Wing Finance ($WING) introduced a credit-based DeFi system that supports cross-chain digital asset lending, allowing users to borrow funds and provide collateral based on their credit score.

Crypto-lending, as it was introduced in the DeFi space, was not as accessible to many as it was meant to be. Despite being open platforms, over-collateralization requirements have limited the number of people who could make loans since they had to own a ton of digital assets first. Wing Finance aims to resolve this issue. In this article, we will explain how this mechanism works.

Check out our video on how you can EARN through Wing Finance:

Background

Wing Finance is a protocol developed by the team behind Ontology, an enterprise blockchain solution protocol. The aim of the developers was to address the problems that were present in mainstream financial products deployed in DeFi. With the process mainly designed to introduce credit elements in the space, Ontology came up with Wing Finance.

In the spirit of further decentralization, Wing Finance also launched a decentralized autonomous organization (DAO) to support community governance and user sovereignty. What Wing brings to the table are concepts such as credit-based lending and expandable categories of assets that can be digitized.

Features of Wing Finance

Here are the main features of Wing Finance:

- Wing Finance supports cross-chain collaboration and decentrazlied governance throughout a range of DeFi projects.

- They have a risk control mechanism that fosters relationships between borrowers, creditors, and guarantors that will be mutually beneficial.

- Wing Finance bridges the world of DeFi and traditional finance through its decentralized credit system.

What is Wing Finance?

Wing Finance ($WING) is a credit-based, cross-chain lending platform on DeFi. And as already mentioned, its main goal is to make digital lending services more accessible to everyone through a credit evaluation module that does away with massive collateralization requirements.

The credit evaluation framework works around the OScore system, a mechanism built on top of Ontology. OScore is a sovereign reputation and credit assessment system for DeFi. It functions through the implementation of identifiers and credentials that are supported in cross-chain transactions.

To put it simply, it is the system that comes up with a credit evaluation tool that factors in the holdings or balance of any particular user, as well as their history of managing digital assets. To do this, OScore attaches a digital identity to a user’s assets, such as those that are built on Bitcoin, Ethereum, and Ontology. This helps the system determine a user’s credit score.

Ontology is working on integrating more evaluation functions and on-chain data in the OScore system. But now, they are already implementing OScore in their user’s wallets.

Collateral Support

Since the platform is powered by Ontology, it can support a collateral pool that contains a variety of cryptocurrencies even if they are on different blockchains. This is what is referred to as ‘cross-chain’ support. Through Ontology’s decentralized identity and data functions, any asset can be digitized.

Decentralized and Automated Credit Evaluation

Smart contracts power the decentralized and automated credit evaluation function of the platform. Decentralized identity and data protocols enable automated credit data verification and evaluation system that does not require any third-party intervention. Furthermore, this is where the OScore system rests.

Features of Credit-Based Lending

- Lower collateralization requirements

Since borrowers can now depend on their OScore data to make loans, the collateralization requirements can be lowered further, if not canceled altogether.

- Asset Digitization

It is easier to digitize assets on the platform because it can now be attached with credit elements from the on-chain data that OScore can gather.

- User Sovereignty

The platform does not need any third-party to perform user verifications. Instead, the credit elements used to tag users function through decentralized identifiers (DID), which are verifiable and decentralized. Smart contracts also ensure that the review of these elements does not need manual intervention anymore.

Wing Pools

There are 2 types of pools on Wing Finance- Flash Pool, NFT Pool and Inclusive Pool.

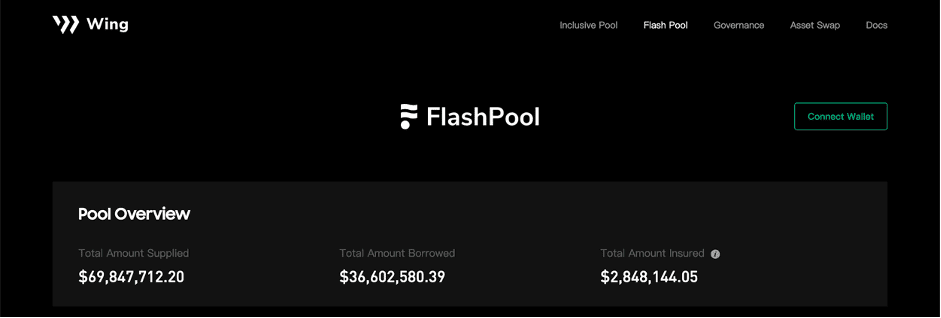

Flash Pool

Wing is deployed on 4 networks with 6 pools in total: Ontology, Ethereum, OKXChain, BNB chain, and Ontology EVM.

Wing Finance’s Flash Pool allows users to borrow and lend on the platform. Lenders also receive interest payments for supplying their funds on the platform. To prevent the likelihood of asset losses, it also has an insurance pool that can cover such risks.

- Lending

Anyone can supply their cryptocurrencies in the Flash Pool which it will lend to the platform’s borrowers. In return, lenders receive interest in both the crypto supplied and WING tokens. The return is correspondent to its APY.

- Borrowing

Anyone can borrow cryptocurrencies from the Flash Pool, they just need to meet the prescribed collateral requirement for their loan. To earn WING rewards, they have to lock 3% of their WING tokens first.

- Insurance

To ensure that potential risks are covered in the platform, users can also take part in the insurance pool of the platform. Users just have to lock their WING tokens in the flash pool for at least 3 days.

NFT Pool

Wing Finance’s NFT Pool is a NFT-collateral based fund pool on the Wing DAO platform. It currently supports 6 types of NFTs: CryptoPunks, MAYC, BAYC, Meebits, Azuki, and CLONE X.

The main feature of Wing Finance’s NFT pool is that it hopes to provide a unique and innovative way to unlock the value of NFTs via its peer-to-pool lending model. With the peer-to-pool lending model, users supply ETH in the asset pool to provide liquidity to the lending pool. These users earn ETH interest from borrowers and the pWING token which is an ERC-20 protocol variant of the WING token.

In the NFT pool, users can borrow ETH by collaterizing NFTs which go into the NFT-collateral pool. The borrowers then receive a corresponding functional NFT. NFT buyers could then purchase these NFTs through the liquidation market with the potential to purchase them at a discount since the NFT prices are calculated from the floor price.

Inclusive pool

Wing Finance’s Inclusive Pool is an asset pool that allows people to undercollaterize assets and maximize their borrowing capabilities. The Inclusive Pool includes a supply & borrow pool, and an insurance pool.

There are currently only 3 supported assets on the Inclusive Pool: pDAI, pUSDT and pUSDC. Users can borrow from the supply pool subject to the rules set by Wing Finance. Users can also loan out assets but is required to collaterize a certain amount every time they do so. This amount is calculated based on the users’ OScore.

WING tokens are distributed to those who use the Inclusive Pool provided they have not breached repayments, or only returned their loans during the grace period.

WING Token

The WING token is Wing Finance’s native utility token. It is used to back the platform’s reward system as well as its voting mechanisms.

Rewards System

In Wing Finance’s Inclusive pool, they are rewarded for maintaining a good credit score on the platform. Examples of activities that help with that include paying loans back on time and maintaining good behavior.

They can also be given reduced interest rates for their loans if they exhibit good repayment practices.

Wing DAO

The community can vote on protocol parameters on Wing’s three main pools. These are the lending pool, borrowed pool, and risk control margin pool. Some examples of the functions that can be subject to a community vote are the type of assets that can be borrowed, minimum and maximum borrowing and lending amounts, and other risk control requirements.

Users only have to own at least 1 WING in order to participate in community governance. Through this, they are given the right to put forward proposals on the services of the platform.

Why are WING prices pumping?

WING prices have gone up nearly 300% in the past 24 hours on 29th July 2022, from $12 to a high of $58. But why are WING prices going up? This could be because there has been an overall rise in DeFi tokens such as Uniswap ($UNI) (up 24.9% in the past 7 days) and PancakeSwap ($CAKE) (up 21.2% in the past last 7 days). However, a more recent reason for the sudden rise in WING prices could be the AMA with WING DAO on the latest NFT pool.

However, there is concern that the WING price pump may not be sustainable as many consider the crypto market to still be in a bearish state.

Conclusion

Over-collateralization requirements in most DeFi products have limited the number of people who could actually borrow crypto and the amount that they can leverage. While these were innovations that many crypto adopters were waiting for, these were not enough to attract new adopters who didn’t have much crypto holdings to begin with.

Wing Finance has made a system where it is much easier to borrow funds and lend idle assets to get returns without compromising the quality of its liquidity pool altogether. And because it functions on top of the Ontology system, it does not suffer from rising gas fees that are experienced in other smart contract chains.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

- MetaMask Guide: How to set up an account? PLUS tips and hacks for advanced users

- Uniswap review and tutorial: Beginners guide and advanced tips and tricks

- Serum DEX guide and review

- SushiSwap ($SUSHI) explained

- 1inch Exchange, Mooniswap and Chi GasToken: The ultimate review and guide

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.