover the source and destination of illicit funds.

Why Is Blockchain Analytics Important?

Often hackers and web criminals use cryptocurrency due to its pseudonymous nature. Thanks to blockchain analytics, we now have access to specialized analytics tools that can scan otherwise hard to track the trail of transactional data on public blockchains. Blockchain analytics makes it possible to follow who is buying what and paying for which product and services utilizing cryptocurrency.

Many blockchain analytics providers help to create these insights by turning blockchain raw data into searchable and executable data that individuals and businesses can easily search and build services on top of. This has tremendous value to regulators, law enforcement, companies and users within the crypto space.

Regulators and law enforcement can have full visibility on illicit transactions and track the movement, allowing them to uncover the identities of the criminals over time. Companies are able to have full visibility over transactions made by vendors or third parties and ensure legitimacy of those claims. Users such as traders are able to have visibility on what smart money is doing and make better informed decisions, leveling the playing field. Smart money in crypto represents a new type of economy where knowledge is open and powerful actors’ behavior is revealed.

All organizations who work within the crypto asset market, whether it be crypto businesses or financial institutions, also need to remain compliant. Blockchain analytics providers can help these financial institutions pursue their compliance efforts. Through blockchain analytics, compliance departments can identify fraudulent or illicit activity, protect themselves from risk and work to create increased trust and transparency within the system and thus maximizing opportunities for growth and profitability.

Blockchain Analytics Providers

Let us take a look at some of the most popular blockchain analytics providers that are developing new insights from raw blockchain data to make it accessible to users of all levels.

1- Dune

Dune, formerly known as Dune Analytics, is a powerful tool for blockchain research. It can be used to query, extract, and visualize vast amounts of data on the Ethereum blockchain. Users can simply query the database to extract almost any information that resides on the blockchain. Dune released its free version in 2019. Since that release, Dune has grown exponentially with users from all around the world joining in to leverage the on-chain analytics it provides.

Dune’s strengths are in its open data source. Analysts, traders, and number crunching data enthusiasts make up the community. They create and openly share their queries which can then be forked and remixed in a multitude of ways by others. That is why Dune has been described as the “Github for on-chain analysis.” The secret sauce is the collaborative effort that is built-in to the Dune platform. So instead of dealing with the status quo, siloed sets of dashboards, the queries on Dune Analytics are open source, creating a revolutionary way for their community to harvest and remix blockchain data.

The community version of Dune allows users to conduct any kind of on-chain analysis. Dune converts the raw blockchain data into a readable format, and queries can be completed with SQL. Dune gives its users access to datasets and they can create their charts and dashboards. Users can then share what they are working on. And working with Dune provides one with good education and powerful insights into how on-chain analytics systems work in general.

With Dune, users can explore the dashboards and queries of others in the community. It is similar to sharing dashboards on Google Analytics. And by researching the work of others, users can find inspiration to come up with even more queries to find deeper insights.

It is not much of a stretch to say that Dune is fast becoming the default platform for Ethereum data seekers.

Use Case: Dune has more than 22,000 different dashboards, a method of discovery. Given that the queries within the dashboards are user-generated, the quality varies. Some may be professional-grade and easy to scan, while others result from a SQL student’s early lessons. These are searchable by name or tags.

Looking for OpenSea’s monthly volume? There is a dashboard for that.

Want to compare it to LooksRare? No problem.

Intrigued by STEPN’s recent rise? Dune has the info..

2- PARSIQ

PARSIQ is the next-generation monitoring and intelligence platform for various blockchains, successfully connecting legal systems and off-chain applications to precious blockchain-based data. PARSIQ’s platform provides a suite of products that handle everything from database querying to instant notifications. The use case of PARSIQ extends not only to the on-chain blockchain but also to the off-chain universe.

Transaction tracking for compliance purposes, financial accounting, or building insights on the different properties of competing blockchains are some of the jobs that PARSIQ’s applications perform as off-chain jobs. PARSIQ also provides a tool that monitors and processes blockchain data. Every single blockchain activity that occurs on the platform results in a massive amount of information. All of this circulates through the PARSIQ platform and activates various parts of it. Every product that belongs to the ecosystem has a particular processing subsystem of the platform standing behind it.

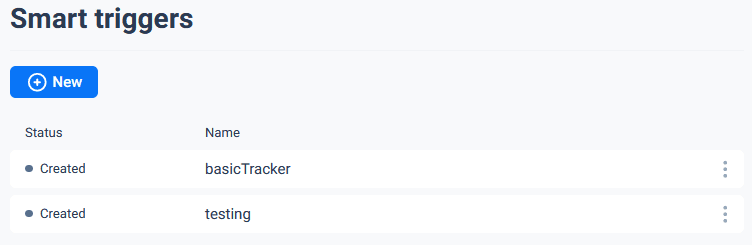

With Smart Triggers, users can create “if-this-then-that” workflows, allowing users to watch for a specific on-chain event and initiate downstream actions when they occur. PARSIQ’s Trigger Wizard is a no-code editor that allows users to create Smart Triggers for the most common use cases in just minutes. Smart Triggers can be used for a variety of use cases:

- Build user notifications — PARSIQ delivers real-time alerts to users when relevant activities occur

- Expand product functionality — users are able to build capabilities on top of blockchain data without writing custom code

- Manage risk — PARSIQ instantly detects risky transactions and blacklisted accounts

In order to solve actual problems and meet the demands of business use cases, PARSIQ introduces the possibility of using various on-demand services and data delivered by third party providers integrated to the PARSIQ platform. Smart Triggers are deployed to the PARSIQ system and continue to circulate the on-chain data. External Data Providers (EDP) are the source of external off-chain or even on-chain data that can be plugged in and additionally combined with Smart Trigger data. With this feature, it is possible to combine the on-chain data with off-chain data, such as market data, risk scoring, forensics information, and more

Use Case: PARSIQ’s wallet surveillance tools notify wallet holders on every inflow and outflow of funds. Any alert sent by PARSIQ’s transports informs users who are at risk with a potentially exploited wallet in their possession.

Whitelisting is another useful tool to preserve users’ trigger count. It gives the user control of what they deem trigger worthy transactions. Making frequent transactions & interactions with certain addresses or addresses they are familiar with would be acceptable without triggers, but addresses not whitelisted will trigger alerts.

To set up wallet surveillance with PARSIQ, you can refer to this tutorial video.

3- Elementus

Elementus is the first universal blockchain search engine and institutional-grade crypto forensic solution. They are building the next generation “Who’s Who” of crypto entities on the blockchain with the best-in-class search and analytics capabilities. Their compliance solution and data analytics platform are being used by key U.S. governmental agencies to solve some of the most high-profile cyber investigations and by financial institutions to build the future of finance and commerce on the bedrock of blockchain and digital currencies.

Elementus applies data science to restructure underlying blockchain data into a schema optimized around the relationships between blockchain activity, providing valuable context far beyond manual investigations on individual transaction level. The Elementus view provides a powerful clustering and confident entity attribution based on insights that exist tens or even thousands of transactions away.

As the use of cryptocurrency increases, so does the complexity of investigations. Elementus’s Intelligent Network Expansion technology allows users to generate a network in seconds based on custom parameters relevant to their investigation.

Elementus is an agile team of data and computer scientists, analysts, and developers representing alumni of Palantir, Facebook, LinkedIn, Slack, Bloomberg, Credit Suisse, Deutsche Bank, and the United States Intelligence Community (IC).

Elementus offers several products dedicated to different solutions within its ecosystem:

- Radar — for compliance solutions. Users are able to extract risk scores for any public blockchain address, consumable via API, real-time alert, or via the Radar user interface.

- Echo — for custom analytics. Users are able to harness the power of Elementus Analytics paired with the versatility of Palantir Foundry, accessing custom data analysis applications for any use case.

- Pulse — for investigations. Pulse provides almost instantaneous tracing of funds from source to destination with multi-level entity attribution, powered by proprietary RapidTrace™ and EntityIndex™ technology

Use Case: Elementus was used to track down billions of stolen bitcoin in a fraud investigation of a YouTube rapper named Razzlekhan and her husband Ilya Lichtenstein. The couple was arrested on federal charges of conspiring to launder a multibillion-dollar trove of bitcoins stolen from cryptocurrency exchange Bitfinex in 2016. The couple was not accused of the theft itself.

Analysis provided by Elementus has found that the pair were able to shield the unseized money through a complex series of crypto transfers. Max Galka, the CEO of Elementus, said the bitcoins were moved across more than 20,000 transactions, indicating that some form of automation software was used.

According to Galka, some of the unseized bitcoins were transferred through the Russia-based darknet market Hydra. “It’s the largest darknet market in existence,” Galka says. “It is highly unlikely law enforcement has the ability to trace these funds further.” According to Elementus, the last known movement of the unseized cache occurred on January 25th 2022, shortly before the couple’s arrests at their Wall Street apartment.

4- AllianceBlock

AllianceBlock is building a globally compliant decentralized capital market by providing a bridge between traditional finance (TradFi) and decentralized finance (DeFi), unlocking trillions of dollars in capital. The AllianceBlock Protocol is a decentralized, blockchain-agnostic layer 2 that automates the process of converting any digital or crypto asset into a bankable product, simplifying the capital transfer process between regulated and opaque markets.

The protocol has three main pillars, focusing on compliance and regulation, data, and DeFi technology. The AllianceBlock Data Tunnel is a key component of the data element, and it leverages their partner Ocean Protocol’s technology, as well as partnerships with Parsiq, API3, Covalent, DIA and Chainlink. The Data Tunnel is a data marketplace that makes data accessible to all through a monetized marketplace, while ensuring traceability, transparency, and trust. Data providers and consumers will benefit from increased access to one another, driven through a secure and easy-to-use solution.

The AllianceBlock Data Tunnel makes it possible to publish data in a decentralized and simplified manner, without needing to be proficient in DeFi, MetaMask, or private keys. This is crucial to attracting a wider, more mainstream audience. In line with this, the Data Tunnel also simplifies usability for data consumers and developers through a standardized output format. This is in contrast to current offerings, with datasets found in a wide range of formats, making it more difficult for consumers.

Ultimately, the Data Tunnel aims to become the oracle of oracles, being able to take data from oracles to the Data Tunnel, enhancing this data, and then feeding it back to the oracle providers. The Data Tunnel is chain-agnostic, in line with AllianceBlock’s wider vision, to allow for the greatest access and breadth to both datasets and consumers and to ensure as wide adoption as possible. The AllianceBlock Data Tunnel aims to incentivize data providers to share more data, acting as the conduit through which both DeFi and TradFi users can access and take advantage of increased data opportunities.

Use Case: Financial institutions are largely excluded from offering investors access to DeFi. Fund distribution is one of the issues. AllianceBlock provides a solution to these issues by offering access to Open Finance that allows all market entities to participate. It is an end-to-end regulatory compliance framework that serves as a bridge between stakeholders and all actors within the capital markets chain.

In a traditional fund distribution model, all intermediaries between the investor and fund manager can operate independently. Many may only communicate with the next chain in the link. When they do communicate, it is likely through email correspondence, or, for certain operations, even fax or post. This creates inefficiencies.

AllianceBlock seeks to create a fund protocol which hosts all of the required activities on one platform. This allows for greater operational transparency and efficiency.

Learn more here about AllianceBlock’s solution to fund distribution, and to explore more use cases for the platform.

5- HUBX

HUBX elevates private placement and loan syndication deal distribution for banks, exchanges, and brokerage firms by connecting into core systems to deliver dynamic data insights and a richer customer experience. In the world of syndicated lending, accessing accurate and timely data is critical for origination and distribution teams to make meaningful and effective decisions. The way data is captured and interpreted constitutes the single most important success criteria to protect and scale capital raising operations. HUBX brings together all relevant data from across an organization to deliver a single source of truth for all participants.

Founded in 2015, HUBX platforms facilitate collaboration between banks and their institutional clients, connect syndicate desks with the rest of the organization, and simplify execution. Each network hub is private, ensuring that the clients’ data is always protected. HUBX strives to help banks adapt quickly and seamlessly to the rapid digital transformation that is driving private capital markets today.

By connecting all participants on their own terms, HUBX will help accelerate deal execution, reduce costs, and introduce standardization and automation into the market. By offering unrivaled customer experience and dynamic insights and tools to their clients, banks are able to harness the true potential of their data and the network effect.

Use Case: HUBX has partnered with financial software solution developer Finastra to help corporate lenders during the loan syndication process by reducing manual workloads. As a first step, this deal sees HUBX Arranger integrated with Finastra’s back-office loan software Fusion Loan IQ, which is used by 90% of the world’s top 100 banks to process over 70% of global syndicated loans. While the market is worth around $4.5trn annually, much like in private equity, the majority of work is manual and disconnected.

According to Axel Coustere, HUBX co-founder, “HUBX Arranger provides a key missing link for Finastra’s clients. The ability to digitally scale the arduous syndication process by tackling the lack of end-to-end execution. There are many manual, time consuming steps and a lack of real -time visibility currently associated with this piece of a bank’s business. Not doing this well limits the banks’ ability to manage and improve risk and ultimately reputation.”

Conclusion: The Rise of Data Analytics

Modern businesses have been benefiting from data analytics for several years now. According to Forbes, data analytics adoption in enterprises increased from 17% in 2015 to 59% in 2018. Now, only 10% of businesses have refused to utilize big data. One category of data analytics that is poised to change and transform the industry is predictive analytics. It is focused on making predictions about future outcomes based on a massive amount of historical data as well as techniques like machine learning. With this type of technology, enterprises will be able to forecast trends and behaviors.

The current state of predictive analytics is hardly perfect. A huge obstacle to overcome is getting quality data from different sources and correlating them. Digital agencies and IT firms have their own silos of data and use different tools in obtaining them. There is also the issue of whether there is enough of the right data. When there is not enough for the system to make conclusions from, the results of predictions may be biased and untrustworthy. Blockchain technology might be able to fill the gap in this space.

Blockchain’s computational power is gained from multiple connected computers, hence it is powerful enough to properly define the model to be analyzed based on a vast number of data sets. It would use its power to analyze the different stored datasets across computers and pull up the ones that can provide the answer. Furthermore, blockchain may be the cloud equivalent to one physical supercomputer, which makes it accessible to small businesses. Currently, companies that want to utilize predictive analytics have to rely on expensive super machines. With blockchain implemented, the costs to obtain such analytics tools will be greatly reduced.

As for potential applications, blockchain analytics could be used in marketing strategies. Marketers could be able to prepare for future marketing campaigns with the help of data gained from market realities. The system might be able to forecast price movements for financial markets, including cryptocurrencies.

The fusion of data and blockchain technology is poised to grow even more in the next couple of years. This could provide an opportunity for blockchain to display its potential as developers continue to experiment.