Eggs have suddenly shown up on our airdrop radar. Seemingly with no actual utility, Eggs calls itself an “eggsperiment in decentralized finance”. The $EGGS token also does not seem to have any use. The only thing that is known about them is that the supply of the EGG token is decreasing by around 0. (https://www.iport.com/) 001% per block or around 7% per day. Eggs however have announced a free $aEGGS airdrop coming soon on Arbitrum, and a user snapshot has not been taken yet. So, you can still be eligible for the upcoming airdrop. In this article, we have compiled our ultimate guide on how to get the Eggs $aEGGS token airdrop.

Eggs ($EGGS, $aEGGS) Airdrop Step-by-Step Guide

Here’s a step-by-step guide on how to get a potential Eggs ($EGGS, $aEGGS) token airdrop:

- On their website, connect your wallet.

- Buy $EGGS on UniSwap.

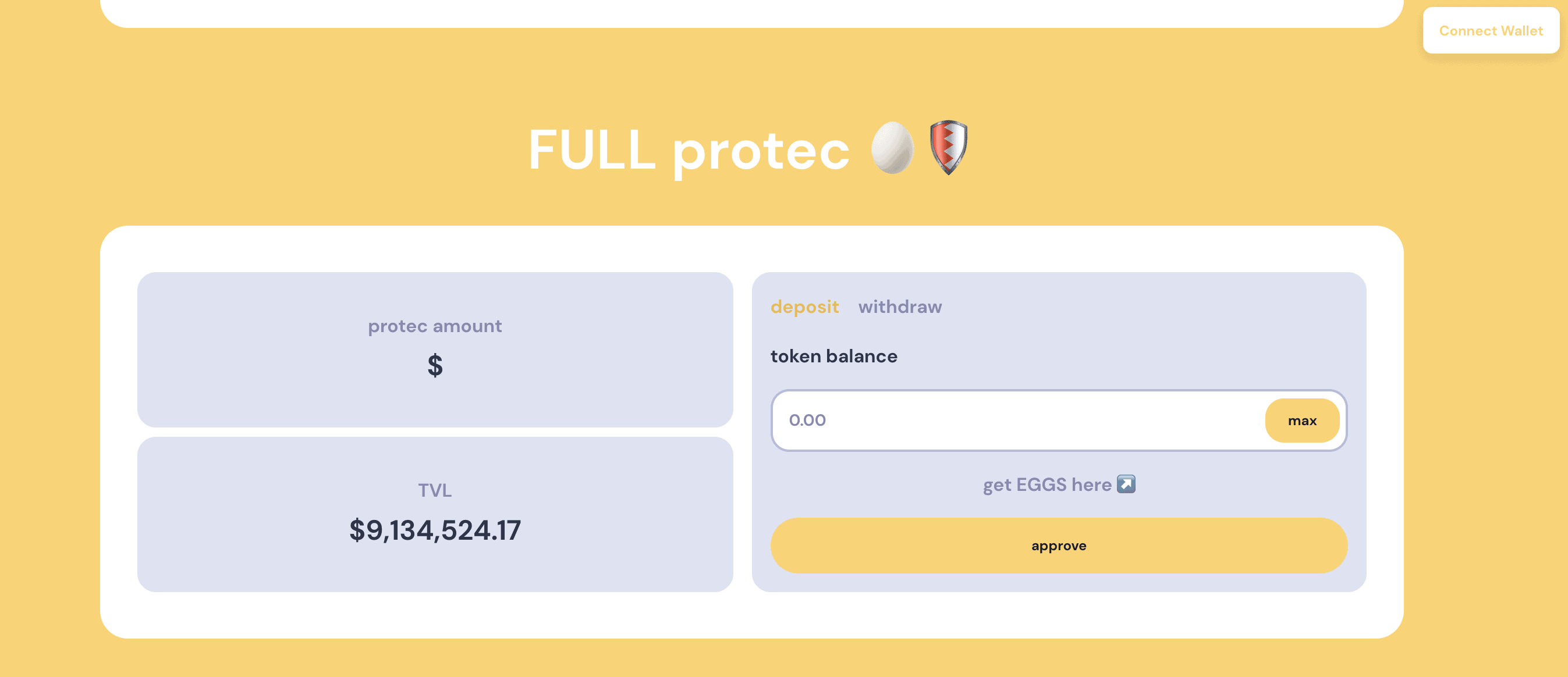

- Stake your $EGGS on either the FULL protec or big protec vaults. Note staking on the smol protec vaults does not make you eligible for the $aEGGS airdrop.

- On the “deposit” tab, choose the amount of $EGGS you want to stake and click “Approve”.

- To withdraw your $EGGS, click on the “withdraw” tab, choose the amount of $EGGS you want to withdraw and click “Approve”.

See below for more details.

What are Eggs?

EGGS is a decentralized finance experiment that is being threatened by the “Egg Cartel”, a group of criminals stealing EGGS and decreasing the supply by 0.001% every block, or around 7% per day. This has caused a crisis in the EGGS market, and users are tasked with looking for ways to protect their investments.

The project asks users to protect their EGGS by depositing them into secure vaults. The full protec vault offers the highest level of protection and has a locking period of 7 days on deposit and partial withdrawals. Meanwhile, Big and Smol vaults offer partial protection in the form of rewards. Both of these vaults have a locking period of 24 hours and partial withdrawals will not lock them. Depositing or claiming rewards will reset the timer and lock for another 24 hours. Protect your EGGS and earn rewards with secure vaults.

Does Eggs have a token?

Eggs have an $EGGS token with an initial supply of 3,324,324,324,357. However, around 931,616,056,878 of $EGG tokens have already been burned. The current supply of $EGGS is less than 2,000,000,000,000 (and decreasing 0.001% every block). EGG has a debasing mechanism to its token supply, which will reduce the number of EGGS in circulation. This will benefit holders of EGGS, as the price of the token will continue to increase if no one is selling and ETH remains stable. The debasing will affect the entire token supply, including EGGS held in vaults and EGGS held in liquidity pools. This is a great opportunity for holders of EGGS to benefit from the increasing value of the token, as the amount of ETH remains the same.

$EGGS tokens do not appear to have any utility. Except that staking $EGGS in either Full, Big or Smol vaults gets you rewards. There are three types of vaults. Full protec vault will fully protect your $EGGS and won’t be affected by debase. But it has a 7-day locking period. The other two vaults only protect your $EGGS partially in the form of rewards of 10 million $EGGS per block (but subject to change). Big protec vault earns you 9/10 of the rewards by staking EGGS/ETH LP on Uniswap V2. Whereas the smol protec vault earns you only 1/10 of the rewards. Both of these vaults only have a locking period of 24 hours. This 24-hour lock will reset every time you deposit or claim $EGGS in the vault.

$aEGGS tokens will be given during the airdrop for those who have locked their $EGGS in the Big or Full protec vaults. However, it does not appear that $aEGGS tokens have any utility either.

Are Eggs safe?

The smart contract for the $EGGS token does have a mint function. This can potentially allow the developer to mint unlimited $EGGS and drive down its market prices due to overwhelming supply. However, according to the project, it is a Timelock contract set for 3 days. This means everyone has time to react for 3 days if the developer does do something.

Eggs however does not seem to be a project with any purpose or token utility, so users and potential airdrop hunters should exercise caution.

How to Receive Potential $aEGGS Token Airdrop?

Eggs has announced on Twitter it will be doing a FREE airdrop on Arbitrum. A snapshot has not been taken yet so users still have a chance to join and be eligible for the airdrop. However, to be eligible for the $aEGGS airdrop, users must have either staked their $EGGS in the Big or Full protec vault. The Smol vault does not count and unclaimed rewards do not count toward the airdrop. According to the team, more details will be announced soon.

Here’s how to receive a potential $aEGGS token airdrop:

- On their website, connect your wallet.

- Buy $EGGS on UniSwap.

- Stake your $EGGS on either the FULL protec or big protec vaults. Note staking on the smol protec vaults does not make you eligible for the $aEGGS airdrop.

- On the “deposit” tab, choose the amount of $EGGS you want to stake and click “Approve”.

- To withdraw your $EGGS, click on the “withdraw” tab, choose the amount of $EGGS you want to withdraw and click “Approve”.

Eggs Airdrop Review

When reviewing an airdrop, there are several factors to consider. First, the likelihood the project will even do an airdrop in the first place. Then, to look at how many tokens the project intends to allocate towards airdrop campaigns, as well as the difficulty in participating in their airdrop. It is also important to look at the utility of the token so that there will be an actual use and purpose in participating in the airdrop in the first place. Finally, a factor to consider when reviewing an airdrop is whether the airdropped tokens are subject to any lockup period.

Likelihood of Airdrop: The Eggs team have already announced an airdrop. Details are coming soon.

Airdropped Token Allocation: The amount of $aEGGS to be airdropped are unknown.

Airdrop Difficulty: The project has announced that only the Full or Big protec vaults will be eligible for airdrops. However you must buy $EGGS and stake them. And there does not seem to be any actual utility for $EGGS.

Token Utility: There does not seem to be any utility for both $EGGS or $aEGGS.

Token Lockup: The $aEGGS token lockup period is unknown.