UPDATE: Which are the best exchanges THIS YEAR? Top Best Cryptocurrency Exchanges (2023)

For this article, exchanges that we at Team Boxmining use frequently are listed in Tier 1, exchanges we occasionally use are listed in Tier 2, down to those which we seldom or do not use at all are listed in Tier 3. However, this is only based on our personal preference. Potential users should also always check if the exchange is supported in their country and if there are any geographical restrictions.

Check out our latest video where we talk about our picks for the best cryptocurrency exchanges in 2022:

Tier 1 Exchanges (Active Trading)

Binance

Binance was founded in 2017 and currently serves over 13.5 million active users across the globe. Unlike Coinbase and Kraken, Binance supports a wide range of altcoins (i.e. cryptocurrencies other than Bitcoin). This attracts more people to transfer their Bitcoin, Bitcoin Cash, and Litecoin from other exchanges to Binance to explore the altcoin world.

It is suited for entry-level crypto traders due to its huge array of tradable cryptocurrencies. Binance supports trading of over 400 different types of cryptocurrencies with more being added almost every week. In fact, Binance has become so popular as a cryptocurrency exchange that the mere news of new coins being listed can cause the tokens’ prices to skyrocket.

The popularity of Binance has made its CEO Zhao Changpeng (CZ) a personality in the cryptocurrency community. His words/actions now have a significant influence on the cryptocurrency markets.

Cryptocurrencies can be purchased on the Exchange through a variety of ways: PayPal, bank transfer, credit card, and debit card (although they charge a substantial 4.5% fee). It is worth noting, however, that users cannot simply exchange their US dollars for cryptocurrencies. Nevertheless, the aforementioned purchase methods should be sufficient for most cryptocurrency traders.

As for security measures, Binance has an asset fund as insurance in case of misappropriated user funds and also provides two-factor authentication.

Binance also has its own native token- BNB, which ranks 4th in terms of trading volume. The token can be used for various features and discounts on the exchange.

Binance does have a US version of its exchange at Binance.US. Although Binance.US will have fewer cryptocurrencies available for trading and features in order to be compliant with US regulations.

Binance is Team Boxmining’s second most frequently used exchange. It is easy to use, their customer service team is very responsive, and Binance is credited with pioneering many of the special features we come to expect today such as Initial Exchange Offerings (IEOs).

Binance also caters to experienced traders with advanced trading options and plenty of analytics. Novice users will inevitably experience a learning curve, but once you find your way around, it becomes almost second nature. (softlay.com)

Check out Binance Exchange Review: Best Crypto Exchange? For a detailed look at what Binance has to offer.

KuCoin

KuCoin has unique assets and an extensive list of tradable coins. The Exchange is highly regarded for its large number of different cryptocurrency pairs, which means users can purchase a wide variety of cryptos.

KuCoin supports over 500 cryptocurrencies which means you can trade lots of small-cap tokens with low trading fees. At team Boxmining, we find that if we want to trade small-cap coins, we need to use MetaMask and then trade on different platforms and DEXs. And if it’s an ERC 20 token you would have to pay ridiculously high gas fees which is not economical. So, if these small-cap tokens are already on KuCoin, then you can save a lot of unnecessary costs.

KuCoin also allows you to use trading bots through their mobile app which automatically buy and sell your cryptocurrencies so you don’t have to follow the market 24/7. However, it’s not always clear how they’re investing your money, so you still need to understand the cryptocurrency trading strategies they use.

On the downside, KuCoin has in the past been plagued by poor Know-Your-Customer (KYC) procedures. At first, it allowed traders to deposit and withdraw large amounts of Bitcoin i.e. 50 Bitcoin per day without providing personal details. They have since changed their KYC policies and now you can only withdraw up to 2 Bitcoin per day without a “Verified” account i.e. an account that has completed the KYC procedures.

In addition, Kucoin is a crypto-only exchange, which means you will need another exchange for buying cryptocurrencies with fiat currency such as HKD, USD or CAD. That means Kucoin is not the most ideal option for newcomers to cryptocurrency, but if you are an experienced trader then KuCoin is a great way to diversify your cryptocurrency portfolio.

SwissBorg

SwissBorg was launched in December 2017, as per their name they are based in Switzerland and are fully compliant with Swiss Law, making them hugely popular amongst Europeans. The Exchange is available in over 100 countries (although currently not supported in the US), and it is noted the full range of features offered by SwissBorg may not be available in every country.

SwissBorg supports over 35 cryptocurrencies and 16 fiat currencies. New cryptocurrencies are continuously being added and users can vote for the next one to be listed. Users can directly fund their SwissBorg accounts via bank transfer with 0 charges.

Another popular feature is SwissBorg’s app which allows users to access their crypto wallets and trade on the go.

To keep ahead of the yield farming and decentralized finance (DeFi) craze, SwissBorg offers their Smart Yield account for yield farming, which allows users to get exposure to farming without much prerequisite knowledge. The Smart Yield feature does this by scanning and finding a range of DeFi and CeFi (Centralized Finance).

SwissBorg also has a native token $CHSB- a multi-utility token that entitles holders to lower fees when buying/selling Bitcoin, CHSB and stablecoins on the Exchange. Other benefits include being able to have a 2x yield on your USDC, BTC, ETH, XRP, and CHSB holdings.

Learn more about SwissBorg with our in-depth guide- SwissBorg ($CHSB): What is it?

Sign up for SwissBorg with our exclusive link to get FREE CHSB!

Coinbase

Coinbase was launched in 2012 and currently has over 30 million users spanning 103 countries. While Coinbase may not offer a wide variety of cryptocurrencies, it is still a top favorite among many investors due to its highly secure and easy-to-use platforms. Also, Coinbase is the first stop for many beginner traders (especially those from the US) as they have a very easy-to-use mobile app, and you can directly fund your Coinbase account from your bank account. Coinbase is also particularly popular in the US since it is the first publicly listed US crypto exchange and it is fully compliant with US regulations.

Coinbase’s popularity stems from the fact that its platform has one of the fastest and easiest cryptocurrency buying processes, which along with their claim to have never been hacked, makes them an ideal choice for beginners. Advanced users can also opt for Coinbase Pro, which has more trading features.

Coinbase supports hundreds of digital currencies, but nevertheless still loses out to other major crypto exchanges in this respect. For US customers, there are no restrictions on transacting the following cryptocurrencies:

- Bitcoin (BTC);

- Ethereum (ETH);

- Litecoin (LTC);

- Bitcoin Cash (BCH);

- Ethereum Classic (ETC); and

- Ripple (XRP).

Here’s a chart of the cryptocurrencies supported by Coinbase depending on your location.

Most common forms of payment are accepted by Coinbase, for example credit and debit cards.

Whilst it is generally secure, Coinbase has been under fire recently for suffering outages when there were huge fluctuations in the prices of Bitcoin in March, April AND May 2020. These outages left many users powerless to do any trades when they needed to the most. Potential users should bear this issue in mind when considering whether or not to use Coinbase.

Coinbase also charges higher fees compared to most other exchanges, charging $0.99-$2.99 per purchase under a $200 transaction and an additional 0.5% fee depending on the amount traded. However many novice or infrequent traders consider this a fair price to pay for the convenience of the platform and as it is one of the few exchanges available to US users.

Check out our Coinbase review for an in-depth look at this exchange. And as mentioned, Coinbase does charge higher fees compared to other exchanges on the market, hence we have our popular guide- Coinbase Fees: How to Avoid Them.

Tier 2 Exchanges (Seasonal Trading / specific coins)

PrimeXBT

PrimeXBT is also one of the newer players in the cryptocurrency exchange space, having been launched in 2018. Credit is given to this Exchange for being one of the most transparent we have come across. Their website is a one-stop resource for anything you wanted to know about the Exchange and they also have in-depth tutorials on how to use its various features.

The Exchange is lacking a bit in supported cryptocurrencies, currently, they only support 7 cryptocurrencies: BTC, ETH, USDC, USDT, LTC, XRP and EOS. In addition, only withdrawals and deposits in BTC are supported. However, what they lack in cryptocurrency support they make up in ability to trade other asset types such as commodities, stock indices and Forex.

The ability to customise your trading screen and annotate charts is probably something long-awaited by technical analysts and serious traders and will keep them coming back to the Exchange.

Check out our PrimeXBT review and guide.

Kraken

Kraken has a substantial presence in Europe, and listed cryptos have fiat pairs. It was founded in 2011 then relaunched in 2013. Kraken offers trading in over 50 cryptocurrencies- full list here. However, some cryptocurrencies are not available in specific countries.

Kraken also offers margin trading and futures trading. With its margin accounts, you can borrow up to five times your account balance to trade crypto assets. Futures trading — contracts which allow you to buy or sell an asset at a set price on an upcoming date — is available for Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple.

Learn more about futures trading with our Futures Trading Guide.

The Exchange also offers its own futures trading platforms. But institutional clients can take advantage of expert insights, one-on-one consultations, account management support, and more.

Kraken is hugely popular amongst European cryptocurrency enthusiasts due to its range of features.

Bittrex

Bittrex is reliable and offers reputable services. Bittrex I used extensively in the past because they listed lots of coins. However, I eventually moved away from Bittrex because Binance overtook them in terms of coin selection.

Bittrex will be removing the following markets after 31 May 2019: BTC-COVAL, BTC-SALT AND BTC-XCP. And the following markets after 6 July 2019: BTC-LUN, BTC-NEOS, BTC-THC and BTC-TKS

Poloniex

I also used Poloniex extensively in the past. However in my experience, their Know Your Customer (KYC) process took a long time. In my case it took 3 months to complete. This was unacceptable especially when it was during the bull market.

Customer support on Poloniex isn’t terrible, so they still seem to be a good exchange.

However if you are a U.S. citizen, you may need to be aware of Poloniex geofencing assets for U.S. customers. On 29 May 2019, the markets for ARDR, BCN, DCR, GAME, GAS, LSK, NXT, OMNI and REP will be disabled for US customers.

Once the market has been geofenced, customers can still withdraw those tokens from their wallet so long as Poloniex supports it globally. However, customers will not longer be able to see their deposit address or generate a new deposit address.

Huobi, OKEx

Huobi and OKEx were the main titans of China. They had lots of Chinese users before the Chinese government cracked down on cryptocurrency trading in the country.

This was known as the “Golden Vacuum” since it obliterated a lot of Huobi and OKEx’s dominance. This destabilized the two exchanges giving way to others like KuCoin and Binance to take charge.

We still consider them as Tier 2 exchanges because they still hold onto some of their past customers and because they have the technology for the future.

There are rumours that the Chinese government allows these exchanges to operate but keeps tabs on their transactions.

BitMEX

BitMEX is mostly a margin trading exchange allowing enormous leverage (i.e. up to 50 times). Leverage trading is when you do not own the physical bitcoin but you own trading contracts.

Unfortunately, BitMEX does not operate in the United States and be careful not to login to your BitMEX account there, your account will get banned.

Although we have heard of some Americans that use VPNs (Virtual Private Networks) to mask the country of origin so as to bypass this restriction.

This is NOT recommended.

BitMEX has poor customer support. It took us 3 months of emails to unban our account when we accidentally logged into BitMEX in the United States.

Tier 3 Exchanges (Possible risks / issues)

Bitfinex

Although Bitfinex is a reputable exchange, its recent struggle with the New York Attorney General for US$850 million loss of customer funds lowers its credibility. We will have to see how Bitfinex will overcome this struggle.

Apart from the case, it has a strong BTC/USD trading pair.

To stay up to date with what is happening at Bitfinex, click here.

OceanEx

OceanEX is launched by BitOcean Global, a fully registered and licensed trading paltform in Japan. It’s created by a core team of members with past experience from Morgan Stanley, BNP Paribas, and Deloitte. OceanEX boasts a host of AI security features to improve user and trading safety. OceanEX is the trading hub of the VeChainThor Ecosystem, with all VeChain assets listed and VeChain trading pairs. Whilst it has many attractive features, we found liquidity lacking on many assets and difficulties both buying and selling various coins.

To learn more about VeChain and its ecosystem, check our Vechain guide.

AscendEX (formerly known as BitMax)

I tried this exchange since I received a lot of requests from viewers.

However I am skeptical of exchanges that use the “Transaction Mining” model. Transaction Mining is where you gain credits or exchange tokens in return for trading.

This directly incentivises wash trading on the platform, which is where a trader simultaneously sells and buys the same assets.

This in turn creates misleading reports on the trading volumes on the exchange.

Tier 4 Exchanges (avoid these exchanges)

HitBTC

These three exchanges have very questionable practices.

For example, HitBTC does not have a real KYC policy. They do not seem to have much issue with you depositing large amounts of funds. However if you trade or want to withdraw a lot they will just ban or suspend your account until you communicate with them. This has happened to me personally and when we researched this and found that many others had the same experience.

Lately there has been a new wave of users complaining about having to provide excessive detail about the source of their funds.

There are also some users who have done their own investigations and concluded that the Exchange is insolvent.

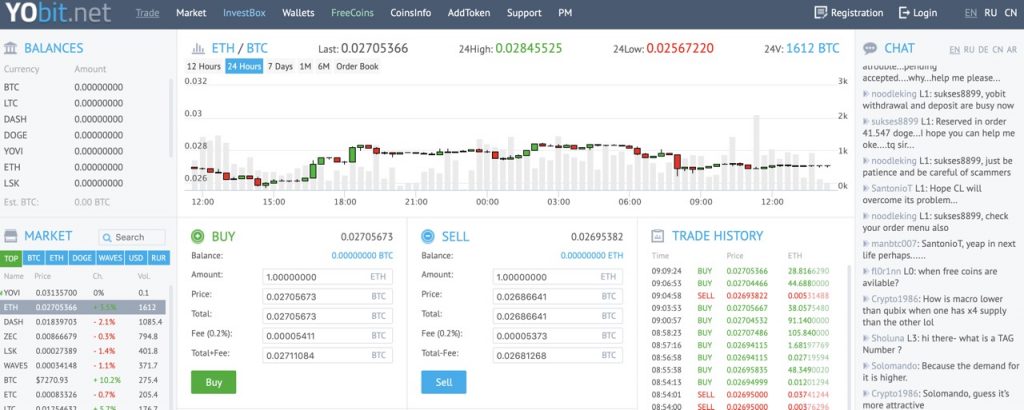

YoBit

The exchange has a troublesome withdrawal process.

Conclusion

Tier 1: Binance, KuCoin, SwissBorg, Coinbase

Tier 2: PrimeXBT, Kraken, Bittrex, Poloniex, Huobi and OKEx, BitMEX

Tier 3: Bitfinex, OceanEx, AscenDEX (formerly BitMax),

In conclusion, conducting a background check on a cryptocurrency platform before signing up is the best way to avoid losing your digital wealth. Following the above list is one huge step towards this goal.

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.

Been using MCX, you should look into it

I’m suprised you have used Bitmax yet. It’s one of the best exchanges I personally use

Good morning

I trust that this message finds you well. I have tried to contact you via email but it has bounced twice now so I am giving your contact form a go.

I enjoy blogging in my spare time and I have written a couple of articles for your blog boxminingmedeveloper.temp927.kinsta.cloud.

Please find them attached on my Google drive: https://drive.google.com/drive/folders/1ScmasvOxx5fL3GKokgzEQ-fUQQmEzV62?usp=sharing

Do let me know what you think and do send me the links to the articles once you have managed to publish them.

Also, do let me know if you would like me to write some more articles for your blog.

Regards

How does the flow of Cryptocurrency handled? How is the ratio between supply and demand balanced? I have read that there has been times when the security of crypto-network has been compromised. Is it really the future of Digital Money? Rather than a currency, it seems to be an investment scheme plan. I am not trying to be a critic here, just a lot of questions bubbling into the mind.

So did your bf really lose all his ethers because of the Jaxx wallet or did he just lose it temporarily (cause it stopped showing the number) and managed to retrieve it with some other method?

For sure, it is important to choose a reliable crypto exchange to minimize risk associated with buying or selling cryptocurrency. Crypto market is decentralized, so there are numerous independent exchanges except one central marketplace. These exchanges are based in different countries, so the level of customers` funds protection mostly depends on applicable regulations of each particular country.

Another important point – security measures implemented by the exchange. Quite often crypto exchanges suffer from cyber-attacks resulting in clients losing their funds. To avoid this, crypto exchange should store clients` funds on special accounts reducing the possibility of unauthorized access.

It seems difficult to choose an exchange to work with due to the large number of exchanges existing nowadays. At the same time, there is quite easy to find information about them because there are a lot of reviews and comparisons available where you can find all information provided in structured and detailed manner. So, the only thing you need to do is to figure out the criteria that are the most important for you and then compare crypto exchanges taking into account regulatory aspects.

Thanks for sharing this valuable information with us, it is really helpful article!.I really appreciate this post. I’ve been looking everywhere for this!

Coinbase…really… KYC is very difficult bc we get not the function for that selfie and are trying for weeks now but does not work and so we cannot get funds in. Their bs law that when sending to a new address takes 72hours to do. For big amount ok but a few bucks? Come on and also to make it faster we need to KYC every time but that does not work here nor on the app. Coinbase is a joke and also that dump on btc there and when Deribit goes under bc of that…Best exchanges are Binance, Bitmex (yeah really) and Bitmax but no exchange is really that good like in the regulated brokers for stock trading….

EO.Trade company is licensed and presents two state-owned licenses at once.

In fact, eo.trade, a very convenient exchange, and the conditions turned out to be quite favorable

Not betting on any exchange. Komodo and atomic swaps is where I am betting the farm….I plan on building and launching Chain meld in future with assistance.

Well, I need to add CoinDeal to this list. It’s probably one of the best trading platforms nowadays. I’ve been using it for a year and I can honestly recommend it. Very rapidly-developing exchange, that’s for sure. There are a lot of various initiatives for their users like for example CDL tokens which can lower your fees. This platform deserves to be on this list in my opinion.

You didn’t cover Gemini. Easier to move funds in and out than Coinbase, which is nice. I’ve funded Gemini, then moved the BTC to my Coinbase Pro account for tradung.

One current disadvantage for active traders is Gemini has no stop orders, but they said they are working on that.

PI like Stop Limit orders to help reduce FOMO. If I think the market is going Bearish, I can sell off some crypto, but place a Stop-Limit order above my sale order incase the market unexpectedly makes a big Bull move. You can make a lot of money on the $500-1000 BTC moves. Most people just HODL as the price tanks in thousand dollar increments because of FOMO, fear of missing the next big Bull spike that happens with cryptos.

For YoBit you have it in the avoid section, but all you say is: “The exchange has a troublesome withdrawal process.”

Can you elaborate on what makes withdraws so bad that it should appear on the shame list?

And I don’t think Kucoin was desperate for customers, I just think they agree KYC has no place in crypto. Crypto was made so we could avoid banks and stay private.

Just my thoughts 🙂

The recharge methods on eo.trade are very diverse. The exchange is represented not only by cryptocurrency pairs, but also by fiat funds. Also, if you wish, you can transfer funds from cryptocurrency wallets.

The crypto currency exchange binance provides very good working conditions.

Il n’y a pas si longtemps, l’échange de crypto-monnaie est apparu sur le marché, mais il a déjà fait ses preuves.

Alle notwendigen Handelsinstrumente und einfache Bedienung, präsentiert an der Kryptobörse eo.trade.

Finora sono soddisfatto delle condizioni fornite dallo scambio eo.trade. Un ringraziamento speciale al supporto per le raccomandazioni e i consigli.

Pretty interesting eo.trade exchange and really good conditions.

No hace mucho tiempo comencé a trabajar con eo.trade, y no tengo absolutamente ninguna queja sobre su trabajo.

Binance is perfect but why Coinbase doesn’t allow exchange without KYC? If they don’t allow exchange then they should stop everything who are not able to complete KYC. How funny without KYC you can receive BTC, ETH, another currency but you can’t exchange them

You could develop your own exchange CryptoHuobi.com [generic word]

You made a mistake in your listing. You list OceanEx at the start of the document as a tier three exchange and then in the conclusion you list it as a tier one exchange??????

Hey! Really a well informative article for the crypto enthusiasts which helps to know the best cryptocurrency exchange platform for buying and selling cryptocurrencies in a safe and secure manner. Thanks! for sharing this article. Keep up the good work. If you are planning to build your own crypto exchange trading platform for your business? Check Osiz Technologies.

When the general public consider cryptocurrency they could as nicely be considering cryptic foreign money.

Very much informative article. This help me to chose the best of the best. Thanks for sharing

Hello Boxmining team!

Forgive me for reaching out through here, but I couldn’t seem to find any other contact information.

I’m Logan, Community Lead at OpenDAO.

Our mission is to bridge real-world assets to DeFi in a meaningful manner.

We have a money market called Open Market that’s been on mainnet for a few months now where lenders can lend their stablecoins against real world collateral such as listed shares, liquidity pools and soon, real estate.

opm.opendao.io

Our rates for lenders have been in the high 9% range.

We also have a yield farming component, and users are currently earning our governance OPEN token, though they are not available publicly yet.

Liquidity Providers can provide liquidity against real world assets, such as real estate, and accumulate our tokens as rewards. They can do this at stake.opendao.io

I’d love to find out how we might get our project on boxming.com or if you could do an article/review of our platform. It’s a fantastic resource for the community at large.

Here are our links for your convenience:

Website: OpenDAO.io

LP yield farming: stake.opendao.io

Lend on the OPM: opm.opendao.io

Telegram: https://t.me/opendao

Discord: https://discord.com/channels/738203878792626227/747986134424092772

Twitter: https://twitter.com/opendaoprotocol

GitHub: https://github.com/opendao-protocols

Youtube: https://www.youtube.com/channel/UCv5O3ANjupSH_yJmdY4o59g

Looking forward to hearing back from you.

Cheers,

Logan

Cryptocurrency trading is a multi-billion dollar industry that is growing at an exponential rate. By leveraging price volatility, traders are earning handsome profits on a daily basis. The demand for new platforms is on the rise as customers prefer lower fees, faster transactions, multiple currencies and better rewards. Use our powerful cryptocurrency exchange script to launch your own platform today!

Build an exchange that supports multiple currencies and high liquidity. Host a variety of order functions that allow a seamless trading experience. We offer solutions that are 100% whitelabel and feature-rich. Our team develops robust platforms that can be customized to match your business requirements.To know more plase visit https://www.cryptocurrencyexchangescript.com/

Really Great Article about listing of top cryptocurrency exchanges 2020. And especially the segregation of the listed cryptocurrency exchange as tier1, tier2 and others will surely helps general audience to pick the right one. Really Impressive.

For more info about cryptocurrency exchange, please visit us >> https://bit.ly/366wKj9

Thanks for sharing such very informative post. Am expecting more of these. https://www.infiniteblocktech.com/cryptocurrency-mlm-software

Cool list of exchanges. Thanks. In my opinion, OceanEx is the best.

The coronavirus (COVID-19), as an unfortunate disaster has been corrupted in many industries and economic growth. The whole world is fighting against the Covid-19. At this time, most people thinking of starting an online business and they knowing well, investing money in cryptocurrencies is the best money-making business. Moreover, COVID-19 will boost cryptocurrency adoption, which will increase the number of crypto investments worldwide.

At this time, starting a Cryptocurrency Exchange business is a very good business idea to make money simply. Know more crypto business ideas here: https://bit.ly/3aABTUt

Good Listing! In 2021, People are more welcoming to Cryptocurrencies and this article will be very helpful for crypto trading beginners

Do enough research and recommendations. I lost btc with hopes of investing, they got away with my 5.5btc, calgarysec-hack com were useful, they helped get most of it back.

Great post

great exchange Binance, on this link 10% cashback

https://www.binance.com/ru/register?ref=WZR7VX7P

Thanks for sharing useful info.

Interesting!

Invest with the best trustworthy and reliable Bitcoin ITspecialist contact them via email: Bitcoinitspecialist AT Gmailcom I promise you never regret investing with them.

How many millionaires women do you know who have become wealthy by investing in savings accounts? Bitcoin mining and investments is what literally saved my life during the pandemic after I was laid off at work.I got into depression when I was sacked and thankfully I never lost hope.

I started looking for how I could invest my savings to double my earnings and I came across this team via(BITCOINITSPECIALIST at G-MAIL COM).

They had so many wonderful reviews on cryptocurrency blogs and financial reviews of the year on Google. I started with just 1000 and in a week I already was counting 25000 in profits. Bitcoin investment can be difficult and risky but all you have to do is contact this team and they will break down the mystery for you…and help you make huge profits through their mining and investment plans within a short period of time.

Thanks for sharing

Great insight!

Thanks for sharing the informative one

It’s Great!

Thanks for sharing, Cryptocurrency exchange is very good for protection of money.

Nice Post!

Great insights!

Gracias por estos detalles, es muy interesante.

Great post

it is very interesting

Amazing post!

Great post, very useful and interesting…

Interesting Article

Thanks a Lot

Nice Article

Thanks For the Post

Excellent article….

Great insight!